|

Wall St.’s record century

|

|

December 31, 1999: 6:33 p.m. ET

Dow, Nasdaq, S&P cap phenomenal year, decade at all-time highs

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Wall Street finished the 1900s at an all-time peak Friday -- capping a century of unprecedented growth punctuated by two market crashes, the longest-running stock rally in history, and the emergence of technology companies as leaders for the 21st century.

All three leading market indicators ended at record highs in an abbreviated New Year’s Eve session. The Dow Jones industrial average -- the only major indicator in existence 100 years ago -- rose 44.26 points to 11,497.12, surpassing the record set Wednesday.

The Nasdaq composite index gained 32.44 to 4,069.31, also topping a mark set Wednesday, while the S&P 500 index rose 4.78 to 1,469.25, the third straight record close for the indicator.

Advances outnumbered declines 2,150 to 922 on the New York Stock Exchange. Trading volume was the second lightest of 1999 -- just 377 million shares -- as many institutional traders had already closed their accounts for the year.

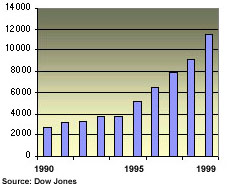

In the 1990s, the Dow Jones industrial average posted its biggest gains of any decade in its history

With strong economic growth and solid corporate profits providing the high-octane fuel for the market, Wall Street smashed virtually every record in its way this year -- leaving many market experts to wonder when the rally will end.

"It's amazing," said Jeremy Siegel, professor of finance at Wharton School of Business. "Every year we say it can't be another year of 20 percent-plus (gains) -- and then every year it's 20 percent-plus. I still maintain we have to get used to lower, more normal returns, but who knows when this streak is going to end?"

Phil Dow, market strategist with Dain Rauscher Wessels, said stock prices are likely to moderate in the coming year but that doesn’t mean the party is coming to an end. (523K WAV) (523K AIFF).

A phenomenal 1999 ... for some

The year’s stellar gains occurred as the U.S. economy is poised to record the longest expansion in history.

In fact, so many market records were set in 1999 it’s almost mind-boggling. For example:

*The Nasdaq composite rose 85.6 percent, the biggest annual gain for a major market index in U.S. history.

*The Dow industrials gained 25.2 percent in 1999, a record fifth year in a row that the blue-chip index posted a double-digit percentage gain.

*The S&P 500 rose 19.5 percent, a record fifth straight year the index posted a double-digit gain.

*A record 203.9 billion shares were traded on the New York Stock Exchange and a record 265.6 billion shares changed hands on the Nasdaq.

(Click here to see how the major indexes have performed over the last 10 years.)

But despite the headlines about records, analysts noted the gains were not widespread.

Of stocks trading on the New York Stock Exchange, 64 percent declined an average of 28 percent. On the Nasdaq, 50 percent of stocks retreated an average of 32 percent.

"It was obviously a very selective market. Not everyone was smiling,” said Al Goldman, chief market strategist at A.G. Edwards & Sons. "If you didn’t own a dot.com, high-tech or telecom stock, you probably didn’t have a great Christmas. Those groups did very well for a few people, but most investors did not love 1999.”

No investor could ignore the dominance of the technology sector. The year ended with Microsoft (MSFT), the world’s largest software company, having the largest market capitalization at $614 billion. General Electric (GE), the only original Dow industrial component still part of the average, came in second at $519 billion.

The year also brought the inclusion of Microsoft and Intel, the world's No. 1 chip maker, in the Dow industrials. The reconfiguring of the blue chip index not only aided its surge forward, but exemplified -- along with the addition of Internet issues Yahoo! (YHOO) and America Online (AOL) to the S&P 500 -- the importance of technology in the modern economy.

‘The Fabulous ‘90s’

The market captured the imagination and interest of millions of Americans who participated in some form, either by tracking their own stocks online in the comforts of their homes, or watching a flurry of financial television programming. The environment created media stars out of top analysts at Wall Street brokerage firms and Federal Reserve Chairman Alan Greenspan.

"The gains have created unprecedented levels of paper wealth,” according to Yale Hirsch, who runs the Hirsch Organization and edits the Stock Trader's Almanac. "More than $10 trillion in stock wealth was added between November 1994 and November 1999.”

To put the figures in perspective, the amount of wealth created by the stock market in the last five years of the decade is enough to buy everyone in the world a Big Mac, fries and Coke for more than a year.

