|

Funds plan for the future

|

|

December 30, 1999: 2:07 p.m. ET

401(k)s, international alliances will help the industry grow in the new millennium

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - The horse and buggy, the eight-track tape, mainframe computers -- all great innovations at one time, but as technology progressed they faded into history books.

On Wall Street, the Internet has helped individual investors elbow the pros out of the way, leading many to wonder about the fate of the $6 trillion mutual-fund industry that helped fuel one of the mightiest bull markets in history.

In the last gasps of the 20th century, fund executives have been scrambling to reinvent themselves, building new operations in the retirement planning sector and forging alliances overseas. The efforts, they say, will keep the fund business chugging along well into the new millennium, although at a slower pace.

Plus, they insist that mutual funds will always have a place in an investor’s portfolio, regardless of whether he or she trades Microsoft from his living room. When the next bear market appears, Main Street investors will appreciate the career money managers.

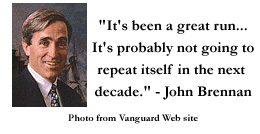

"The principles that mutual funds are based on always come under fire at the peak of bull markets,” said John Brennan, chairman of fund giant Vanguard Group. "In the late 60s, all you needed to own was Kodak, Polaroid and Xerox. Now it’s the latest IPO. People say why do I need to own 50 stocks when I can own two and make a lot of money?”

Mutual funds, Brennan said, are not exactly a flash in the pan. The oldest mutual fund is MFS Massachusetts Investors Fund, which was introduced in 1924 by MFS Investments. The fund, with $8.2 billion in assets, has a 10-year annualized return of 15.85 percent, according to Morningstar.

Another old-timer is Vanguard’s Wellington Fund -- it predates Vanguard -- the seventh-oldest fund dating back to 1929. Wellington Fund, with $26.7 billion in assets, has a 10-year annualized return of 12.73 percent, Morningstar said.

"Investors were leveraging stock in the roaring 20s, and the Wellington Fund is doing just fine 70 years later,” Brennan said.

The fund industry started taking off in the 1980s, but the 1990s was really the decade of massive growth. By 1998, assets in mutual funds surpassed assets in U.S. banks, a monumental milestone. Star managers like Fidelity’s Peter Lynch became as well known as celebrities. In 1999, there were 9,253 funds tracked by Morningstar.

The best performers of the decade include tech funds, with average annualized returns of 28.73 percent as of Dec. 29; communications funds, up 20 percent over the same period; large growth funds, up 18.54 percent; Small growth funds, up 18.40 percent; and financial stock funds, up 18.40 percent, Morningstar said.

A year of triple-digit returns

Still, few people expected the explosion in 1999 that sent the Nasdaq soaring to more than 50 record closes. Small- and mid-cap stocks, which had languished in previous years, caught fire thanks largely to technology. International markets also soared after a long dry spell.

Among 1999 winners, technology stock funds are up an average of nearly 134.04 percent year to date through Dec. 29, while funds that invest in Japan, other parts of Asia, emerging markets, small U.S. growth stocks and mid-cap growth stocks are up 62 percent to 114 percent in the same period, according to Morningstar. (Click here to see some top funds in those sectors).

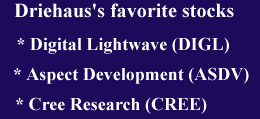

"It’s been an unbelievable year,” said a euphoric Richard Driehaus, founder and chief executive of Driehaus Capital Management. The Driehaus Small-Cap Fund is up 178 percent year to date as of Dec.20, while the Driehaus Mid Cap Fund is up 195 percent in the same time, he said.

In fact, times are so robust that Driehaus came back from lunch one day to discover the two funds had jumped 5.5 percent while he was gone.

"We’ve had good years, but nowhere near the magnitude of this year,” Driehaus said.

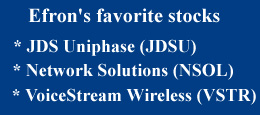

Eric Efron, co-manager of the USAA Aggressive Growth Fund and USAA Small Cap Stock Fund, also has reason to smile. Aggressive Growth is up 80.7 percent year to date as of Dec. 21, while the Small Cap fund is up 25.6 percent since it launched Aug. 1, USAA said.

