|

Europe ends in record mood

|

|

March 3, 2000: 1:11 p.m. ET

Paris, Frankfurt set new highs, BT lifts London; Swisscom soars

|

LONDON (CNNfn) - Europe's major stock markets mostly rose Friday after a benign U.S. employment-market report released pent-up demand for telecommunications and computer-related shares and others in the region expected to profit from mushrooming electronic commerce.

Blue-chip indexes in Paris and Frankfurt scored small gains, but enough to set record closes for the second straight day, while London gained almost 1 percent.

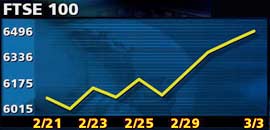

The U.K.'s benchmark FTSE 100 index closed up 55.4 points, or 0.86 percent, at 6,487.50, buoyed by strong advances in British Telecommunications and Vodafone AirTouch. The index gained 4.7 percent on last Friday's close.

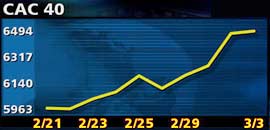

Media and telecom shares in Paris's CAC 40 index saw firm demand, sending the index up 36.56 points to 6,514.11. Power-engineering firm Alstom led the index with a 15 percent leap after announcing restructuring plans earlier in the week. France Telecom lost a little ground after its 26 percent leap Thursday, an advance that helped the CAC gain 5.3 percent over the week.

In Frankfurt, the Xetra Dax closed 14.26 points higher at 7,960.03, lifted for the second straight session by a jump in Deutsche Telekom stock, gaining on speculation about a possible European or U.S. takeover by the German firm. The Dax rose 2.9 percent over the week.

The SMI in Zurich closed down 0.38 percent at 7,025.30, though Swisscom shares soared 12 percent following a bullish research report from Credit Suisse First Boston.

The pan-European FTSE Eurotop 300, a broader gauge of the region's larger stocks, closed 0.76 percent higher at 1,631.74, with its telecom and technology sub-indexes both gaining almost 4 percent.

The euro failed to make any advance in the currency markets Friday, trading at $0.9618, down slightly from $0.9645 late Thursday. The single currency lost 1.5 percent against the dollar during the week, falling as low as $0.9390 Monday. Its modest rally was helped by a strong hint from the European Central Bank that it would raise euro-zone interest rates at the end of the month.

The bond market received a fillip Friday from the U.S. employment report. The yield on the benchmark 10-year German bund future shed 5 basis points to reach 5.45 percent.

In the region's stock markets, Paris was pushed to a record by a 7 percent leap in media and utility group Vivendi (PEX), which said it had won a 1 billion-euro water treatment contract from South Korea's Hyundai.

Engineering group Alstom (PALS) shot up 14.5 percent, buoyed by restructuring plans for its division involved in building power plants. Engineering group Alstom (PALS) shot up 14.5 percent, buoyed by restructuring plans for its division involved in building power plants.

Amid a revival of enthusiasm for telecom- and Internet-related issues, data network operator Equant (PEQU) rose 5.9 percent while construction and mobile-phone firm Bouygues (PEQU) climbed 5.8 percent in the wake of its better-than-expected earnings Thursday.

France Telecom (PFTE) drifted 1.6 percent lower, hanging on to most of the 26 percent gain in its shares Thursday amid enthusiasm over its suggestion it may sell shares in its Internet and mobile-phone businesses.

In London, British Telecommunications (BT-A) led the market with a 10.3 percent rally on renewed hopes that the company may sell some of its cellular and Internet assets. Vodafone AirTouch (VOD) rose 2.5 percent in afternoon trade. Pearson (PSON), the owner of the Financial Times and other publishing and broadcasting assets, rose 6.3 percent, and computer services company Logica (LOG) climbed 4.4 percent.

Electronics retailer Dixons (DXNS) gained 7.8 percent, helped by its inclusion on the "buy" list at Commerzbank, and diversified retailer Kingfisher (KGF) was 2.9 percent ahead after it said it will raise 500 million euros ($481 million) from the initial public offering of shares in its French Internet arm, Liberty Surf. Electronics retailer Dixons (DXNS) gained 7.8 percent, helped by its inclusion on the "buy" list at Commerzbank, and diversified retailer Kingfisher (KGF) was 2.9 percent ahead after it said it will raise 500 million euros ($481 million) from the initial public offering of shares in its French Internet arm, Liberty Surf.

Brewing and leisure group Bass (BASS) was 3.3 percent lower after gaining Thursday on hopes that it may sell its beer arm to Dutch brewer Heineken.

Pharmaceutical giant Glaxo Wellcome (GLXO) and merger partner SmithKline Beecham (SB) both retreated more than 5 percent.

Aerospace and defense company BAE Systems (BA) was down 2.7 percent in London even after it reported full-year earnings at the top end of the range of analysts' forecasts.

Mining companies gave up most of the big gains made in the previous session. Rio Tinto (RTO) shed 6.7 percent after its 9.9 percent gain Thursday, and Billiton dropped 4.8 percent, having soared 10 percent the previous day on a jump in commodity prices.

In Frankfurt, the market's largest stock by weighting was also the leading gainer on the Dax index: Deutsche Telekom (FDTE) rose 6.4 percent, its shares breaking through the 100-euro level for the first time to close at 103.2, amid merger speculation and news of rising customer numbers at its T-Online Internet unit.

Other telecom and tech stocks also advanced, with electronic components maker Epcos (FEPC) up 4.5 percent and SAP (FSAP) gaining 3.3 percent. Other telecom and tech stocks also advanced, with electronic components maker Epcos (FEPC) up 4.5 percent and SAP (FSAP) gaining 3.3 percent.

Sporting goods maker Adidas Salomon (FADS) gave up 7.7 percent after sharp rises ahead of its earnings release Thursday, while industrial conglomerate-and-tourism company Preussag (FPRU) lost 4.9 percent.

In Zurich, telecom operator Swisscom surged another 11.25 percent following a bullish broker's report from Credit Suisse First Boston. Government sources Friday punctured speculation that the Swiss government might soon sell more of its controlling stake in the company, reducing its holding to less than 50 percent.

In Amsterdam, Royal KPN, the former state-owned telephone company, soared 10.5 percent to 145.9 euros on merger speculation and as brokerage CSFB raised its price target for the stock to 155.

-- from staff and wire reports

|

|

|

|

|

|

|