|

U.S. stocks end mixed

|

|

February 2, 2000: 6:01 p.m. ET

Nasdaq advances but the Dow and S&P dip following rate hike by the Fed

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - News that the Federal Reserve raised short-term interest rates sent U.S. stock prices on a wild ride Wednesday, as investors tried to determine if the Fed will hike rates again next month.

The Federal Reserve increased, or "tightened," short-term interest rates by a quarter point, in line with expectations. The action brings the fed funds rate, the rate at which banks charge each other for borrowing money, to 5.75 percent. It also raised the discount rate, the rate that the Fed charges its member banks for loans, by a quarter point to 5.25 percent.

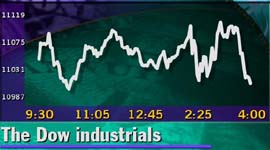

The Dow Jones industrial average fell 37.85 points to 11,003.20. The Nasdaq composite index advanced 21.98 to 4,073.96, while the S&P 500 index inched down 0.16 to 1,409.12.

On the New York Stock Exchange, advances outnumbered declines 1,671 to 1,341, as trading volume reached 1 billion shares. On the Nasdaq, advances led declines 2,326 to 1,731, on volume of 1.5 billion shares.

Treasury prices rose sharply, with the bellwether 30-year Treasury bond gaining nearly two full points in price. That lowered its yield to 6.28 percent, its lowest level of the year, from 6.42 percent late Tuesday. The dollar rose against the yen, but fell against the euro.

Policy statement viewed as hawkish

Although the Fed rate hike was largely expected, many analysts viewed the statement that accompanied the action as hawkish. The central bank said it sees the risk of inflation as greater than the risk of an economic slowdown, noting it was concerned with "increases in demand will continue to exceed the growth in potential supply," which would feed inflation.

The central bank increased rates three times last year in an effort to cool the economy and fend off inflation. Many analysts expect the broader market to remain under pressure until the Fed completes the tightening cycle.

"Investors are realizing the Fed will continue to raise rates until the economy slows to its potential," said Claude Persico, market economist at Dresdner Kleinwort Benson.

Fears of more rate hikes pressured financial issues. Stock investors fret about higher interest rates because tighter credit can hurt corporate profit. Higher rates can be particularly tough on financial services firms, which make money on lending and underwriting stock and bond deals; higher rates tend to slow such business.

Among the Dow components, American Express Co. (AXP: Research, Estimates) declined 4-13/16 to 164-3/16, Citigroup Inc. (C: Research, Estimates) retreated 1/2 to 57-3/4, and J.P. Morgan & Co. (JPM: Research, Estimates) dipped 1-7/16 to 121-3/16.

Nevertheless, Al Goldman, chief market strategist at AG Edwards & Sons, remained bullish on the market. He told CNNfn he was not surprised about the market's volatile movement following the Fed action. (499K WAV)

(499K AIFF)

The Fed meets again on March 21.

Tech strength continues

Investors' appetite for technology issues continued, with the Nasdaq composite index outperforming the broader market Wednesday. Analysts said the sector is not as sensitive to interest rates because many tech companies do not have the classical debt structure that the blue chip and S&P 500 companies have.

The index's most recent record high close was 4,235.40 on Jan. 21, following its breathtaking 85.6 percent gain in 1999, the largest annual gain for a major index in the United States.

January was a tough month for the stock market, with the Nasdaq losing 3.16 percent. Some investors express doubt about the technology sector due to its high volatility, preferring the safety of more venerable stocks such as the blue chips.

But Brian Finnerty, managing director of C.E. Unterberg Towbin, a technology and research firm, was enthusiastic. "Don't get out of techs. New innovations and great things are happening every day. You have to be there or you will be left at the starting gate," he said.

Patricia Chadwick, president of Ravengate Partners, told CNN that the technology strength signaled that the economy can grow without inflation. (155K WAV) (155K AIFF)

VerticalNet slides

Aside from the Fed, market participants closely watched the latest batch of corporate earnings releases. VerticalNet Inc. (VERT: Research, Estimates) fell 19-1/8 to 233, after the business-to-business Web site late Tuesday posted a wider fourth-quarter pro forma loss of 28 cents per share. The company also set a two-for-one stock split.

But shares of Time Warner Inc. (TWX: Research, Estimates), the world's largest media company, jumped 8-9/16, or 11 percent, to 86-1/2 after posting better-than-expected fourth-quarter operating income of 20 cents per diluted share against expectations of 16 cents. Time Warner is the parent of CNNfn.

America Online Inc. (AOL: Research, Estimates) also performed well, gaining 5-1/8 to 60-3/8. The Internet service company, which recently announced plans to merge with Time Warner, said its service now has more than 21 million subscribers.

Among other Internet stocks, Amazon.com (AMZN: Research, Estimates) rose 2 to 69-7/16 during regular trading hours. After the market close, the online retailer posted a fourth-quarter loss of 55 cents a share. Earnings tracker First Call Corp. forecasted 48 cents.

Shares of another e-tailer, eToys Inc. (ETYS: Research, Estimates), soared 2-1/2, or more than 17 percent, to 17 following an upgrade on the stock's rating by Robertson Stephens to "buy" from "long-term attractive."

Click here for a look at today's CNNfn hot stocks.

Click here for a look at today's CNNfn technology stocks.

|

|

|

|

|

|

|