|

Pace of production slows

|

|

March 15, 2000: 12:42 p.m. ET

Industrial production gains at slower pace; prices for wholesale goods up

|

NEW YORK (CNNfn) - Production at U.S. mines, factories and utilities gained at a moderate pace in February, while prices of imported goods at the wholesale level rose at the fastest pace in almost 10 years -- two reports that provide mixed signals about the pace of the U.S. economy and the threat of higher inflation.

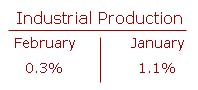

Output from U.S. producers gained 0.3 percent in February, the Federal Reserve said Wednesday, below January's 1.1 percent gain and the 1 percent increase expected by economists. Faster output of computers and semiconductors was offset by declines in output of cars and home appliances, according to the Fed's figures.

In a separate report, the Labor Department said prices for imported goods gained 1.9 percent last month -- the fastest pace since October 1990 -- after a revised increase of 0.3 percent in January. The increase reflected a surge in crude oil prices, which rose to record highs in the United States. The import price index measures the cost of international wholesale goods and raw materials for U.S. businesses.

Export prices rose 0.5 percent in the month.

The numbers painted a mixed picture of the pace of the U.S. economy. On one hand, producers didn't churn out as many goods last month, suggesting demand at home and abroad may be slowing down. On the other, the prices producers paid for raw materials rose -- an indication that they may ultimately pass those rising costs on to consumers, which may accelerate inflation.

A strange mix

"It's a very strange mix," said David Rosenberg, a senior economist with Toronto-based brokerage Nesbitt Burns Inc. "It may signal some kind of slowing, but I think I'd have to see a lot more evidence of that. It doesn't appear that consumer consumption is slowing in any meaningful way."

February's gain in production was the 14th monthly increase in a row, albeit the smallest percentage increase since November. Overall industry ran at 81.7 percent of capacity, the same pace as in January. A 3.6 percent jump in semiconductor production helped boost output, while a 3 percent drop in auto production and a 2.5 percent decline in home appliance output offset gains.

The overall gain in output came as businesses stocked their shelves with more goods, according to a separate report from the Commerce Department. The overall gain in output came as businesses stocked their shelves with more goods, according to a separate report from the Commerce Department.

Inventories rose 0.5 percent in January, the Commerce Department said, a shade above the 0.4 percent gain expected by analysts and the same rate as December's 0.5 percent rise. The stock-to-sales ratio -- a measure of how long it would take to fully deplete inventories at the current sales pace -- fell to a record low of 1.31 months. Sales gained 0.8 percent after a 1.2 percent rise in December.

Clamoring for goods

Indeed, the rise in inventories came as manufacturers scrambled to stock their shelves with goods that retailers -- and consumers -- keep clamoring for. Low inventory levels partially reflect the "new economy" idea of just-in-time shipment of goods and business-to-business buying and selling, said Rob Palombi, a senior analyst with Standard & Poor's MMS.

"There's still a lot of consumer demand out there, and as businesses try to restock their inventory levels they will increase demand, which will lead to stronger growth," Palombi said. "That could be problematic for the Fed."

One of the principal reasons the Fed has raised rates four times since June is to head off inflation at the pass by slowing the economy down and easing the desire among consumers to spend money. The Fed last raised rates by a quarter point at the beginning of February, and is expected to move its benchmark Fed funds rate by another quarter-point on March 21. One of the principal reasons the Fed has raised rates four times since June is to head off inflation at the pass by slowing the economy down and easing the desire among consumers to spend money. The Fed last raised rates by a quarter point at the beginning of February, and is expected to move its benchmark Fed funds rate by another quarter-point on March 21.

At the same time, no significant evidence of accelerating inflation has emerged, even with the U.S. economy chugging along at its current pace. Inflation occurs in several ways, most notably when companies' costs rise and when consumers earn more money and become more willing to spend.

Brian Fabbri, chief economist with investment firm Paribas, told CNNfn's In the Money that inflation may begin to creep higher as companies begin to struggle keeping their costs contained. That, in turn, could put a strain on corporate profits heading into the second half of the year, he said. (483KB WAV) (482KB AIFF)

Where's the inflation?

Other analysts disagree, arguing that new forms of technology have boosted productivity and allowed manufacturers to keep their costs down, even with prices for raw materials on the rise. What's more, in the case of imported goods, a stronger U.S. dollar has helped increase what a dollar buys overseas, further offsetting any potential inflation pressures, S&P's Palombi said.

"If that were going to have an impact on inflation, then arguably we would have already seen it," he said. In addition, "the U.S. dollar has been on a firming path against the yen and the euro, which should help offset inflation risks on imported goods and services going forward."

After reaching near par against the yen at the start of the year, the dollar has risen to above 106 yen. It has also made steady ground against the euro, with the euro falling below parity in late January to trade around the 96-cent level. After reaching near par against the yen at the start of the year, the dollar has risen to above 106 yen. It has also made steady ground against the euro, with the euro falling below parity in late January to trade around the 96-cent level.

To be sure, Wall Street will be keeping an eye peeled on Thursday's wholesale inflation numbers and Friday's retail inflation report to determine whether prices for companies and consumers are on the rise.

Analysts polled by Briefing.com expect wholesale prices rose at a 0.6 percent pace last month. Excluding energy costs, which have played a large role in wholesale costs to producers of late, prices are forecast to have risen 0.3 percent. Consumer prices are expected to have increased 0.4 percent in February, according to forecasts; excluding food and energy costs prices are seen having gained 0.2 percent.

Current account swells

"It really tells us, particularly the CPI, just how much all the changing prices are actually getting down to consumer level," said Joe Battipaglia, market strategist with Gruntal & Co. "My take on it is that the number is still going to be very muted. This is not about a new economy replacing an old one. This is about the real economy adapting to the new age."

In yet another report released Wednesday, the Commerce Department reported that the U.S. current account deficit, the broadest measure of foreign trade, widened to a record in the fourth quarter as imports outpaced exports.

Commerce said the deficit swelled 12 percent to $99.78 billion in the fourth quarter, surpassing the previous record set in the third quarter. For the full year, the deficit hit a record $338.92 billion, up more than 53 percent from 1998's $220.56 billion.

|

|

|

|

|

|

|