Internet company IPOs and the rising importance of bandwidth have helped the funds soar, Efron said.

"The IPO surge, I’ve never seen anything like it,” Efron said. "It’s been very, very strong. A lot of these companies are small, developmental-stage companies.”

Online trading takes its toll

Yet despite all of this good news, the fund industry overall has faced record redemptions in 1999 as investors leaped into online trading. There were about 5.1 million online investors in July, and by December the number has grown to 6 million, according to Boston researcher Gomez Advisors. That number is expected to soar to 10 million by the end of 2000, the company said.

Meanwhile, mutual funds had redemptions of $816 billion as of Dec. 22, compared to $748 billion in 1998, $398 billion in 1996, and $329 billion in 1994, according to the Investment Company Institute, a Washington trade group.

"Nineteen ninety-nine was a tough year for many in the fund industry,” said Jeff Lyons, executive vice president for mutual funds at Charles Schwab. "Overall, it was a good year, but certainly more of the net flows were concentrated in fewer and fewer companies.”

At the same time, fewer new funds are debuting and there are more mergers and consolidations in the business, Lyons said.

"This is an implication that it’s getting tougher and tougher to compete,” Lyons said. "A few years ago, hundreds of new funds were coming out every year. Those days are over.”

Looking ahead to the 21st century

But fund companies are hoping to cash in on the 80 million baby boomers planning for retirement and expect more assets to come from 401(k)s and IRAs. Social security reform that privatizes some assets could be another boost for funds.

"The 401(k) market is huge - it’s a very big part of incremental flows,” said Mark Whiston, vice president and chief marketing officer at Janus Funds. "It’s very sticky money. (Investors) are making decisions and sticking with them.”

Fund companies also see Europe, Asia and Latin America as virgin markets with great potential. Many of the top names in the industry are forging alliances or introducing new products overseas.

For example, Janus in December launched funds that mirror its U.S. products that the company is distributing via banks and brokerages to investors all over the world. The assets in the Janus World Funds total $1.3 billion.

Many countries are also looking to supplement state-run pension plans with retirement plans similar to the U.S. 401(k), said John Ballen, president of MFS Mutual Funds.

"In Japan, there’s 15 times more money in banks than in mutual funds,” Ballen said. "Even in Europe, banks dominate. There’s plenty of room for mutual funds to gain market share.”

Another important factor to consider is that Wall Street will not always perform so well. As the market gets harder to beat, investors will give the job back to the pros, fund experts say.

"The public has been oblivious to the fact that volatility on the upside can be matched on the downside,” said Burt Greenwald, a fund analyst in Philadelphia. "If there’s an extended bear market, more people will go back to funds.”

Priorities for 2000 and beyond

Looking forward, many experts say fund companies still need to prove themselves to investors through strong returns, lower fees and better education.

"You need to have a diversified base of business, and you need to be in different categories to weather ups and downs,” said MFS’s Ballen. He expects growth of 3 to 4 percent a year, plus another 10 percent a year through appreciation of fund assets. Assets in funds will likely hit $10 trillion in the next five years, he said.

Fund costs have not come down nearly as much as online trading fees, said Russ Kinnel, an analyst at Morningstar.

"They need to do a better job of managing money at a lower cost,” Kinnel said. "They can do a better job.”

(Click here to see Kinnel’s fund picks for 1999).

Vanguard’s Brennan promises new funds (he will not say what kind) and says the company will remain independent.

"Just because information is readily available, it doesn’t mean it’s any easier to pick stocks that will do well,” Brennan said.

At Janus, Whiston said the company would continue to focus on stock picking and education.

"In a bull market people chase returns and aren’t necessarily savers,” Whiston said. "They need to make a long-term commitment to asset allocation. People focus on month to month flows, but what matters is are you attracting shareholders who will be committed for three to five years.”

And Lyons, of Schwab, said the company plans to be a "clicks and mortar” operation, offering strong Internet service as well as individual attention via phones and satellite offices.

"People want the best of both,” Lyons said. "They see the value in the kinds of tools and information and ease of convenience on the Web. Yet they still want contact with a person.”

|

|

|

|

|

|

|