Companies such as wireless technology provider Qualcomm rose like a rocket ship. Going public in December 1991 at a post-split equivalent of $2 a share, it ended the decade at $176.125 -- an 87-fold increase in value.

And companies such as Microsoft and Cisco Systems (CSCO), which weren’t even around 25 years ago, now stand among the leaders in market capitalization.

The Internet allowed instant availability of information and access for market participants. In addition, trading volume increased at a high-speed pace, with over 1 billion shares changing hands at the Nasdaq on a regular basis.

As the decade draws to a close, the results are staggering. More than 200 billionaires have been created in the last 10 years alone, versus just 13 in the 1980’s, and the number of "paper millionaires” grows with the record index numbers.

"This has been the most spectacular bull market of all time. In 30, 40 years from now, they will be talking about the fabulous 90’s,” Hirsch said.

A mix of optimism and caution

But some analysts expressed a sense of uneasiness about the market’s breathtaking milestones, specifically those of the Nasdaq. With stock valuations so high, many believe the composite index has reached unsustainable levels and will face a correction next year.

David Sowerby, a portfolio manager at Loomis, Sayles said technology stocks in particular could see a shake-out in the first half of the new year (309K WAV) (310K AIFF).

Strategists expressed concern about future Fed rate hikes, noting there was complacency about the Fed’s monetary policy action this past year. The central bank increased short-term interest rates three times in 1999, and many analysts are convinced the Fed will hike them again in the new year.

Wharton’s Siegel said investors should expect 8 to 10 percent gains from their stock investments, a far cry from 1999's record advances.

A century of wealth

The century that ended Friday began with a stock market dominated by industrial companies -- whose success hinged on America’s ability to turn out tons of raw materials that could be transformed into automobiles, washing machines and skyscrapers.

Companies such as General Electric, U.S. Steel (X), Standard Oil and Ford Motor Co. (F) provided the fuel for America’s emergence as an industrial power, giving rise to the term "blue-chip stocks” because of their reliability for turning out profits year after year.

As the 1920’s drew to a close, it seemed the market’s euphoria would never end. But, on Oct. 28 and 29, 1929, the stock market crashed, wiping out $14 billion in market value. Almost overnight, investors who had bet everything they had on the speculative market were broke. Businesses closed, banks collapsed and the nation plunged into the Great Depression.

It would be 22 years before the Dow would return to the lofty levels of 1929 and almost as long again before the blue-chip index would finally top the 1,000 mark.

Former heavyweight boxing champ Muhammad Ali, Sports Illustrated’s Sportsman of the Century, rang Friday’s opening bell on the New York Stock Exchange

With the Cold War came a new type of conservatism, even on Wall Street. But the seeds for the market boom at the century’s end were planted with the advent of individual retirement accounts, or IRAs, which allowed average Americans to invest in stocks to build a nest egg for their later years.

As America prepared to move into the Digital Age, corporate takeovers, leveraged buyouts and junk bonds energized the stock market of the 1980s, giving rise to a new breed of scoundrels on Wall Street.

Once again, the stock market crashed, with the Dow falling 508 points in a single 1987 day. More than $500 billion in market value was wiped out, prompting many investors to fear the economy was heading toward another depression. But the bull market refused to die and within a few weeks the Dow was forging ahead once again.

By the start of the 1990’s, the Cold War was over and the technological boom was in full swing. Powered by the explosive growth of the Internet, America’s economy was firing on all cylinders. On Wall Street, companies with ties to the Internet were the new darlings.

Practically anything with a "dot.com” at the end of its name could expect to see its stock price double, triple or quadruple in a few months, profit or no profit. And investors, eager to cash in, joined the party by the thousands, thanks in large measure to discount brokerage firms, mutual funds and online trading accounts.

In taxis, restaurants and offices across America, people talk about stocks with the same passion as they talk about their favorite baseball team or the latest episode of a hot TV sitcom. Wall Street experts such as Abby Joseph Cohen, Ralph Acampora and Peter Lynch have become household names. And when Fed chairman Greenspan crosses a Washington street on the day of a crucial meeting on interest rates, all eyes turn to his briefcase for clues to the Fed’s next move.

Fed Chairman Alan Greenspan’s every move is now scrutinized by investors.

"We’re all participating in one way or another in this great equity market,” said Barry Hyman, chief market strategist at Ehrenkrantz King Nussbaum. "There will be declines along the way, but there’s still opportunity as we go into the next five to 10 years.”

-- with contributions from CNNfn.com writers Jake Ulick and Jerry Dubrowski

|

|

|

|

|

|

|