|

Primedia goes 'new media'

|

|

March 30, 2000: 3:26 p.m. ET

Liberty Media and CMGI each take a 5 percent stake in media and publishing firm

|

NEW YORK (CNNfn) - Primedia Inc., best known for its publishing empire of consumer and trade magazines like Seventeen and Automobile, on Thursday unveiled two deals - each valued at about $200 million -- aimed at transforming the company into a new media player, boasting broadband, Internet and e-commerce properties.

New York-based Primedia (PRM: Research, Estimates), a $1.7 billion company that prints some 270 publications, said venture capital firm CMGI and television programmer Liberty Media Group have each purchased 5 percent stakes in Primedia, in separate deals experts valued at about $400 million in total.

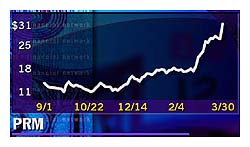

Under the deals, venture capital firm CMGI (CMGI: Research, Estimates), based in Andover, Mass., will take a 5 percent stake in Primedia in exchange for 1.53 million shares of CMGI stock. Shares of CMGI fell on Thursday, declining 3-15/16 to about 107-7/8, while Primedia shares rose almost 5-3/16, or almost 20 percent, to 32-5/16. Under the deals, venture capital firm CMGI (CMGI: Research, Estimates), based in Andover, Mass., will take a 5 percent stake in Primedia in exchange for 1.53 million shares of CMGI stock. Shares of CMGI fell on Thursday, declining 3-15/16 to about 107-7/8, while Primedia shares rose almost 5-3/16, or almost 20 percent, to 32-5/16.

The transaction will enable faster growth of Primedia's business-to-business marketplaces, via joint ventures the plan to create in key sectors, the company said.

Programming services company Liberty Media (LMG.A: Research, Estimates), which is based in Englewood, Colo., will invest $200 million in cash in New York-based Primedia, in exchange for its 5 percent stake, and 1.5 million warrants in the company.

In addition, Liberty Media, or its Liberty Digital unit, will receive an option to acquire a 12.5 percent stake in Primedia's new Primedia Broadband Video unit in exchange for cash, Liberty Digital Series A common stock or Liberty Media Group tracking stock.

Primedia said it would buy $25 million of Liberty Digital stock. The companies expect to work together to develop consumer broadband video and other interactive video applications for Primedia's portfolio of content.

The deals following through on promises made by Chairman and Chief Executive Tom Rogers, a television veteran credited with spawning CNBC, MSNBC and NBCi. When he was hired five months ago, he pledged to awaken the dormant value in Primedia's meaty assets and subscriber rolls.

Over that time period, Primedia's stock has nearly tripled.

"We will have now hired senior operating managers, consummated numerous ads for equity deals, entered into several alliances, and put in place a growth strategy that launches our future," he said. "These transactions give us significant traction in our new media efforts."

At a press conference, Rogers said the company's revenue from new media properties would double in 2000 to $50 million, and jump to $100 million in 2001. The segment's cash flow loss, a key figure of fiscal health for media companies, is seen jumping to $80 million in 2000 from about $32 million last year.

But Rogers predicted savings of $25 million-to-$35 million before interest, taxes, depreciation and amortization in 2001.

Rogers also revealed a reorganization of the company's business segments -- into a Consumer Group and a Business-to-Business Group - and announced a new stable of managers brought on to help build out his new media plan. Rogers also revealed a reorganization of the company's business segments -- into a Consumer Group and a Business-to-Business Group - and announced a new stable of managers brought on to help build out his new media plan.

They include John Loughlin, former president of Meredith Corp.'s Broadcast Group, to head Primedia's new Magazine and Internet Group, and former Business Week president David Ferm, who recently joined the company as president of its B2B Group.

The company may in the future spin off the B2B group, which includes trade publications like American Trucker, and business-to-business Internet company IndustryClick, Rogers said.

What's more, the company unveiled joint ventures and alliances with a number of partners, including Military.com, Quiltcollector.com, CameraConnection.com, and CarsDirect.com. What's more, the company unveiled joint ventures and alliances with a number of partners, including Military.com, Quiltcollector.com, CameraConnection.com, and CarsDirect.com.

The Liberty deal could be a big boost for Primedia's Channel One segment, which broadcasts news to some 8 million students in more than 12,000 middle and high schools across the United States.

"Some (Channel One) assets are under-exploited or not exploited on the Internet, and when paired with Liberty Media, jumpstarts our ability to do broadband video or streaming video," said Jim Ritts, Channel One Network president.

The company said it plans to divest 20 properties that do not mesh with the new strategy. The divestitures are expected to generate between $125 million and $150 million, the company said.

On Wednesday, Primedia said its popular New York magazine said it created a partnership combining the brands and content of the magazine and Cablevision Systems Corp.'s Rainbow Media Holdings Inc. unit. The companies will create the New York-focused Internet sites, including content exchange and development across the print, television and Web businesses. On Wednesday, Primedia said its popular New York magazine said it created a partnership combining the brands and content of the magazine and Cablevision Systems Corp.'s Rainbow Media Holdings Inc. unit. The companies will create the New York-focused Internet sites, including content exchange and development across the print, television and Web businesses.

|

|

|

|

|

|

Primedia

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|