|

Truckers ride out fuel rise

|

|

March 2, 2000: 8:10 a.m. ET

Many public trucking companies expect profit growth despite high diesel prices

By Staff Writer Chris Isidore

|

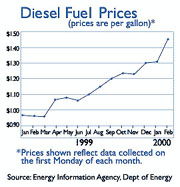

NEW YORK (CNNfn) - Jerry Moyes is paying 50 cents more per gallon for diesel fuel than he was a year ago, and he's buying quite a bit -- three million gallons a week.

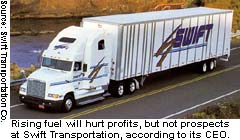

"You do the math. It's not pretty," said the chief executive of Swift Transportation Co., one of the nation's largest trucking companies.

Swift and other trucking companies are turning to customers for surcharges to try to account for the increased prices, but Moyes say they are only covering about half of his increased cost. Still the owner of one of the fastest growing and more profitable carriers in the country has an unexpected view of his business prospects right now.

"We're more optimistic today than we've been in the last 10 years," he said.

Decent earnings outlook for many trucking stocks

The reason for the optimism is that, so far, freight demand remains relatively high, giving the carriers a better shot at collecting fuel surcharges. And the fuel problems are likely to hurt many of the smaller, privately held carriers harder than the larger publicly traded companies, putting either tighter trucking capacity or buying opportunities on the horizon for many larger companies.

But, even without closures of some smaller trucking companies, strong demand for trucking and a shortage of drivers at a time of low employment is helping carriers keep rates high and trucks full, even if fuel takes a bigger bite out of their bottom line. But, even without closures of some smaller trucking companies, strong demand for trucking and a shortage of drivers at a time of low employment is helping carriers keep rates high and trucks full, even if fuel takes a bigger bite out of their bottom line.

"We've got a very strong economy. Rates are good," said Paul Jeanne, trucking analyst for Deutsche Banc Alex. Brown. "Absent the fuel thing, a lot of the carriers would have had very nice quarters."

Analysts are not rushing to slice earnings estimates on most of the public companies, despite the run-up in fuel.

In fact, of the 28 carriers for which earnings tracker First Call Corp. conducts analyst surveys, 15 of them are expected to post better earnings than they did a year earlier.

Estimates have basically stood still even while fuel prices shifted into high gear in early January. And, although the First Call forecast has dropped for 13 of those carriers during that time, most of those declines are only a penny or two a share. And five carriers have actually had earnings estimates raised during the period.

Opportunities along with challenges

Phoenix-based Swift (SWFT: Research, Estimates) is one of those that had estimates lowered after it released a statement on Feb. 16 warning of lower profits due to fuel costs. That lowered estimates to 17 cents a share compared with 20 cents a share before the warning and the 19 cents a share it made a year ago.

But the company's stock actually has risen since the announcement. That may be because the stock was already trading at a depressed level, or it could be because investors took Moyes at his word that the fuel situation could create more advantages than opportunities even as it depresses profits.

"I think there will be considerable failures in the sector in the next nine months," Moyes said in an interview. He said that even if Swift does not buy some of the smaller, troubled carriers, he believes failures could tighten capacity further just as peak season starts this summer, raising rates even more.

"We think capacity will become a major issue in the second half of the year," he said.

Swift handles trailer-size shipments of freight, a low-cost sector of trucking known as truckload. It is almost completely nonunion and has relatively few costs other than labor, trucks and fuel, so the increase in fuel prices hits it relatively hard.

Some trucking sectors look for improvement

The sector of trucking which handles pallet-sized shipments through a series of terminals, known as less-than-truckload or LTL, is being hurt far less than the truckload sector.

Part of that is because higher labor and infrastructure costs means fuel is a smaller percentage of costs. And part of that is because closure of three major unionized carriers in the sector during the last 16 months has squeezed capacity and allowed carriers to get customers to sign-off on fuel surcharges as part of the standard contract.

"We're pretty comfortable the surcharge is pretty well covering our increased costs," said Dawson Cunningham, chief financial officer of Roadway Express Inc. (ROAD: Research, Estimates), one of the largest LTL carriers. "Not every customer is subject to it, but the vast majority are."

So six of the seven LTL carriers followed by First Call are expected to see improved profits. Only one, the troubled Consolidated Freightways Corp., has seen estimates lowered since the fuel prices started climbing in January, while three have seen estimates increased.

Still the stocks and trucking executives say they do not know what they can do to convince investors to look past fuel prices.

"I'm sitting here with a (price/earnings) multiple of eight," said Cunningham. "I beat earnings' estimates and my stock dropped. We're a victim of interest of tech sector and dot.coms."

Some say that while earnings' forecasts may be holding steady at the moment, confidence in those numbers is soft.

"I think the stocks all reflect concerns that the estimates won't hold up because the economy will weaken," said Paul Schlesinger, analyst with Donaldson, Lufkin & Jenrette Securities. "If it becomes clear the estimates do hold up, I'm confident the stocks will do well. I've got fairly conservative estimates, below consensus, and the stocks are steals based on my estimates."

Problems other than fuel hound some carriers

There are troubled, publicly held trucking companies, but most are facing problems above and beyond the fuel costs.

Consolidated Freightways (CFWY: Research, Estimates) posted disappointing results for 1999, when fuel was not a problem for most of the year. A systems integration problem hurt, and the company has been dogged by rumors of a possible sale since negotiations to sell to another LTL carrier fell through at the eleventh hour in December 1998.

The company is seeking a new chief executive, and is expected to lose money in the quarter.

In the truckload sector, J.B. Hunt Transport Services Inc. (JBHT: Research, Estimates), one of the largest companies, is going through a reorganization that is likely to hit profits. First Call estimates it will make only 3 cents a share in the quarter, compared with 29 cents a year ago.

But, even Hunt officials insist they stand to benefit from the current crisis. A number of smaller carriers are in the process of being cut off by fuel providers, according to Craig Harper, Hunt's chief operating officer.

And a number of drivers who own their own trucks and pay their own fuel, known as owner-operators, are parking the trucks and applying to be company drivers at Hunt and other companies, Hunt said.

"The industry is in a crisis situation," said Harper. "We've seen an influx of owner operators applying to be company drivers."

Carriers that use owner operators are passing along as much of the fuel surcharge as they can collect to the drivers, and paying some additional costs, such as insurance premiums, to try to keep those drivers in place.

But, while officials at those carriers say their owner operators are staying put, they are refusing loads to some areas of the country, such as the Northeast, where fuel costs have soared particularly high.

"The real challenge becomes trying to manage them on a day-to-day basis," said Dan Van Alstine, vice president of marketing for Transport Corp. of America, a Minnesota truckload carrier.

TCA also had a sale to an LTL carrier fall through earlier this year during a due diligence period. It continues to look for a new buyer. But, Van Alstine said discussions on a possible sale started last year, just before the death of its founder and well before the current run-up in fuel prices.

"It has nothing to do with the fuel or economic issues we're dealing with as an industry," he said.

|

|

|

|

|

|

|