|

Trade deficit hits record

|

|

March 21, 2000: 11:03 a.m. ET

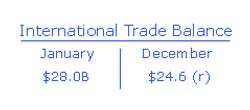

January gap surges to $28B; imports hit record on surging demand for oil

|

NEW YORK (CNNfn) - Americans' appetite for goods produced abroad resulted in a record trade deficit in January as demand for consumer products surged and oil prices jumped to near nine-year highs, the government reported Tuesday. Exports declined for the first time in eight months.

January's trade deficit widened to a record $28 billion, the Commerce Department said. That was well above December's revised $24.6 billion deficit and $1.5 billion above economists' estimates of a $26.5 billion gap. January's figure was revised downward from the $25.5 billion deficit first reported.

The record trade imbalance provided yet another indication to analysts and economists of the resilient strength of the U.S. economy, now in its record 108th month of uninterrupted expansion. That strength has been driven in large part by U.S. consumers' voracious appetite to acquire goods, something the Federal Reserve seeks to reign in by raising interest rates. The record trade imbalance provided yet another indication to analysts and economists of the resilient strength of the U.S. economy, now in its record 108th month of uninterrupted expansion. That strength has been driven in large part by U.S. consumers' voracious appetite to acquire goods, something the Federal Reserve seeks to reign in by raising interest rates.

"Imports are extremely strong because there's a lot of demand from consumers for goods," David Blitzer, chief economist with Standard & Poor's, told CNNfn's Before Hours. "The increase in oil prices played a large role in that but, it still points to an extremely strong economy."

Another rate rise

Fed officials meet today in Washington to discuss the pace of the U.S. economy and whether to lift rates again to discourage consumers from borrowing and spending. Most analysts expect the Fed's Open Market Committee will lift the benchmark Fed funds rate by a quarter point to 6.0 percent, the fifth quarter-point move in eight months.

Blitzer said he expects to see the trade deficit level off in the months ahead as demand overseas for U.S.-made goods picks up slightly, and as demand at home begins to ease in the wake of the Fed's recent spate of rate increases. (499KB WAV) (499KB AIFF) Blitzer said he expects to see the trade deficit level off in the months ahead as demand overseas for U.S.-made goods picks up slightly, and as demand at home begins to ease in the wake of the Fed's recent spate of rate increases. (499KB WAV) (499KB AIFF)

Overall imports rose to a record $112.1 billion in the first month of the year, while exports dipped slightly to $84.1 billion, Commerce said. Higher oil prices factored into the record deficit. Crude oil prices have almost tripled in the past year, rising as high as $34 a barrel from a 12-year low of $10.35 a barrel reached in December 1998.

The trade deficit with OPEC, which the Commerce Department breaks out into a separate category, more than doubled to $2.6 billion in January from $1.2 billion in December and $880 million in January 1999. The U.S. imports more than half its crude oil.

The jump in oil prices followed the Organization of Petroleum Exporting Countries' (OPEC) decision to curb production to avoid a global oil glut. OPEC members meet in Vienna next week and are expected to lift those restrictions and bolster the amount of supply. Crude oil for May delivery recently traded at $25.65 a barrel.

Cars, chips cellphones

Surging demand for new cars pushed auto imports up 4.2 percent in January, the third monthly gain in a row. Demand for chips used in personal computers and wireless phones also helped bump imports to a record, Commerce said.

At the same time, demand for U.S.-made components wasn't as strong. Exports of advanced technology products fell nearly 20 percent while exports of semiconductors dropped 7.7 percent. Aircraft exports sank 4.7 percent.

The merchandise trade deficit with Japan, the world's second-biggest economy, narrowed to $5.6 billion in January from $7 billion in December. The trade deficit with Western Europe also declined, narrowing to $3.59 billion in January from $3.89 billion in December.

By contrast, the deficit with China widened to $6.03 billion in January from $5.61 billion in December. The deficit with Canada, the U.S.'s largest trading partner, also grew, widening to a record $4.29 billion in January from $3.45 billion the previous month. The gap with Mexico surged to $1.77 billion in January from $879 million in December.

|

|

|

|

|

|

|