|

Europe tilts higher at close

|

|

December 27, 1999: 12:46 p.m. ET

Frankfurt posts record close; Paris touches intra-day high before retreating

|

LONDON (CNNfn) - European stock markets finished on the higher side Monday, with Frankfurt closing at a record high and Milan touching an intra-day record before giving back some gains.

Paris and Amsterdam ended lower, even though the main indexes also reached intra-day highs.

The Xetra Dax in Frankfurt closed up 55 points, or 0.81 percent, at 6,854.87 after peaking at 6,992. It was the ninth straight session advance for the index, which was bolstered by strength in financial issues.

Milanís MIB 30 ended up 1.84 percent at 42,369. The index soared 2.4 percent at one point as investors poured into telecom shares before stepping back.

The SMI in Zurich closed up 16 points, or 0.22 percent, at 7,413.30, helped by strong insurance stocks.

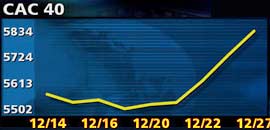

In Paris, the CAC 40 closed down 18 points, or 0.31 percent, at 5,834.47. It climbed more than 1 percent early trading before a sharp drop in oil refiner TotalFina pegged back the market. Amsterdamís AEX index also retreated from early gains to finish down 0.01 percent at 660.37.

London markets were closed for a public holiday.

In the currency markets, the euro lost ground to end the European session around $1.0120, while the dollar recovered to 02.10 yen from having earlier fallen as low as 101.30.

The Italian market was pushed higher by telecom stocks, as yellow pages company Seat Pagine Gialle gained 17.7 percent on news it had launched a 720 million euro ($726 million) friendly takeover bid for office supply firm Buffetti, whose shares closed 26 percent higher.

Telecom Italia, which has a stake in Seat, rose more than 3 percent, as did its mobile arm TIM and parent Olivetti. Tecnost, the vehicle used by Olivetti to acquire control of Telecom Italia in May, surged 12 percent.

Financial shares fueled Frankfurtís morning surge, but later fell back sharply. Banks and insurers continue to benefit from a government tax proposal that will allow them to divest large industrial and financial holdings.

Deutsche Bank (FDBK) ended 6.9 percent higher after a session of large swings in thin trade. Insurer Allianz (FALV) closed 3.8 percent ahead, but Munich Re lost 2.4 percent after jumping more than 20 percent Thursday.

HypoVereinsbank, Germanyís second-largest bank, rose 2.6 percent, and third-ranked Dresdner Bank (FDRB) ended 3.8 percent higher.

Mannesmann (FMMN) shares closed 1 percent higher, even though the company denied a weekend press report that it was open to a friendly bid to fend off the hostile takeover offer from Britainís Vodafone AirTouch (VOD).

Parisí CAC broke through the 5,900 mark before pulling back, helped by an initial 5 percent surge in Crťdit Lyonnais (PCL) shares amid takeover speculation. But the stock ended just 0.2 percent higher.

Technology stocks continued their strong recent performance. Consultant Cap Gemini (PCAP) led the gainers with a rise of almost 10 percent at one point before being suspended at the high end of its limit. The stock finished 6.4 percent higher.

Pay-TV giant Canal Plus (PAN) added 5 percent.

Bouygues (PEN), the construction and telecom company, ended 3.1 percent ahead as bidders circled its Bouygues Telecom unit. France Telecom (PFTE) added 1.45 percent, but data communications provider Equant (PEQU) shed almost 5 percent after recent gains.

The CAC was also pulled back by a 5 percent slide in TotalFina (PFP) after one its tankers created an oil spill off of Franceís west coast.

The Zurich market was underpinned by a 1.5 percent rise in shares of Zurich Financial Services, despite its denial of reports that it was preparing a bid for Britainís Royal & Sun Alliance (RSA).

--from staff and wire reports

|

|

|

|

|

|

|