|

Trade deficit hits record

|

|

January 20, 2000: 12:18 p.m. ET

November imports from Canada, Europe push gap to $26.5 billion

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Americans' appetite for goods produced abroad resulted in a record trade deficit in November as demand for imported consumer goods surged, the government said Thursday. Export of goods also jumped to a record.

In separate reports, the Philadelphia Federal Reserve said its index of regional manufacturing activity slipped in January from December, while the Labor Department said its tally of initial jobless claims declined sharply last week.

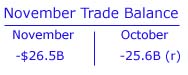

November's trade deficit widened to a record $26.5 billion, the Commerce Department said. That's well above October's revised $25.6 billion deficit and almost $1 billion above economists' estimates of a $25.5 billion gap, as compiled by Briefing.com.

October's figure was revised downward from the $25.9 billion deficit first reported.

November's surging imports provided yet another sign to analysts and investors that the resilient U.S. economy may need to be tempered with another interest rate increase from the Federal Reserve -- a reflection of an economy about to enter its ninth year of uninterrupted expansion, economists said.

A robust economy

"Really it just provides confirmation that the economy is strong and the Fed is likely to rein it in a bit with higher rates," said Kathy Bostjancic, a senior economist with Merrill Lynch.

Bonds, which are sensitive to economic reports suggesting strong growth and potential inflation pressures, declined an additional 1/4 of a point in price, pushing the yield on the 30-year benchmark Treasury to 6.75 percent.

Stocks once again opted to ignore the writing on the wall, focusing instead on stellar profit reports from technology bellwethers rather than the threat of rising interest rates.

Click here for the Commerce Department's full report

Higher oil prices also played a factor in the record deficit. Crude oil prices have more than doubled in the past year, rising to an average price of $20.90 a barrel in November, according to Commerce, from a 12-year low of $10.35 a barrel reached in December 1998. The jump in prices follows the Organization of Petroleum Exporting Countries' (OPEC) decision to curb production to avoid a global oil glut.

Those higher prices have boosted the total dollar value of imports this year because the United States imports more than half the crude oil it uses, analysts said. The November trade deficit with major oil producing countries rose to $2.8 billion.

"Further widening in the trade deficit in the months ahead is very likely given that the surge in oil prices will drive imports higher and that there has been no let-up in the domestic economy," said Sherry Cooper, chief economist with brokerage Nesbitt Burns.

Imports, exports surge

But it's hasn't been solely rising oil prices that have spurred eight out of 11 months of record trade imbalances. Depressed U.S. exports and a flood of cheap imports - both a product of the global financial crises of 1997 and 1998 - have created a huge difference between what Americans bring into the country from abroad and what they ship out.

Both imports and exports surged to records in November. Imports totaled a record $109.3 billion, up from $107.9 billion a month before, while exports rose to a record $82.9 billion from $82.3 billion in October, the Commerce Department said.

Western Europe and Canada - the United States' largest trading partner -- topped the most-active list of trading partners during the month. The trade deficit with Canada jumped to $3.3 billion from $2.9 billion in the previous month. With Western Europe, the deficit rose to $5.5 billion.

With Japan, the world's second-biggest economy, the gap narrowed to $6.4 billion from $7.2 billion in the previous month.

The trade deficit with China shrank slightly to $6.5 billion from $7.2 billion in October.

China's trade figures are closely watched in part because the United States is currently endorsing China's bid to join the World Trade Organization.

A political maelstrom

Those in Washington opposed to expanding open trade with other countries have seized on last year's soaring trade deficit figures to support their argument that the Clinton administration's pursuit of massive trade agreements is hurting U.S. producers more than helping the U.S. economy.

Indeed, protecting U.S. workers' jobs was one of the driving elements behind labor group protests at last month's World Trade Organization discussions in Seattle. The meetings among the 135-member countries were disrupted by violent protests and failed to launch a new round of global trade talks.

But politics aside, economists agreed that November's report represents more evidence that the hot U.S. economy needs another dousing in the form of higher interest rates from the Fed. Policy makers will meet in two weeks in Washington to discuss monetary policy. Most analysts expect the Fed will raise its benchmark Fed funds target by another quarter point to 5.75 percent.

"As long as the economy keeps chugging along, this deficit is not going to improve," said Michael Fenollosa, an economist with John Hancock Securities. "This could set the stage for a bout of inflation, increasing the odds that the Fed will raise rates more aggressively later on this year."

Manufacturing output slows

Separately, manufacturing activity in the mid-Atlantic region slowed for a second consecutive month, the Philadelphia Fed said Thursday. Business activity eased to a reading of 9.1 in January from a revised 15.1 in December. The prices paid component, which is closely watched for signs of inflation, edged down to 21.9, from December's revised 23.7.

Also Thursday, the Labor Department reported that the number of Americans filing new claims for unemployment benefits fell to 272,000 for the week ended Jan. 15, down a sharp 39,000 from the revised 311,000 in the prior week, suggesting the hot U.S. job market continues to show no signs of quitting.

--with files from Associated Press

|

|

|

|

|

|

|