|

What the Fed is thinking

|

|

March 20, 2000: 6:06 a.m. ET

Two former Fed Governors share their views on what the FOMC's going to do

|

NEW YORK (CNNfn) - Here we go again -- another Federal Reserve policy meeting and another expected increase in short-term interest rates. A sobering reminder to Americans that they are spending too much and saving too little for their own good. Or so the Fed thinks.

CNNfn.com asked former Fed Governors Robert Heller and Wayne Angell for their views on what the brains at the Fed are really thinking about the pace of the economy, the yo-yo stock market, all this talk about "old versus new," and whether rates really need to go higher in the absence of inflation pressure.

CNNfn.com: What's your current take on the U.S. economy? Have we entered a new era?

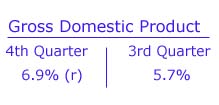

Heller: We are doing just wonderful at the present time, probably too wonderful for the Fed's taste. So far, the markets and the economy have really ignored the 1-percentage-point increase in the Fed funds rate over the past year. We still have a very fast, rapidly growing economy, with high growth, good industrial production, strong strides in technology and a strong underpinning from business. If there is one big change over the past year, it has been energy prices. So the Fed will say, "OK, we have to prevent those energy prices from being built into all goods and services," so they will keep going on their merry way until they see an actual decline in the growth rate.

Angell: This economy can go on expanding for another nine years. This is a wonderful new era that couldn't have happened without a vigilant Fed. The Fed's expertise in developing the business cycle has reached a level where we no longer have the boom and bust after-effect of it. In 1987-1988, the Federal Reserve made a mistake. By concentrating -- against my objections -- on the stock market, (then Chairman Paul Volcker) lowered rates because he thought the wealth effect was going to have a slowing effect on the economy. We blew it. And consequently we were in desperation to stop the inflation rate from rising. So we had to have an end-of-expansion slamming on the brakes, which led to a recession. Greenspan has ensured that as we start the 10th year of this expansion, we don't have those end-of-cycle deals where everyone recognizes inflation is around the corner. Angell: This economy can go on expanding for another nine years. This is a wonderful new era that couldn't have happened without a vigilant Fed. The Fed's expertise in developing the business cycle has reached a level where we no longer have the boom and bust after-effect of it. In 1987-1988, the Federal Reserve made a mistake. By concentrating -- against my objections -- on the stock market, (then Chairman Paul Volcker) lowered rates because he thought the wealth effect was going to have a slowing effect on the economy. We blew it. And consequently we were in desperation to stop the inflation rate from rising. So we had to have an end-of-expansion slamming on the brakes, which led to a recession. Greenspan has ensured that as we start the 10th year of this expansion, we don't have those end-of-cycle deals where everyone recognizes inflation is around the corner.

CNNfn.com: The Fed has made clear it is concerned about accelerating inflation. Should it be?

Heller: It's amazing that consumer prices have remained so stable for so long. That's due in part to our high levels of imports, which keeps price pressure on final goods and services. You also have productivity, which has offset costs. That has been one of our saviors -- the sharp increases in activity through computers and so on. It was long in coming, if you look at the 1980s, when we were buying computers and nothing ever happened to productivity. At the same time, you see that something is happening in the pipeline -- commodity prices have been going up for a year, obviously oil and gas prices are going higher, and that tends to eventually filter its way down into the economy. Certainly a very significant revolution has taken place, but not everything is "new economy." If you look at traditional sectors, automobiles and what have you, the vast bulk of it is still "old economy," which reacts in typical fashion to economic cycles and rising energy prices. In short, the Fed has to remain vigilant against inflation. Otherwise we wouldn't have what we see today.

