|

Lucent warns of 1Q dip

|

|

January 6, 2000: 8:44 p.m. ET

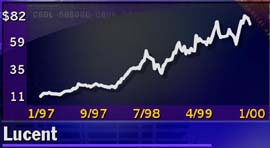

Telecom darling’s stock reels on word its net will fall at least 18% amid customer buying changes

|

NEW YORK (CNNfn) - Lucent Technologies Inc. warned Thursday its fiscal first-quarter income will fall short of analysts’ forecasts because of changes in customer buying patterns. The news caused the most widely held stock in the nation to plummet more than 28 percent.

Lucent, the nation’s largest maker of telecommunications equipment, projected its earnings during the quarter will come in between 36 cents and 39 cents per share, down from 48 cents a share a year ago in the quarter. Analysts expected income of 54 cents, according to First Call Corp.

The warning, which came after the close of NYSE trading, caused a sell-off in Lucent (LU) stock. The shares, which ended at 69 in regular consolidated trading, tumbled to 52 in active after-hours trading.

Such a decline is a huge departure for a stock that, as one of the bellwethers of high technology, has enjoyed an almost untarnished upward run since the company - the former Bell Labs - was spun off from long-distance giant AT&T (T) in 1996.

An array of problems

Behind the warning, analysts said, is that Lucent hasn’t made good on promises to deploy its new fiber-optic equipment to customers, such as AT&T and the regional Bell companies, while its top rivals have.

"They over-promised what they could provide on long-term growth,” said Eric Buck, an analyst with Donaldson, Lufkin & Jenrette, who said he has been wary of Lucent’s promises.

Lucent, analysts said, has been essentially giving away older equipment to tide over customers until newer systems are more widely available. Lucent’s major competitors have newer and faster equipment already on the market, they said.

Lucent spokespeople did not return calls for comment.

In a statement, Lucent said its customers are shifting purchases to its new 80-channel Dense Wavelength Division Multiplexing, or DWDM, gear. That, analysts said, is a sign that the customers are getting impatient about swallowing older 16-channel Lucent systems while the company gets on track.

"They thought they could get away the same old crap again, and they couldn’t, that’s what it meant,” said Charles DiSanza, an analyst for Gerard Klauer Mattison.

Also behind the earnings slump, Lucent cited greater-than-expected demand for its OC-192 capacity, which helps its fiber-optic systems carry more data. That led to deployment problems, it said.

And finally, customers began to change their software buying patterns, instead of loading up those purchases in the December quarter. Lucent had been pushing for that, to even out its quarter-to-quarter results.

"The December quarter is historically the quarter they have the biggest portion of their profits by far,” said Robert Wilkes, an analyst with Brown Brothers Harriman. ”They’ve been making an effort to smooth that.”

Click here for an after-hours quote

In a statement, Richard McGinn, Lucent chairman and CEO, said: "We are clearly disappointed with the results for the quarter.” He said Lucent expects revenues still to grow 3 to 5 percentage points faster than the overall networking market, which the company said is growing about 14 percent a year.

"However, given the slow start for the year, we expect to be in the lower end of that range for fiscal 2000."

A hot but tough market

The market for high-speed telecommunications equipment is booming. Lucent, while the industry leader, is not alone, with competitors such as Cisco Systems (CSCO), Nortel Networks (NT), and Ciena (CIEN) vying to provide telecom infrastructure.

All three have been on a buyout binge and Nortel announced another deal on Thursday.

"The story is Nortel’s optics beat the pants off of Lucent’s optics,” said Charles DiSanza, an analyst at Gerard Klauer Mattison. "Lucent’s first words out of its mouth [during a conference call Thursday] were this was Lucent’s mess-up, not an industry thing.”

Despite that, the warning from Lucent weighed on the entire sector in after-hours trading. Nortel, which announced the latest in a string of consolidation moves in the networking sector Thursday, sank 12-7/8 to 77; Ciena shed 3/4 to 45-1/8; Cisco lost 5-1/4 to 94-3/4.

Cisco and Nortel sought to reassure investors that their businesses remained sound in the wake of Lucent's warning. Cisco said it had no change in its financial guidance for the current fiscal second quarter, while Canada's Nortel said it remained comfortable with its previous guidance for 1999 and 2000.

Lucent also said its revenues would come in at between $9.8 billion and $9.9 billion. That's about the same as the year-ago quarter and about $1 billion below most analysts' expectations.

The company will report its fiscal first-quarter results on Jan. 20.

McGinn said the company expects earnings growth of about 20 to 25 percent for fiscal year from 1999’s $1.20 per share. At that rate, Lucent would come up with yearly earnings of $1.44 to $1.50 per share, short of the $1.63 that analysts expected.

For its second quarter, Lucent said it expects revenue growth of about 12 percent to 15 percent over last year's level of $8.78 billion, while income should rise 25 to 35 percent over last year's 17 cents a share. It expects faster growth in the second half of the year when its newest optical products are fully on line.

-- Reuters contributed to this story

|

|

|

|

|

|

Lucent

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|