|

Meltdown on Wall St.

|

|

January 4, 2000: 6:01 p.m. ET

Fed rate hike fears pressure stocks; Nasdaq suffers worst one-day point drop in its history

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Wall Street suffered its worst day in almost 16 months Tuesday, with technology companies bearing the brunt of the selling as investors focused on the possibility of higher interest rates.

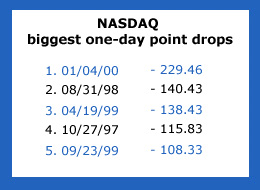

One day after soaring to a record close, the Nasdaq composite plunged back to earth, tumbling 229.46 points, or 5.6 percent, to 3,901.69. The drop was the biggest single-day point loss for the technology-heavy index in its history. However, on a percentage basis, the decline ranked as the eighth-largest drop in Nasdaq history.

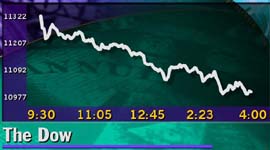

The carnage was only slightly better for blue chips with the Dow Jones industrial average tumbling 359.58, or 3.2 percent, to 10,997.93, representing the fourth biggest point drop in its history. Coupled with Monday’s 139.61 point loss, the blue chip indicator has fallen almost 500 points the past two sessions.

The S&P 500 index tumbled 55.80, or 3.8 percent, to 1,399.42, its fifth largest one-day point decline in history.

Analysts attributed the steep sell-off to concerns the Federal Reserve will hike interest rates by at least a quarter of a percentage point at its next policy meeting in early February.

"Sellers are in control. There is a need for fear,” said Michael Farr, portfolio manager at Farr Miller & Washington.

Higher interest rates are generally bad for stocks because they normally translate into lower corporate profits. While investors have been concerned for months about the future of interest rates, many experts said such fears were pushed to the back burner by the belief that the Federal Reserve would not hike rates until the Y2K deadline passed.

Now that the it appears that few companies are suffering from Y2K problems, analysts believe the Fed will move quickly to raise rates and keep the U.S. economy from overheating.

On the New York Stock Exchange, declines swamped advances 2,239 to 911 as trading volume reached a heavy 989 million shares.

Market experts say investors should buckle up

Treasury prices rose, with the bellwether 30-year bond gaining over a full point in price, lowering its yield to 6.53 percent from 6.62 percent late Monday.

In the currency markets, the dollar rose against the yen and fell against the euro.

Market participants said investors largely discounted news that President Clinton will renominate Fed chairman Alan Greenspan for a fourth term. Jim Benning, trader at BT Brokerage, said it already was factored into the market.

Rate hike fears continue

Concerns about upcoming Fed rate hikes pressure stocks for the second consecutive session, with many market analysts believing the central bank will increase rates by at least a quarter of a percentage point at its next monetary policy meeting Feb. 1 and 2.

"It’s interest rates. Portfolio managers are taking the opportunity to readjust their portfolios in the face of rising interest rates,” said Brian Conroy, head of listed trading at J.P. Morgan.

"There is nervousness about interest rates. We’ve had a phenomenal run and went too far too fast,” said BT Brokerage’s Benning.

Investors await key data

Investors await the next key economic release, Friday’s U.S. employment report for December, to provide clues to upcoming Fed monetary policy.

Art Hogan, chief market analyst at Jefferies & Co., told CNNfn a benign report would provide support. (272K WAV) (272K AIFF)

Ken Tower, director of technical research at UST Securities, told CNNfn he saw the sell-off as no major cause for concern. (684K WAV) (684K AIFF)

Also pressuring the market was news that John Manley, equity strategist at Salomon Smith Barney, lowered his recommended asset allocation for stocks to 55 percent from 60 percent.

Techs suffer

The technology sector posted heavy losses, pulling the Nasdaq composite far below the 4,000 mark. The index outperformed the broader market Monday, achieving a record close at 4,131.15.

"There’s manic panic in the Nasdaq. There is interest rate concern as the economy continues to be quite strong,” said Larry Rice, chief strategist at Josephthal & Co.

Bob Dickey, technical analyst at Minneapolis-based Dain Rauscher Wessels, told CNNfn he detects a change in the sectors driving the markets. (499K WAV) (499K AIF)

Among the losers was software maker Parametric Technology (PMTC). Its stock plummeted 5-1/8, or more than 20 percent, to 20 after the company said its fiscal first-quarter earnings would be between 4 and 6 cents per share, down from 11 cents in the year-earlier period.

Qualcomm (QCOM) continued to be one of the most actively traded issues on the Nasdaq. The wireless technology provider’s shares gave back some of its recent stellar gains, slumping 17-1/4, or nearly 10 percent, to 162-1/16.

Dell (DELL) declined 4-1/4 to 46-5/8 on the heels of Merrill Lynch analyst Steve Fortuna’s report that the computer maker is having difficulty managing its business amid high component costs, which could negatively affect its fiscal fourth-quarter results.

Among Internet issues, Yahoo! (YHOO) gave back the day’s gains, falling 32 to 443. Schroder raised its 12-month price target to 600 from 350 and maintained its "outperform” rating on the stock.

CNET (CNET) was also a late casualty, slipping 5/8 to 60-13/16 after trading in positive territory for most of the session. The technology news and information service announced a deal with AMFM (AFM) to create an all-technology news radio network. AMFM retreated 2-11/16 to 74-7/16.

VA Linux Systems (LNUX), a leading Linux operating system provider eased 12 to 180. Deutsche Bank Alex. Brown, which was an underwriter of the company’s initial offering, began coverage of the stock with a "buy” rating and set a 260 price target.

Among computer makers, Compaq (CPQ) tumbled 2-1/2 to 28-1/2 and IBM (IBM), a member of the Dow industrials, declined 3-15/16 to 112-1/16.

Financial service issues sink

Also on the skids beside technology were financial stocks. Among the Dow components, American Express (AXP) fell 5-15/16 to 151-5/16, Citigroup (C) retreated 2-1/4 to 50-3/4 and J.P. Morgan (JPM) slid 6-1/16 to 115-3/8.

On Internet chat boards Tuesday afternoon, investor sentiment was mixed.

"Don't worry about the markets,” said one posting. "People are just selling in wake of big gains of '99."

But others were not so confident.

"The correction is just beginning,” another investor said.

(Click here for a look at today’s CNNfn hot stocks.)

(Click here for a look at today’s CNNfn technology stocks.)

|

|

|

|

|

|

|