|

Investing: 2000 and beyond

|

|

December 30, 1999: 8:27 a.m. ET

Experts see price-to-sales ratios, value stocks, international sector as leaders

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - Some predict the flame that fuels the U.S. economy will begin to fade in the next 10 years.

Others suggest the domestic economy will power on, but say the international markets will take its place as the next new hot spot for bargain-hunting investors.

And still others believe the volatility that emerged on Wall Street this year is merely a precursor to the day-trading induced turbulence that lies ahead.

On one school of thought, however, the experts seem to agree: The Main Street investor will be faced with a much less forgiving stock market in 2000 and beyond.

"In the next few years, we may be in for a soft landing where we see things cool off a bit,” said Peter Cardillo, a stock market strategist for Westfalia Investments. "The bull market will continue for a long time, with a few corrections here and there, but whether investors will be able to make 25 percent to 40 percent returns (on equity investments) is questionable.”

It’ll be a world where dot.com firms are forced to put up or shut up, where value investing comes back in vogue and where unsophisticated investors -- spoiled by the staggering returns of the go-go 1990s -- may well be in for a rude awakening.

Strategists say hold tight

So where does that leave you?

For investors who aren’t sure where to turn next, stock market strategists say the message is clear: Don’t do anything drastic.

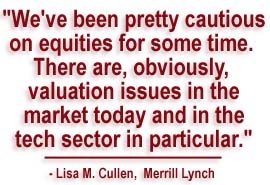

"We wouldn’t advocate any kind of radical change at this point,” said Lisa M. Cullen, vice president of investment strategies for Merrill Lynch. "We are always proponents of diversification, of course. But for individual investors, it really depends on their risk profile and what their investment goals are.”

As a long-term investor, the best way to avoid a costly panic crisis is to prepare yourself -- and your portfolio -- for market trends to come.

For starters, experts say, be aware that growth investments -- and technology stocks in particular -- may be in for a bumpy ride, even as they continue to produce investing returns.

If your blood pressure soars at the slightest stock price fluctuation, you may want to lighten up on those holdings in your overall portfolio.

Don’t forget that, while volatile, tech and Internet stocks these days have among the highest growth potential on the market. Being overly cautious may help you sleep at night, but it won’t do much for your long-term investment goals.

"The Street has truly changed a lot because of the day trading frenzy,” said Rich Miller, a broker at J.C. Bradford. "What you have is a lot more traders out there creating more volume, and that’s going to continue to create great waves of volatility.”

Miller predicts a number of "watershed sell-offs” in the months and years to come, in which neophyte day traders dump their shares after a rough day on Wall Street and cash in their chips much the worse for wear.

"You’ll get a lot of people who get hurt out there and I don’t know if they’ll make it through that,” Miller said. "The guy who day trades on Tuesday and works his construction job on Wednesday will end up losing $10,000, get a margin call and he won’t have the money to pay it."

(Click here for CNN’s most recent special report on day trading.)

All the more reason, then, to adhere to the tried and true investment strategies that have helped investors weather Wall Street storms in the past.

One strategy that has proven effective is dollar-cost averaging, whereby individual investors purchase equity shares on a regular basis over the course of many years to balance out stock market fluctuations.

Some years you’ll buy high. Some years you’ll buy low. But in the end, odds are you will have purchased that stock at an average price per share.

"I think if you have yourself diversified enough, you’ll be OK,” Miller said, noting most investors should continue padding their portfolios with mutual funds. "That’s the job of a mutual fund, to keep you from losing your butt.”

Spreading out your investments among value and growth stocks, blue-chips and small caps, high-risk and safety stocks -- such as utilities with their steady returns -- is another good way to insulate yourself from the mass market exodus many strategists believe will happen 10 years down the road.

"The baby boomers begin retiring in the next 8 to 12 years and that’s going to be a lot of money pouring out of the market as they pull out their pension funds and 401(k)s,” Cardillo said.

Scott Bleier, an investment strategist for Prime Charter Ltd. in New York, agrees.

"We are in the midst of the greatest demographic boom that we’ve seen in the United States so far,” he said. "But late in the first decade (of 2000), we’ll start to see that demographic sweet spot erode and people will start spending less and investing less. All this prosperity will end.”

Investing today

For the immediate future, the pros say you’ll want to begin making stock picks based on sector growth potential and long-term market trends.

In its latest strategy report, Merrill Lynch said "we think that investors should seek out sectors that are leveraged to global recovery, like selected basic industry stocks.”

The brokerage house said it "de-emphasized consumer cyclicals,” like automobiles, retailers and household furniture manufacturers, and focused instead on Real Estate Investment Trusts (REITS) and natural gas issues as the next new categories of value stocks.

Indeed, a growing number of stock market pros are recommending investors add energy stocks to their portfolios early next year.

As for stocks in general, Merrill Lynch said you’ll have to pick your poison carefully. That’s because consumer spending and consumption growth is being fueled by mounting debt, a worrisome trend.

"We have some concerns that all of this is rising at unsustainable levels, especially with the cost of capital rising (as interest rates go up),” Cullen said.

