NEW YORK (CNNfn) - Fears about higher interest rates sent blue-chip stocks and technology shares down sharply Friday, pushing the Dow industrials to their lowest level in four months.

Analysts said "double witching," in which stock index futures and options expire simultaneously, and selling ahead of a long weekend also contributed to losses. U.S. financial markets will be closed Monday in observance of Presidents Day.

Market participants said the downturn was not surprising. "It's fair given the interest rate scenario. This was an orderly pullback," said Paul Rich, trader at BT Brokerage.

The Dow Jones industrial average fell 295.05 points, or 2.8 percent, to 10,219.52. The daily point drop is the seventh largest in the index's history.

The tech-heavy Nasdaq composite index retreated 137.18, or 3 percent, to 4,411.74 -- its seventh-largest daily point decline on record. At midday, the index's updates were not available due to a computer problem.

The broad-based S&P 500 declined 42.16, or 3 percent, to 1,346.09. The broad-based S&P 500 declined 42.16, or 3 percent, to 1,346.09.

Breadth was negative on the New York Stock Exchange, with declines trouncing advances 2,305 to 703 on trading volume of 1 billion shares. On the Nasdaq, losers led gainers 2,616 to 1,588, with 1.9 billion shares changing hands.

In other markets, Treasury prices rose, with the 30-year bond gaining nearly a full point, lowering its yield to 6.15 percent from 6.22 percent late Thursday. The dollar rose against both the yen and the euro.

Tame inflation news discounted

Investors shrugged off the latest inflation data that suggested inflation remains in check. The U.S. consumer price index (CPI) rose 0.2 percent in January, according to the Labor Department. The number was in line with analysts' expectations.

Meanwhile, the U.S. trade deficit fell to $25.5 billion in December, the Commerce Department said Friday. The number was below analysts' expectations of a $26.4 billion gap.

The economic news came on the heels of Federal Reserve Chairman Alan Greenspan's semi-annual Humphrey-Hawkins testimony Thursday, in which he reaffirmed his concerns about the risks of a tight labor market and other imbalances in the economy.

Lisa Cullen, U.S. investment strategist for Merrill Lynch, told CNN's In the Money that Greenspan's comments, which strongly hinted more rate hikes are needed to slow the economy, dampened enthusiasm about the generally positive inflation numbers. (305K WAV) (305K AIFF)

"Investors are focusing on Greenspan and the fact that he said they (the central bank) had increased rates four times and it did little to slow the economy," said Alan Skrainka, chief market strategist at Edward Jones. "He is saying more work needs to be done."

One trader said a reason the market declined sharply one day after Greenspan's testimony was many participants were sidelined awaiting the CPI, the last piece of key data for the week.

With the economy in a record 107th month of expansion, the central bank has raised short-term interest rates four times since last June in order to keep inflation at bay. Analysts widely expect the central bank to hike rates again by a quarter percentage point when it meets March 21.

Old economy stocks weigh Dow

"Old economy" stocks, which include the financial services, industrial and retail sectors, weakened the blue-chip index. These venerable companies are more sensitive to interest rates than the technology companies.

"Old economy stocks are feeling the pinch in fear that rates are going much higher," said Peter Cardillo, director of research at Westfalia Investments.

Among the Dow negatives, American Express (AXP: Research, Estimates) fell 10-1/16 to 137-7/8, SBC Communications (SBC: Research, Estimates) declined 3-9/16 to 36-7/16, and International Paper (IP: Research, Estimates) retreated 1-15/16 to 40-9/16.

General Electric (GE: Research, Estimates) also pressured the blue chips, falling 5-3/4 to 125-1/4, following news that New York state's attorney general is suing the company.

The blue chip index finished the week with a loss of nearly 2 percent. Analysts noted the Dow was still in correction territory, considered a drop of 10 percent or more from an index's high -- it has declined nearly 13 percent since its record close of 11,722.98 on Jan. 14. The blue chip index finished the week with a loss of nearly 2 percent. Analysts noted the Dow was still in correction territory, considered a drop of 10 percent or more from an index's high -- it has declined nearly 13 percent since its record close of 11,722.98 on Jan. 14.

Nasdaq on the skids

The technology sector also ran out of steam. The Nasdaq composite index, usually immune to interest rate concerns, succumbed to the broader market's pressures.

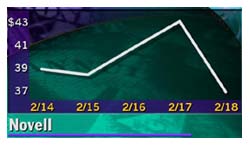

Hurting the index was Novell (NOVL: Research, Estimates), plummeting 8-15/16, or more than 20 percent, to 34-1/8. The company, a leading provider of network software, late Thursday reported fiscal first-quarter net income of $45 million, in line with analysts' forecasts.

Agilent Technologies (A: Research, Estimates) fell 3-1/4 to 93-3/4. The company, a spin-off of Hewlett-Packard (HWP: Research, Estimates), reported fiscal first-quarter net income of 28 cents per diluted share late Thursday, above analysts' expectations of 22 cents.

Agilent makes test and measurement equipment for electronics and communications companies. Following the earnings report, both Lehman Brothers and Bear Stearns & Co. increased their price targets on the stock.

Internet stocks also suffered. Among the Nasdaq components, Amazon.com (AMZN: Research, Estimates) dropped 4-1/4 to 64-3/4, eBay (EBAY: Research, Estimates) fell 8 to 137-1/4, and Yahoo! (YHOO: Research, Estimates) eased 7-1/16 to 156-1/8.

Immunex (IMNX: Research, Estimates) gave back an early gain, edging down 13/16 to 193-3/8. The biotech company late Thursday announced a three-for-one stock split.

(Click here for a look at today's CNNfn hot stocks.)

(Click here for a look at today's CNNfn technology stocks.)

|