|

Asian markets climb in ‘99

|

|

December 30, 1999: 8:14 p.m. ET

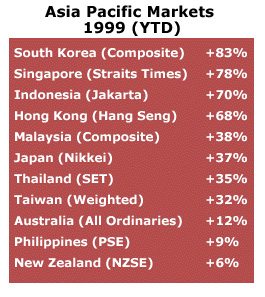

Tokyo, Hong Kong enjoy solid gains; Seoul, Singapore year’s top performers

|

NEW YORK (CNNfn) - Asian markets closed out 1999 on a high note Thursday, completing a year marked by surging investment in technology stocks that helped the region climb back from the economic turmoil of 1997.

On the region’s final day of trading this year, Tokyo’s blue-chip Nikkei 225 jumped to its highest close for the year, gaining 123.76 points, or 0.7 percent, to 18,934.34 in a half-day session Thursday. Hong Kong’s Hang Seng index gained more than 301.28 points, or nearly 2 percent, to a near record high of 16,962.10 on the strength of red-hot high-tech and Internet shares.

In other markets, Singapore shares edged up 0.28 percent Thursday, Indonesia stocks added 0.30 percent, Thailand’s SET index was up just under 0.5 percent Thursday, while Malaysia’s KLSE rose just under 1 percent.

In Australia, the benchmark All Ordinaries index climbed 11.4 points, or about 0.4 percent, to a record high close of 3,152.5. The previous record close was 3,145.2 on April 27.

Stock markets in South Korea, Taiwan, and the Philippines were closed Thursday.

Trading was light throughout the region ahead of the New Year’s holiday. Stock and bond markets will be closed in Japan, South Korea, Hong Kong, Indonesia, the Philippines, Thailand, Taiwan and Singapore Friday to give banks and brokerages time to prepare for the Y2K changeover.

The dollar bought 102.10 yen, down 0.20 yen from late Wednesday in Tokyo and also below its late New York level of 102.19 yen overnight. Although the yen continues to strengthen against the dollar, fears of intervention by the Bank of Japan should help to support the greenback, dealers said.

In other currencies, the euro traded at 102.78 yen, down from 103.26 yen late Wednesday in Tokyo.

South Korean market leads

For all of 1999, stocks in Tokyo, the region’s biggest market, rose 37 percent over 12 months, while Hong Kong blue chips jumped 68 percent.

But the region’s best performer was South Korea, where stocks catapulted 83 percent, followed by Singapore’s Straits Times index, which rose 78 percent on the soaring demand for high-tech stocks.

"These are great returns for markets that two years ago people avoided like the plague,” said Michael Goodson, Asian equity strategist at Salomon Smith Barney in New York. "The crisis is over, and the economies will growing close to trend line growth next year.”

Indonesia’s main stock index increased 70 percent in 1999, despite political turmoil in the violence-wracked country. But analysts say they are wary about the Indonesian market, and that investors should keep in mind that the 1999 bounce came from a very low base. The country’s economy was hit hard by the 1997 financial crisis.

"The political problems will continue to drag on,” said James Tso, president of SAFE/TSO Investment Management in Reston, Va. "I’d be careful going into Indonesia in any aggressive way.”

In other 1999 market gains, Thailand rose 35 percent for the year; Taiwan gained 32 percent; Malaysia rose 38 percent; Australia increased 12 percent; New Zealand gained 6 percent and the Manila Composite Index added 9 percent.

For all of 1999, the top-performing Kospi average in South Korea gained 465.61 points to close at 1,028.07. The rebound came without a corresponding rise in inflation, with the country’s inflation rate coming in at its lowest level since the government started recording consumer price index data in 1965.

"They were very serious about restructuring their economy after the financial crisis,” said Jerry Lu, a research analyst at China Region Opportunity Fund. He said the South Korean government instituted reforms that allowed the private sector, particularly smaller and younger companies, to grow.

"South Korea has been one of the best managed economies,” added Tso. "Clearly, Korea will continue to rebound; but I think the same can be said about Malaysia and Thailand.”

Meanwhile, the Korean currency, the won, has steadily been climbing. The won has appreciated about 6 percent against the dollar in 1999, strength that has prompted renewed warnings of possible government intervention.

2000 outlook

Analysts say the overall sentiment in Asian markets remains positive, but that investors should continue to keep an eye on ongoing political issues hanging over the region.

The Hang Seng index in Hong Kong should rise to 19,000 points next year, predicted Jason Ho, sales director at BNP Prime Peregrine Securities.

"Hong Kong will continue to do well as long as the communist government leaves them alone,” SAFE/TSO’s Tso added.

China Region Opportunity Fund’s Lu said that currently, his top country pick is Taiwan.

"They have a very good economy, a very good system already set up,” he said.

While Taiwan’s relationship with China -- which Beijing claims as part of China but remains beyond its control -- will always be an issue, a major political uncertainty should be removed after scheduled presidential elections in March, Lu said.

Lu also predicted that the World Trade Organization will agree to admit China into the trading bloc sometime in 2000, a development that would boost investor sentiment throughout Asia, he said.

ADRs, baskets recommended

Individual investors looking to get into the market should pick selectively from solid businesses based in the region by buying American depositary receipts, analysts said. Other options include the baskets of country stocks offered in the U.S. or closed-end mutual funds, analysts advise.

”We're focused on telecom businesses -- things that people will always need no matter what happens,” Tso said.

For the long term, the region’s stability and prosperity must come from a partnership between China and Japan to lead the region, said another observer, who predicts the formation of an Asian Common Market by about 2010.

"This sounds far-fetched now ... However, history eventually moves forward on mutual interests rather than emotive prejudices,” Andy Xie, chief economist at Morgan Stanley Dean Witter in Hong Kong, told Reuters.

-- staff and wire reports

|

|

|

|

|

|

|