"We’ve been pretty cautious on equities for some time. There are, obviously, valuation issues in the market today and in the tech sector in particular.”

That being said, Cullen noted, you don’t want to ignore the red-hot tech sector altogether. You just have to be much more careful about which stocks you select.

"The place you’ll want to be is where there are sustainable growth themes, and the most interesting sector for that is the Internet and wireless telephony,” she said.

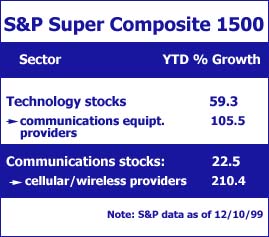

Technology stocks on the S&P Super Composite have soared 59.3 percent so far this year, according to Standard & Poor’s sector scorecard. As a subset of the technology sector, communications equipment providers have surged a staggering 105.5 percent.

The S&P Super Composite was last updated Dec. 12 and is comprised of 1,500 stocks on the S&P 500, Smallcap and Midcap indexes. The S&P 500 index alone climbed a respectable, but less awe-inspiring, 15.3 percent this year.

As Cullen suggested, communications companies show no signs of slowing down -- as epitomized by the year-end blast-off of Qualcomm.

On a year-to-date basis, communications firms on the S&P 1500 index rose 22.5 percent, while cellular and wireless firms in that category rocketed 210.4 percent.

"We see wireless voice and data businesses as the future,” she said. "It’s an exciting theme and the market certainly looks like it’s got a lot of life to go.”

The ratio game

One other trick of the trade that might help you find that next Dell (DELL) stock is a newly embraced tool called price-to-sales ratio.

Over the last 50 years, the price-to-sales ratio has emerged as the single best valuation tool, beating out the more commonly used price-to-earnings ratio, said James P. O’Shaunessy, author of "What Works on Wall Street.”

P/S ratios, he said, are especially important for weeding out the well-positioned tech stock from the over-priced dot.com firm. For the record, O’Shaunessy predicts that 80 percent of the Internet-related companies vying for Wall Street’s attention these days will have been merged, acquired or fallen by the wayside in the next 10 years.

"Internet-related companies are so exciting now because it’s a brand new world out there and they are inventing it,” O’Shaunessy said. "At the end of the day, you need to determine which Internet company makes sense and which doesn’t. You have to approach these companies with tremendous caution.”

To calculate a company’s price-to-sales ratio, simply divide the company’s current stock price by its sales, or revenue, per share. You’re looking for a company with relatively low P/S ratio and a high relative strength, or expected price momentum.

"You need to find a simple strategy and let it work for you,” O’Shaunessy said. "To identify the ones that are going to be the big winners, you really want to focus on the ones that are going to be able to aggregate the most number of users and extricate the most money from them. That’s the name of the game.”

O’Shaunessy also noted that value investing will come back in fashion in the next few years as volatility in growth stocks -- including the tech sector -- takes its toll.

"Value has been deeply out of favor for the last three years, but now you might want some exposure there,” he said, noting both strategies include levels of risk.

That means you should be dividing your investment up among the high-risk, high-reward stocks that you or your broker believe to be on the rise, and the value-oriented issues whose stock appears to be trading at less than it’s worth.

There again, you’ll want to use both the price-to-earnings ratio and the P/S ratio to help you decide.

Crossing the pond

Lastly, investors looking for the next best place to park their dollars might be wise to begin focusing on investments abroad.

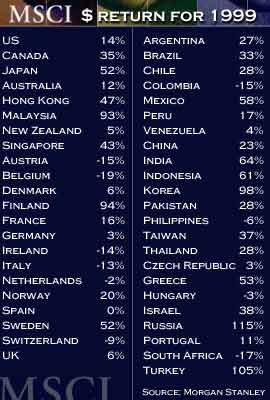

"In our view, U.S. investors should think globally (for year 2000 investment strategies),” Merrill Lynch chief investment strategist Charles I. Clough wrote in his latest report. "Non-U.S. markets outperformed the U.S. in 1999 by a wide margin for the first time since 1993. That is likely to continue if profit growth accelerates abroad on the heels of recovery in Asia and Europe, while it slows here.”

Asia, he noted, is at once a story of economic recovery and technological promise.

At the same time, Clough wrote, Europe is "clearly recovering while consolidation occurs in the telecommunications, retailing and financial sectors.”

"International investing has been increasing dramatically over the last few years already,” said Leila Heckman, head of global asset allocation for Salomon Smith Barney. "The international markets have done quite well this year, including Japan and most of the European markets.”

She noted U.S. investors who bet on European equities would lose, and continue to lose, part of their returns due to the weakened euro. But that doesn’t mean you should shy away.

"Basically, if you are a U.S.-based investor, you should have 80 percent of your equity portfolio invested in the United States and 20 percent outside the U.S.,” she said.

Ideally, part of your overseas dollars would be invested in the emerging markets like Latin America, Asia and Eastern Europe. The rest should focus on Western Europe and so-called "developed Asia,” which includes Hong Kong, Singapore and Australia.

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|