Angell: We are now starting our fifth year of 4 percent real growth and the rate of core inflation is actually coming down. Fast economic growth does not cause inflation and low unemployment does not cause inflation. In other words, economics is really quite different than the consensus view. If the Federal Reserve continues to move the rate of inflation towards zero, and they are targeting zero, even though they would never admit it, then the unemployment rate will fall and economic growth will speed up. Low unemployment rates qualify the U.S. for this particular new era. The lower the unemployment rate goes, then the less obstacle there is to blatantly replace workers with capital. The wealth effect that comes from Americans getting wealthy in the stock market and the real estate market does tend to create a lot more economic activity and with that prices can rise. But Alan Greenspan and company are so worried about the stock market that they aren't apt to make any inflation mistakes. Is it good that the Fed is focused on inflation? Yes. It's better that they err on the side of caution. Angell: We are now starting our fifth year of 4 percent real growth and the rate of core inflation is actually coming down. Fast economic growth does not cause inflation and low unemployment does not cause inflation. In other words, economics is really quite different than the consensus view. If the Federal Reserve continues to move the rate of inflation towards zero, and they are targeting zero, even though they would never admit it, then the unemployment rate will fall and economic growth will speed up. Low unemployment rates qualify the U.S. for this particular new era. The lower the unemployment rate goes, then the less obstacle there is to blatantly replace workers with capital. The wealth effect that comes from Americans getting wealthy in the stock market and the real estate market does tend to create a lot more economic activity and with that prices can rise. But Alan Greenspan and company are so worried about the stock market that they aren't apt to make any inflation mistakes. Is it good that the Fed is focused on inflation? Yes. It's better that they err on the side of caution.

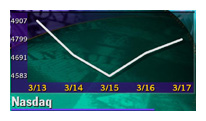

CNNfn.com: Should the Federal Reserve be focused at all on the U.S. stock market, particularly the lofty valuations of high-tech companies?

Heller: If Greenspan is worried so much about the stock market itself and speculation in the stock market, then higher margin requirements are a way to dampen that. I can't figure out why they haven't acted on it. No one is doing anything there and why not? Here you have a scalpel rather than a big, blunt hammer to use as an instrument to dampen exuberance in the market -- and they are not using it. By raising margin requirements, you can attack the speculation by attacking the market itself. In my days, the stock market wasn't one of the variables. It was one of the many inputs in the process. I don't think that's changed, but I still wonder why the Fed has such a preoccupation. The market will do what the market will do. And the Fed should do what it does: concentrate on balancing strong growth with low inflation for as long as possible. The market is much less of a factor, I think, than the Fed considers it to be.

Angell: The Federal Reserve has some strange notion that the stock market could somehow jeopardize the expansion -- which, of course, it cannot. But the Fed, worrying about the wealth effect, in a sense guards doubly against an inflation event. In that sense, it's positive that the Fed is focused on the stock market and the wealth effect it creates, and it enhances their inflation fight that much more because they are even more guarded than normal. But in reality there is no reason for them to focus on the markets because there is no connection. As I told the Board of Governors in August of 1999, if the Federal Reserve would like to lower equity prices, it would be easy to do. All they would have to do is announce that they are not worried about inflation rising, that it wouldn't hurt for a little more liquidity to grease the wheels, and if inflation were to double from 2 to 4 percent that would be okay. If they did that, the stock market would lose half of its value in two days' time. But I said if they appeared vigilant, the stock market would love it and do the opposite of what they wanted it to do. Angell: The Federal Reserve has some strange notion that the stock market could somehow jeopardize the expansion -- which, of course, it cannot. But the Fed, worrying about the wealth effect, in a sense guards doubly against an inflation event. In that sense, it's positive that the Fed is focused on the stock market and the wealth effect it creates, and it enhances their inflation fight that much more because they are even more guarded than normal. But in reality there is no reason for them to focus on the markets because there is no connection. As I told the Board of Governors in August of 1999, if the Federal Reserve would like to lower equity prices, it would be easy to do. All they would have to do is announce that they are not worried about inflation rising, that it wouldn't hurt for a little more liquidity to grease the wheels, and if inflation were to double from 2 to 4 percent that would be okay. If they did that, the stock market would lose half of its value in two days' time. But I said if they appeared vigilant, the stock market would love it and do the opposite of what they wanted it to do.

CNNfn.com: What are the biggest risks to the U.S. economic expansion right now? Does anything about this time seem familiar?

