|

Mannesmann: 'Nein' to $128B takeover

|

|

November 19, 1999: 6:01 p.m. ET

CEO, preparing defense, says Vodafone poses shareholder risks, 'cartel' problems

|

NEW YORK (CNNfn) - Germany's Mannesmann rejected a sweetened $128 billion all-stock takeover bid from Vodafone AirTouch Friday, setting the stage for a bitter takeover battle with its European rival.

Klaus Esser, Mannesmann's chief executive officer, said the rejection arose from concerns the deal would be a "spectacular, risky venture" for shareholders without a cash element and that it would face potential "cartel" problems.

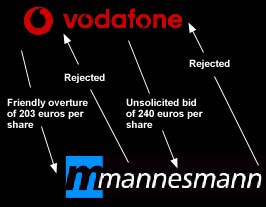

The words from Esser came after a meeting of Mannesmann's board, which he said reinforced support for management against the 240-euro-per-share bid. Vodafone's move is the largest unsolicited offer in history and a deal would be the biggest merger of all time.

Second rejection this week

The rejection marks the second time in less than a week that Mannesmann rejected an offer from Vodafone. Last Sunday, Vodafone's friendly bid of 203 euros was rebuffed by Mannesmann as inadequate.

A takeover would give Vodafone, already the world's largest mobile phone company and a key partner with Mannesmann in several European markets, 42 million customers and a pole position in the race to offer wireless data and voice services.

Investors weren't too impressed with the bid, which was widely expected following Mannesmann's first rejection and subsequent remarks from Esser that he didn't expect Vodafone could afford a bid high enough for his company.

Vodafone said it was forced to circumvent Mannesmann executives because a letter from the German firm Thursday indicated Esser "has no interest in a constructive negotiation."

Shares of Mannesmann actually fell Friday despite the higher offer. Mannesmann shed 14.40 euros, or 6.9 percent, to 193.10; Vodafone (VOD) fell 6.25 pence, or 2.2 percent, to 275.4 pence.

One industry analyst, speaking on condition of anonymity, said there were several reasons for that: "First, the stock had been on an upswing in recent days; second, Vodafone has made it clear this is its final offer, and the [Mannesmann] supervisory board said 'no' - so there is the potential for a hostile bid."

European fund managers and analysts have been sizing up Vodafone's hostile bid as a litmus test for capitalism in Europe, which has been liberalizing many sectors in recent years and is finding itself much more integrated following the launch of the common euro currency earlier this year.

Esser said Mannesmann will begin a campaign among shareholders next week to drum up support for its defense. Mannesmann said it also scheduled a meeting of its supervisory board Nov. 28.

Several hurdles remain

Several hurdles remain, including wary politicians in Germany, which has most often been home for big international buyers - such as Daimler-Benz when it bought U.S.-based Chrysler last year -- than to targets. Analysts polled by Reuters handicapped the prospects of success for a hostile bid at about 60 percent.

The battlefield turns to shareholders now, where both sides are likely to try to win in the court of public opinion.

Vodafone said Thursday it had received the green light from its shareholders to boost its original offer. Vodafone is offering 53.7 of its own shares for each Mannesmann share -- and said that is its final offer.

As part of the deal, Vodafone would assume 23 billion euros worth of Mannesmann debt, bringing the deal's total value to 147 billion euros ($152.9 billion). Vodafone said a deal would dilute its earnings by 10 percent in the first year after completion, but will generate cost savings of almost $1 billion a year by 2004.

Question of the price

At least one money manager who owns shares of both companies said Mannesmann should take time to consider Vodafone's latest offer. "Let the Mannesmann people prove it's worth more," said the fund manager, who spoke on condition of anonymity. He said his fund has hundreds of thousands of dollars in each company.

"If [Mannesmann] say it's not high enough, it implies that they have a figure," the fund manager said. Germany's Commerzbank in a research note Friday said Mannesmann should fetch a "take-out" price of 282 euros and that the company was worth at least 235 euros per share based on very modest growth projections.

"The price on offer strikes quite a good balance between the need for Vodafone to minimize [earnings] dilution and the requirement to build critical mass in the global telecom market," according to analyst Mandeep Singh at ABN Amro. "The bid's chances of success are finely balanced. My feeling is the odds are marginally in favor of a victory for Vodafone."

Media reports have said Vodafone, despite the record-setting price it is offering, may not be the only bidder and a "White Knight" could step forward to rescue Mannesmann. But even within a hot mutual fund with holdings in both companies, there's a difference of opinion about whether its offer could be trumped.

