|

Greenspan plugs e-conomy

|

|

March 6, 2000: 12:52 p.m. ET

Central bank chief once again talks up New Economy; no specifics on rates

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Surging productivity growth has helped the U.S. economy grow at a much faster pace than ever before without triggering inflation, and the Federal Reserve Board must remain vigilant to ensure that it continues that way, Fed Chairman Alan Greenspan said Monday.

"Until market forces, assisted by a vigilant Federal Reserve, affect the necessary alignment of aggregate demand with the growth of potential aggregate supply, the full benefits of innovative productivity acceleration are at risk of being undermined by financial and economic instability," Greenspan said in remarks to a conference on the New Economy at Boston College.

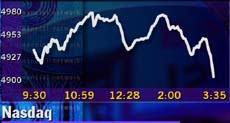

His comments came as the Nasdaq composite index, the bellwether indicator that has become synonymous with companies contributing to the technology revolution, meandered its way toward the record 5,000-mark -- a milestone for an index that hit 4,000 less than 10 months ago. But the other message in his remarks -- that rates are definitely on the rise -- sent the more rate-sensitive Dow Jones industrial average down more than 200 points by mid-afternoon and prompted the Nasdaq to reverse course and put off reaching the 5,000-mark for another day. His comments came as the Nasdaq composite index, the bellwether indicator that has become synonymous with companies contributing to the technology revolution, meandered its way toward the record 5,000-mark -- a milestone for an index that hit 4,000 less than 10 months ago. But the other message in his remarks -- that rates are definitely on the rise -- sent the more rate-sensitive Dow Jones industrial average down more than 200 points by mid-afternoon and prompted the Nasdaq to reverse course and put off reaching the 5,000-mark for another day.

Greenspan's comments also followed on the heels of a rather harsh warning from Securities and Exchange Commission Chairman Arthur Levitt, who told the same audience of business leaders and academics that he is very concerned about what seems to have become America's national pastime: investing in the zealous and, in the eyes of some, overvalued stock market.

Wishful thinking

"In the celebration of today's prosperity, I'm concerned that some of the basic but important fundamentals of investing are being lost on investors, or, even worse, being ignored," Levitt said. "Unless investors truly understand both the opportunities and the risks of today's market, too many may fall victim to their own wishful thinking."

Fueling the U.S. economy's blazing performance in recent years has been incredible advances in technology -- everything from smaller and faster computer chips to wireless telephones to new and innovative ways to move information quickly from one end of the world to the other. The U.S. economy expanded at a 6.9 percent pace in the fourth quarter. Fueling the U.S. economy's blazing performance in recent years has been incredible advances in technology -- everything from smaller and faster computer chips to wireless telephones to new and innovative ways to move information quickly from one end of the world to the other. The U.S. economy expanded at a 6.9 percent pace in the fourth quarter.

While those kinds of products and services have fueled productivity and allowed the economy to grow at a non-inflationary pace, the productivity gains are fueling expectations for corporate profit -- a theme that has spurred the Nasdaq to multiple records and spawned a giddy glee on Wall Street and Main Street that has encouraged consumers to spend.

That kind of demand for new homes, new cars, new stereos, DVD players and vacations -- called the "wealth effect" by Greenspan in previous speeches -- could eventually offset the amount of supply of goods and services available, pushing up prices and prompting the economy, now a month and six days into its ninth and record year of economic expansion, to falter.

The rate debate

Of concern to Wall Street analysts is that the euphoria of the technology driven bull market will end as the Fed continues to raise interest rates.

On the consumer side, higher rates tend to damp enthusiasm for borrowing as payments on credit cards and lines of credit go higher. The prime rate banks charge their best customers currently rests at 8.75 percent. For companies, it works much the same way. Those that borrow from the bank or the corporate debt market have to pay more in interest as rates climb.

But technology companies are different. Most of them raise capital by issuing stock, which costs them next to nothing. That means financing charges are irrelevant to their bottom line -- meaning they can continue to grow and work on their products and services without necessarily being affected by the Fed's policies -- something that has irked policy makers for some time.

Mary Farrell, chief strategist with Paine Webber, told CNNfn that she expects the Fed will likely raise rates several more times to slow the economy down. At the same time, she explained that the development of the Internet and communications will not be slowed by Fed policy. (353KB WAV) (353KB AIFF)

Steady, stable growth

"Our immediate goal at the Federal Reserve should be to encourage the economic and financial conditions that will best foster the technological innovation and investment that spur productivity growth," the Fed Chief said.

At the same time, ensuring a "stable macroeconomic environment of sustained growth and continued low inflation" is the only way to ensure that productivity growth continues in the future, and requires that "demand must moderate into alignment with the more rapid growth rate of potential supply," he said. (592KB WAV) (592KB AIFF)

While Greenspan did not specifically refer to interest rates or monetary policy, most analysts and investors heard nothing in his remarks that would change their opinion that another quarter-percentage-point increase in short-term rates is coming at the conclusion of the Fed's March 21 policy meeting. While Greenspan did not specifically refer to interest rates or monetary policy, most analysts and investors heard nothing in his remarks that would change their opinion that another quarter-percentage-point increase in short-term rates is coming at the conclusion of the Fed's March 21 policy meeting.

"His assertion that 'a vigilant Fed [will] affect the necessary alignment of the growth of aggregate demand with the growth of potential aggregate supply' leaves little room for doubt as to where interest rates are headed," said Ian Shepherdson, chief U.S. economist with High Frequency Economics.

Since last June, the Fed has raised rates four times, in an attempt to slow economic growth by making borrowing for consumers and businesses more expensive. The Fed funds rate, the benchmark interest rate that sets the trend for consumer and business loans, currently stands at 5.75 percent.

Overextended market?

Speaking at the same conference, SEC Chairman Arthur Levitt said he was concerned about the level of understanding many investors have about the workings of financial markets, suggesting many of them are overextending themselves to get in on one of the largest bull markets in U.S. history.

While the stellar gains among many technology companies is justified, Levitt warned that a large number of them, particularly in their rush to reap the rewards of an initial public offering, do not have the foundation for a solid, long-term business and will ultimately fail.

"Any way you look at it, many of today's valuations seem to defy traditional explanation," he said. "The run-up of these valuations is largely the result of multiple stock splits and soaring stock prices fueled by an almost insatiable investor appetite. Sometimes their race to an IPO comes at the expense of laying a foundation for a viable, long-term company."

U.S. Treasury Secretary Lawrence Summers also jumped into the New Economy theme, telling the same group Monday that the technology-driven economy was benefiting the majority of Americans. At the same time, he warned that continued fiscal discipline -- keeping the budget in surplus, paying down the national debt and keeping on track of deregulating markets to boost competition -- was needed to keep it growing.

"Growing demand and growing markets and networks will tend to reduce costs and raise efficiency, making successful economic management all the more important," Summers said. "That is why continued emphasis on deregulation will be crucial, to ensure that government is not preventing or distorting the development of fast-growing markets," he said.

|

|

|

|

|

|

|