Heller: I'm only 60! In the 1970s, Japan seemed not to be able to do anything wrong, and the U.S. economy is like that right now. And at that time in the 1980s and 1990s too, the Bank of Japan really jacked up rates, pricking the stock market. And they've been sitting there ever since. There are some parallels, but there are also some important differences. The important difference is Japan at that time was really in a catch-up mode, importing technology from the U.S. and so on, getting up to or level of productivity. You can argue that the Japanese hit a wall. We are not apt to hit a wall, but have a movable target in front of us due to productivity increases and technology, and we are expanding the economic potential. On the other hand, once you have one of those assets and price deflation spirals, it's very difficult to stop.

Angell: There's nobody at the White House, there's nobody at the Treasury, there's nobody out there to put pressure on the Fed for raising rates. So Greenspan is saying, what will it hurt to raise rates one, two or three more times when there is no political opposition and no concern about slowing the economy too much. This is a wonderful era that couldn't have happened without a vigilant Fed. The biggest risks right now are policy risks -- if the Fed somehow lets inflation get out of control, which I think there's almost no chance of, or if somehow they produce a deflationary environment, which would create a situation similar to Japan's in the early 1990s. Those are the risks to the expansion, but they are minimal. Angell: There's nobody at the White House, there's nobody at the Treasury, there's nobody out there to put pressure on the Fed for raising rates. So Greenspan is saying, what will it hurt to raise rates one, two or three more times when there is no political opposition and no concern about slowing the economy too much. This is a wonderful era that couldn't have happened without a vigilant Fed. The biggest risks right now are policy risks -- if the Fed somehow lets inflation get out of control, which I think there's almost no chance of, or if somehow they produce a deflationary environment, which would create a situation similar to Japan's in the early 1990s. Those are the risks to the expansion, but they are minimal.

CNNfn.com: Can Greenspan and the Federal Reserve engineer another "soft landing" for the economy?

Heller: I've never liked the term soft landing, and I don't like it now. You don't want to land; you want to keep on going. When you're on a plane, everyone lands, gets off the plane, and goes home. But we don't want to go home; we want to keep on moving, keep on going ahead. Not quite at the same speed as before, but we want to go forward. Yes, Greenspan can orchestrate that, so long as the Fed sticks to its agenda of being vigilant against inflation.

Angell: The key is where I began, which is that this expansion could very well go on for nine years. The expansion doesn't end until the Fed wants it to end, and the Fed won't want it to end until an inflation mistake has been made. I think we're in a place right now where the economy continues to operate at an exceptional pace, and Greenspan has already tapped on the brakes a couple of times to slow things down. And last week's producer price index and consumer price index numbers showed that, with the exception of oil, there's no risk of inflation. So in fact, there's no need to land at all. When the price of oil begins to come down, then all this good news on inflation is really going to become apparent to everyone. Angell: The key is where I began, which is that this expansion could very well go on for nine years. The expansion doesn't end until the Fed wants it to end, and the Fed won't want it to end until an inflation mistake has been made. I think we're in a place right now where the economy continues to operate at an exceptional pace, and Greenspan has already tapped on the brakes a couple of times to slow things down. And last week's producer price index and consumer price index numbers showed that, with the exception of oil, there's no risk of inflation. So in fact, there's no need to land at all. When the price of oil begins to come down, then all this good news on inflation is really going to become apparent to everyone.

CNNfn.com: How many more times will the Fed raise rates before it calls it a day?

Heller: I think the Fed will move two, maybe three times more, but likely wrap things up by the June meeting. The effects of their last rate increases will begin to take effect by the second quarter, which should moderate growth to a level that's more comfortable for them.

Angell: Greenspan will increase the Fed funds rate to 6 percent next Tuesday (March 21), and I think he'll likely do it again in May and again on June 28th. Once that's done he'll be able to appear at the Humphrey-Hawkins testimony to Congress in July and tell them that the economy is in good shape -- that there's no risk of inflation. I would imagine that's how he hopes it will work out.

Robert Heller is Executive Vice President of Fair Isaac, a San Francisco-based technology credit advisement company. Wayne Angell is chief economist for New York-based investment bank Bear Stearns.

-- Compiled by Staff Writer M. Corey Goldman

|

|

|

|

|

|

Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|