|

Durable orders decline

|

|

February 24, 2000: 10:58 a.m. ET

January orders slip 1.3%, less than expected, as electronics orders fall

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Orders for durable goods produced by U.S. factories declined for the first time in four months in January, the government reported Thursday, a slower pace than economists had forecast and not enough to convince Wall Street that demand for American-made goods is slowing down.

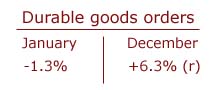

Durable goods orders fell 1.3 percent in January, less than the 2 percent drop expected by analysts, and well below December's revised 6.3 percent surge. December's gain was the largest since a 7.3 percent jump in December 1992. Excluding transportation products, which tend to be volatile from month to month, orders slipped 0.5 percent after a revised gain of 1.5 percent.

Although considered volatile, the decline in orders wasn't taken as a sign that the robust U.S. economy is showing signs of slowing, despite four interest rate increases of a quarter-percentage point each by the Federal Reserve since June, and the possibility of a fifth on the way next month.

"The bottom line is that a one-month decline in this measure does not reverse the clear, firm upward trend," said Ian Shepherdson, chief U.S. economist with High Frequency Economics in Valhalla, New York.

Churning out goods

Sales of electronic equipment spurred much of January's decline, falling 13.2 percent, the largest drop since July 1997. Transportation products fell 3.9 percent, barely offsetting a 23.2 percent surge a month earlier. Offsetting those declines was a 12.3 percent jump in industrial equipment orders, the biggest increase in 15 years.

Surging demand both at home and abroad for U.S.-made goods has kept manufacturers that produce big-ticket items very busy in recent months. And with no indication that consumer spending at home is slowing or that demand overseas for U.S. goods is waning, orders are expected to keep flowing in.

Indeed, unfilled orders for durable goods rose 0.6 percent in January after rising 2.3 percent in December. Shipments of durable goods increased 2.8 percent in January after rising 0.8 percent in December. Durable goods are items such as cars and dishwashers, designed to last three years or more. Indeed, unfilled orders for durable goods rose 0.6 percent in January after rising 2.3 percent in December. Shipments of durable goods increased 2.8 percent in January after rising 0.8 percent in December. Durable goods are items such as cars and dishwashers, designed to last three years or more.

"There is clear and strong evidence that the factory sector is expanding solidly," said Steven Wood, an economist with Banc of America Securities in San Francisco. "This will complicate the (Federal Open Market Committee's) plans to slow the economy." Fed officials are widely expected to raise rates by another quarter point at their March 21 policy meeting.

Michelle Girard with Prudential Securities agreed with Wood's assessment, pointing to the general increase in durables orders during the past three months as a sign that demand for U.S. goods isn't waning. (164KB WAV) (164KB AIFF)

Market reaction

The more staid Dow plunged more than 170 points by mid-morning as investors concluded more rate hikes are likely on the way. The Nasdaq surged forward into record territory as investors expressed confidence in the profitability of companies involved in technology, but it too lost ground late in the morning.

Robert Froehlich, chief investment strategist with Scudder Kemper Investments, told CNNfn that despite the drop in orders, the U.S. economy is still on a tear and likely will need to be tempered with more rate increases from the Fed. Higher rates tend to slow economic growth by making it more expensive for consumers and businesses to borrow and spend.

At the same time, because of the volatility of the month-to-month numbers, most investors will be looking to other economic reports -- notably February's employment report due for release March 3. (358KB WAV) (358KB AIFF)

Separately, the Labor Department reported that first-time jobless claims declined to 278,000 in the week ended Feb. 19 from a revised 285,000 a week earlier, indicating fewer American workers are applying for benefits.

|

|

|

|

|

|

|