"The bid is almost bigger than Bill Gates's personal wealth, so maybe he could do it, but I don't know who else," said David Plants, a fund manager with Dresdner RCM Europe Fund, which has about 7.5 percent of the $50 million it manages in Mannesmann.

But Plants' co-manager, Barbel Lenz, disagreed. "I think the bid could go up. This company is a jewel, it's the best cellular phone provider in Europe." They and a group of other major shareholders were to meet a top Vodafone executive in San Francisco Friday.

Esser said Friday Mannesmann wouldn't interested in support from a White Knight bidder, and rather prefers to be independent.

Tough legal environment for bid

While the offer price is seen as adequate to win over shareholders and deter any White Knights, Vodafone still faces a huge task in overcoming the complexities of German corporate law, which have prevented any hostile takeover from succeeding in Germany.

If successful, the bid would be the first-ever hostile takeover in Germany. A key question is how German government officials, who so far have stayed on the sidelines, will react.

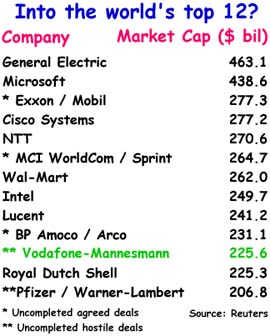

Vodafone CEO Chris Gent said his company has approached European regulators, who would have to approve the merger. The deal would create the Continent's most valuable company by market capitalization, valued at around $260 billion.

Mannesmann was dealt a humiliating blow Thursday in its attempt to prevent Goldman Sachs from advising Vodafone, making a claim of a conflict of interest. A British High Court judge threw out the suit, saying Mannesmann had presented "totally false" evidence and that its conduct was "totally disgraceful and unacceptable."

Upon completion of the deal, Mannesmann shareholders would end up holding 47.2 percent of the enlarged firm.

Fast-moving market

The telecom market in continental Europe, which was deregulated only Jan. 1, 1998, has developed at breakneck pace. New operators have sprung up, rapidly grabbing market share from incumbent operators and attracting heady stock market valuations in the process.

The development of cellular services has been at the forefront of this change, greatly aided by a common technology platform called GSM, which has allowed users to make calls anywhere on the Continent and has led to a boom in subscribers.

The next step for the cellular industry is converting phones to Internet-capable technology. Increasingly, the focus will be on enabling phones to download data and information directly from the Internet.

Mannesmann is focused on integrating fixed-line and cellular technologies -- it already owns Germany's second-largest fixed network -- while Vodafone's strategy is based solely on exploiting the potential of cellular networks.

IPO for fixed-line units

Vodafone indicated it intends to undertake an initial public offering of shares in Arcor and Infostrada, Mannesmann's German and Italian fixed-line businesses.

Vodafone already is a minority shareholder in Mannesmann's Mobilfunk and Omnitel units. Mobilfunk operates Germany's D2 wireless network, the country's most popular. Omnitel is Italy's second-largest cellular operator, behind Telecom Italia Mobile, Europe's largest player (until the Mannesmann-Orange deal goes through), with 18 million subscribers.

The Vodafone bid was sparked by Mannesmann's $36 billion takeover bid for Orange (ORA), the third-ranked U.K. mobile operator and a Vodafone rival. That deal is still pending.

Plants of the Dresdner RCM Europe Fund said that investment bankers had advised Mannesmann to make the move for Orange to bulk up enough to stave off a takeover, but in fact it triggered a larger appetite from Vodafone, which doesn't have a presence on the European continent as impressive as Mannesmann.

If it wins Mannesmann, Vodafone has said that it will hand Orange shares back to shareholders to placate U.K. regulators, who won't allow a single company to own two of the four existing cellular licenses in Britain.

Huge bank loan

A combined company would have net debt of 33.6 billion euros, although more than half of Mannesmann's 23.1 billion euro debt is related to its takeover of Orange.

Vodafone plans to finance the bid with a record-breaking 23 billion pound ($37 billion) bank loan, the largest-ever syndicated fund raising. Banking sources said they expected the loan to be refinanced with a bond issue, which is likely to surpass the 15 billion euro bond issue by Olivetti to fund its hostile takeover of Telecom Italia earlier this year.

Standard & Poor's immediately put Vodafone on its ratings watch list with negative implications because of the additional burden on the U.K. firm's balance sheet. Vodafone said it is committed to maintaining its existing single-A credit rating.

-- from staff and wire reports

|

|

|

|

|

|

|