|

UPS soars past record IPO

|

|

November 10, 1999: 4:30 p.m. ET

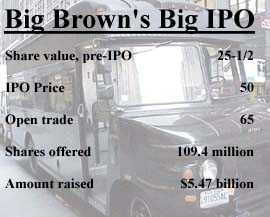

Stock opens at 30 percent premium to IPO that raised record $5.5B

By Staff Writer Chris Isidore

|

NEW YORK (CNNfn) - United Parcel Service burst out the gate rapidly Wednesday, as the scramble for the stock by investors large and small sent it up 30 percent at the opening of trade. The stock closed its first day with a 35 percent gain.

The Atlanta parcel-delivery giant priced the IPO at $50 a share late Tuesday, above the recently raised $47 to $49 range set only Friday. The first trade, at 10:03 a.m. on the New York Stock Exchange, was 65. The stock continued to climb, reaching a high of 70-5/16 at 11:35 a.m. before sliding to 67-1/4 at the 4 p.m. close.

That is still up 17-1/4 or 35 percent from the IPO price and 164 percent from the price of the stock Tuesday when it was privately traded.

The company combines a strong balance sheet, among the best profit margins in the trucking industry and a lion's share of the growing business of delivery goods purchased by consumers online, making it an attractive Internet play as well.

"I think there's an excitement that surrounds the whole Internet component, even though it's still not the bulk of what they do," said Ben Holmes, founder of ipoPros.com, an online research firm. "But it also becomes an institutional darling almost immediately."

Institutional investors oversubscribed the offering 10 times over, and with individual investor demand that climbed to 14 to 15 times oversubscription, according to a person familiar with the offering. Some 80 million shares traded Thursday, almost three-quarters of the volume of shares issued Wednesday.

Lots of profits, but high price

The company posted net income of $1.95 billion in the 12 months ending Sept. 30, before a $1.4 billion charge for possible payment in a tax dispute. That gives it a ratio of price to trailing earnings of 28 at the IPO price, but a ratio of almost 38 at the closing price. It had revenue of $26.3 billion for the 12-month period, far exceeding any other transportation company.

That compares to a P/E ratio of 20 for its key competitor, FDX Corp. (FDX), owner of Federal Express and rival ground parcel carrier RPS. FDX's stock was at 43-1/4, down 3/4, at the 4 p.m. close.

UPS had more than $2.6 billion in cash or equivalents on hand at the end of the last quarter and the best debt rating of any corporation, so it did not need the money from the IPO. Its officials said it wanted to be able make acquisitions using stock rather than cash and create a market for shares held by employees and retirees.

The company said has generally grown through expansion of operations, rather than acquisitions, but it has used purchases to fill in holes in its global network, such as the purchase earlier this year of Challenge Air, a Miami air cargo carrier with authority that UPS lacked to fly to many South American countries.

At the time of the IPO plans were announced, James Kelly, UPS' chairman and chief executive, mentioned the growing threat from acquisition-hungry European postal authorities that have privatized recently.

"It really hasn't been about the money. It's been about positioning our company for the future and giving us the currency for acquisitions," Kelly said in an interview on CNNfn Wednesday after the close of trading.

Company comments make some people think that UPS would focus on other overseas purchases with its stock. Others suggested that technology companies might be on its plate.

"The valuations for technology companies are very high. Why would you pay cash for that, why not pay with another inflated stock?" said Ullas Naik, senior vice president, research and an IPO expert at FAC Equities.

Smashes former US IPO record

UPS, trading under the symbol (UPS), is selling a 10 percent stake in itself with the offering of 109.4 million shares, meaning the offering raised $5.47 billion. The underwriters, including most of the major investment banks on Wall Street, have an allotment of another 10.94 million shares that could push the IPO above $6 billion.

The previous record of a U.S. IPO was the $4.4 billion raised in October 1998 when DuPont started is divestiture of Conoco Inc. with a sale of a 30 percent stake in the oil company.

It plans to use the proceeds of the sale to repurchase shares from the 126,000 existing shareholders, which include 66,000 active hourly employees, another 40,000 active managers, 17,000 retirees or estates of former employees and 3,000 heirs of the company's founders. The hourly employees have been able to purchase shares only since 1995 and hold the smallest stake in the company. There are more than 330,000 employees worldwide.

Remains in control of management

Foundations and trusts of the founders hold about a third of the 1.09 billion shares, and top management of the company is firmly in control of the stock. In fact, since the original shares have 10 times the voting rights of shares offered to the public Wednesday, the top managers influence more votes than all the public buyers of the stock through their own holdings and their positions on various boards and foundations.

Kelly, who rang the bell Wednesday to open trading at the New York Stock Exchange, owns 414,344 shares, according to the company's most recent report. Those shares jumped from a value of $10.6 million before the IPO to $20.7 million at the IPO offering price to $27.9 million at Wednesday's close.

UPS always said that the ability to make decisions for the long term was a key reason it did not want to go public. The company lost hundreds of millions of dollars establishing a business in Europe before that operation finally became profitable last year. But company officials said at the time the IPO was announced they were confident there would not be a change in that culture.

While analysts said they believe the company will be more conscious of Wall Street than in the past, they also believe that UPS will continue to follow its own course.

"If they decide they need to send packages to Mars and have to spend a lot of money to develop space ships to get there, they will," said one analyst, who spoke on the condition he not be identified.

Most trucking analysts were not allowed to comment on the stock's first day because the size of the offering had brought most major investment banks into the deal, placing their employees under a "quiet period."

|

|

|

|

|

|

United Parcel Service

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|