|

Party on Wall Street

|

|

March 3, 2000: 6:16 p.m. ET

Stocks surge, Nasdaq hits record, after tame jobs data calms rate fears

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - What's bad for Main Street proved good for Wall Street.

U.S. stocks rallied Friday after a government report showed job growth slowed in February, easing fears the Federal Reserve will aggressively hike interest rates.

Stocks soared on the news, snapped up by investors betting that lower-than-expected borrowing costs will mean stronger corporate profits.

The frenzy pushed the Nasdaq composite index to its fourteenth record close of the year, its third largest point gain on record, and within striking distance of the 5,000 mark.

"The jobs data this morning and a record inflow of funds into the tech sector -- both of which combined to keep the tech and telecom sectors alive," Andrew Barrett, technology strategist at Salomon Smith Barney, told CNN's Street Sweep. "It looks like it's going to continue going forward and we'll be looking at Nasdaq 5,000 before we know it."

The Nasdaq composite index jumped 160.26 points, or 3.4 percent, to 4,914.77, smashing its previous record of 4,784.08 set Wednesday. For the week, the Nasdaq rose 7.1 percent and has nearly doubled in the last twelve months as investors chase the technology stocks that are expected to lead the economy's growth.

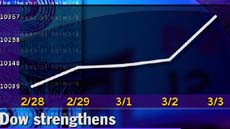

The Dow Jones industrial average, meanwhile, capped five straight winning sessions just one week after falling below 10,000 for the first time since April.

The index of 30 blue chip stocks surged 202.28 points, or 2 percent, to 10,367.2 Friday. That gave it a weekly gain of 5.1 percent.

Still, the Dow, home to many out-of-favor "old economy" stocks -- or non-technology stocks -- is down 9.8 percent this year.

The broader S&P 500 index jumped 27.41 points, or 2 percent, to 1,409.17 Friday, registering a 5.7 percent rise for the week.

More stocks rose than fell. Advancing issues on the New York Stock Exchange topped decliners 1,719 to 1,255 on heavy volume of 1.1 billion shares. On the Nasdaq, winners beat losers 2,575 to 1,656. More than 2.1 billion shares changed hands.

In currency markets, the dollar rose against the euro but was unchanged versus the yen. Treasury securities gained.

Good for Wall St., bad for Main St.

In the week's most closely watched economic report, the Labor Department said the economy created 43,000 jobs in February, significantly below forecasts of a 235,000 gain. Average hourly wages rose 0.3 percent, in line with forecasts. And the unemployment rate edged up to 4.1 percent from 4 percent in January, a 30-year low.

While potentially bad for employees, stock investors loved the news that the economy may be slowing enough to keep the Fed from tightening credit appreciably.

Arthur Cashin, director of trading at PaineWebber, was blunt.

"Less people at work means better things for the stock market," he told CNN's In the Money.

Separately, the Commerce Department said factory orders fell 1.1 percent in January, larger than the 0.6 percent drop analysts expected.

The Federal Reserve, the U.S. central bank, tightened credit four times since June, bringing its main lending rate to 5.75 percent.

Art Hogan, chief market strategist at Jefferies & Co., said Friday's job report suggests that those rate hikes have succeeded in slowing the economy.

"Not to be heartless, but this is very good for Wall Street," Hogan told CNNfn's market coverage. "And I think that is why we are seeing this market take off in the early going."

Still, most analysts say sustained evidence of the economy's slowdown is needed before the Fed's tightening cycle ends.

And some say the stock rally will spark a surge in spending by consumers, who fuel two-thirds of the economy's growth. Fed Chairman Alan Greenspan has warned that this so-called wealth effect spending may need to be tempered with even higher interest rates.

Tech stocks lead the charge

Nevertheless, stocks rallied Friday. Some of Nasdaq's biggest movers included Microsoft (MSFT: Research, Estimates), up 2-3/4 to 96-1/8, and Oracle (ORCL: Research, Estimates), up 6-1/2 to 75.

3Com (COMS: Research, Estimates), which took its Palm unit public on Thursday, gained 1-1/4 to 83-1/16.

But Palm Inc. (PALM: Research, Estimates), the world's No. 1 provider of handheld computer devices, fell 14-13/16 to 80-1/4 on its second day of trading. The drop comes after Palm rose 150 percent in its debut.

John Zimmerman, director of growth strategies at Banc of America Capital Management, told CNNfn's market coverage the tech surge should continue.

(432K WAV) (432K AIFF).

Twenty-three of the Dow's 30 stocks rose. The biggest movers included General Electric (GE: Research, Estimates), up 4-3/16 to 139-3/8, Du Pont (DD: Research, Estimates) up 3-7/8 to 50-3/4, and IBM (IBM: Research, Estimates), up 5-7/8 to 109.

|

|

|

|

|

|

|