|

Nasdaq hits record high

|

|

January 19, 2000: 5:43 p.m. ET

Internet shares send tech-heavy index higher but Microsoft hurts Dow

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - Technology stocks rose Wednesday as investors snapped up Internet shares, pushing the Nasdaq composite index to its second record close of the year.

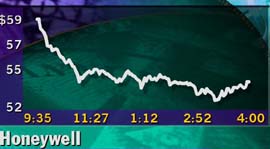

But big losses to Microsoft and Honeywell, whose earnings reports disappointed some investors, dragged the Dow Jones industrial average lower.

The Nasdaq composite index rose 20.48 points, or 0.50 percent, to 4,151.29, beating the 4,131.15 record close of Jan. 3. But the Dow Jones industrial average fell for the second straight session, dropping 71.36 points, or 0.62 percent, to 11,489.36.

Dissecting the mixed markets, analysts see stock investors torn between fears of rising interest rates and generally strong corporate profits reports.

"Earnings have been fantastic," said Alan Skrainka, chief market strategist at Edward Jones, referring to the start of the quarterly reporting season that began in earnest Tuesday. "Any weakness in the market you've got to attribute to (the) rising interest-rate environment."

The broader Standard & Poor's 500 ended little changed, rising 0.76 points to 1,455.85.

Breadth was nearly even on the New York Stock Exchange, with advancers leading decliners by a slim 1,515 to 1,512 margin. Volume on the big board was heavy; 1.06 billion shares changed hands.

More Nasdaq stocks rose then fell, as advances led declines 2,282 to 1,888. Volume hit a robust 1.6 billion shares.

The mixed markets come as bond yields that are near two-and-a-half year highs dampen the appeal of some equities, but corporate profits continue to show strength. Of the 22 percent of the S&P 500 companies that have reported fourth-quarter earnings, 69 percent beat Wall Street expectations, according to First Call Corp.

"I think the story is going to be the same going forward," Ned Riley, chief investment strategist at State Street Global Advisors, told CNNfn's Street Sweep. "We're going to see the tech companies reporting well. But the high interest rates we've seen so far have undermined some of the financial stocks and drug stocks."

In other markets, bonds edged higher. The dollar rose against the euro but fell versus the yen.

Techs rise

Internet firms led the Nasdaq higher. Among them, CMGI (CMGI) rose 6-1/16 to 122-3/8, Yahoo! (YHOO) jumped 22-13/16 to 364, Amazon.com (AMZN) rose 2-11/16 to 66-13/16, and Lycos (LCOS) rose 5-1/4 to 77-11/16.

But Microsoft (MSFT) fell 8-5/16 to 107 after posting better-than-expected earnings but warning of a slowdown ahead.

The world's biggest software maker earned 47 cents per diluted share during the fiscal second quarter, ended Dec. 31, up from 36 cents per share a year earlier. But the company didn't meet the most optimistic of "whisper" earnings numbers bandied about by some observers. Further, Chief Financial Officer John Connors cautioned that earnings per share growth might slow over the next two quarters.

Industrial and consumer stocks, however, gained on Wednesday as investors appeared to seek safety in previously out-of-favor sectors. 3M (MMM) rose 1-11/16 to 98-13/16, McDonald's (MCD) climbed 7/8 to 42-3/8 and Caterpillar (C) jumped 1-1/4 to 59-3/4.

Several financial stocks rallied as well. Chase Manhattan Corp. (CMB) rose 3-1/8 to 74-1/8 after reporting fourth-quarter operating earnings of $1.68 billion, or $1.97 per diluted share, topping estimates by a wide margin. CitiGroup (C) gained 1-1/4 to 59-3/4.

Dow members

Three Dow industrial components reported earnings Wednesday that met or beat expectations. But among them, Honeywell (HON) fell 4-3/4 to 54-1/4 after the industrial conglomerate reported earnings from operations of $630 million, or 78 cents a diluted share, meeting forecasts.

Among other Dow members, Boeing Co. (BA) gained 2-5/8 to 47-5/8 after reporting fourth-quarter earnings of 74 cents a diluted share, up sharply from a year earlier and above Wall Street forecasts of 69 cents a share.

And United Technologies (UTX) dropped 2-1/16 to 60-11/16 after reporting earnings before restructuring and other charges of $362 million, or 70 cents a diluted share, ahead of forecasts.

Of the seven Dow members reporting earnings so far, six beat Wall Street forecasts while one came in in-line with forecasts.

(For a complete look at Wednesday's major earnings news, click here.)

Higher rates ahead?

Analysts say bond yields near the highest levels in more than two and a half years have dampened demand for equities. And with the economy showing few signs of slowing down, many expect the Federal Reserve to launch several interest-rate hikes starting next month to slow the economy and pre-empt rising inflation. Stock investors fret that higher rates, because they mean steeper borrowing costs, will hurt corporate profits.

In the latest sign the economy continues to strengthen, new housing construction rebounded in December to the strongest pace in nine months.

"In the first half, we think interest rates are heading higher," Peter Anderson at American Express Financial Advisors, told CNNfn.

Still, Edward Jones' Skrainka told CNNfn that investors should focus on strong earnings over rate hike concerns. (344K WAF) (344K AIFF)

After the bell

International Business Machines Corp. (IBM), America Online Inc.(AOL) and Apple Computer (AAPL) all rose ahead of posting solid earnings results after the close of trading. IBM rose 1-3/4 to 117-1/2 before posting fourth-quarter results of $1.12 per diluted share. AOL jumped 2-13/16 to 64-1/16 ahead of reporting a profit of $224 million, or 9 cents per diluted share. And Apple gained 2-13/32 to 106-7/16 after posting first-quarter earnings of $1 a share before one-time items, compared with analysts' projections of 90 cents a share.

(Click here for a look at CNNfn's hot stocks.)

(Click here for a look at CNNfn's tech stocks.)

|

|

|

|

|

|

|