|

Xerox to cut 5,200 jobs

|

|

March 31, 2000: 12:22 p.m. ET

Documents company says restructuring necessary to remain competitive

|

NEW YORK (CNNfn) - Xerox Corp. announced Friday that it is cutting 5,200 jobs, or 5 percent of its work force, because it can "no longer operate business as usual and expect to win," said the company's CEO Rick Thoman.

The cuts will come from all ranks of the company's 94,600 employees worldwide, spokesman Jeff Simek said. About 10 percent of the company's total middle and senior management positions are included in those cuts, he added.

More than half the 5,200 jobs will come from offices in the United States. Details are to be worked out among business groups, unions, government and local leadership, Xerox said. More than half the 5,200 jobs will come from offices in the United States. Details are to be worked out among business groups, unions, government and local leadership, Xerox said.

Faced with heavy competition and a difficult reorganization of its sales force, the No. 1 U.S. business machine maker said it is narrowing its focus to two core markets: business machines, such as copiers for home and medium-sized offices; and larger document systems for big corporations.

The Stamford, Conn.-based company plans to post a charge of $625 million against earnings in the first quarter as a result of the restructuring.

The company, which built its reputation as "the documents company," posted fourth-quarter earnings in January of $294 million, or 41 cents a share, down more than half from its year-earlier quarter with earnings of $615 million, or 84 cents a share. Revenue fell 6 percent to $5.4 billion.

Chief Executive Officer Thoman said the marketplace has changed from the days when Xerox was a leader in photocopying technology, but added that, "We're intensifying our drive to become a faster, leaner and more flexible enterprise." Chief Executive Officer Thoman said the marketplace has changed from the days when Xerox was a leader in photocopying technology, but added that, "We're intensifying our drive to become a faster, leaner and more flexible enterprise."

Simek said the facility closings will include some manufacturing plants, as well as warehouse and distribution facilities. He declined to disclose the location of the plants to be closed.

The announcement was not unexpected, because Thoman initially announced the restructuring plan in December along with a fourth-quarter earnings warning.

Fourth restructuring in a decade

Friday's announcement was Xerox's fourth major restructuring in the last decade. In 1998, the company took a $1.1 billion charge and cut about 9,000 jobs in another reorganization.

The company said none of the latest round of cuts will affect its sales or research and development efforts. The charge includes about $175 million for closing facilities and scrapping some of its inventory.

Jack Kelly, a Goldman Sachs analyst, said Xerox ran into sales problems a year ago when it cut too many people from its administrative units, causing a falloff in retail customer service.

Additionally, Kelly said that its competitor, Cannon, introduced a successful line of black and white copiers last year, which cut into Xerox's sales.

Simke said Xerox has had difficulty competing with other firms such as Dell, which can offer cheaper prices in the retail market by selling directly over the Internet.

However, the company does sell on the Web and also through dealers and product re-sellers to remain competitive, and it is also No. 1 ahead of Sharp and Cannon in market share estimates for digital copiers, according to surveys by research firms Dataquest and IDC, Simke said. However, the company does sell on the Web and also through dealers and product re-sellers to remain competitive, and it is also No. 1 ahead of Sharp and Cannon in market share estimates for digital copiers, according to surveys by research firms Dataquest and IDC, Simke said.

"Our biggest challenge has been making the change quickly enough and cutting our costs quickly enough to be competitive," he said.

Gibbony Huske, an analyst with Credit Suisse First Boston, said the move is pretty much what Wall Street had anticipated, and that further job cuts and restructuring charges are unlikely in the near future.

The move will give the company flexibility to shift its focus and better compete with Cannon and Hewlett-Packard, Huske said.

"A lot of the jobs are coming from mid and upper levels of management ... They will shift some of the manufacturing overseas," Huske said. "The company is clearly focused on a growing share in the printer market."

Huske said hard financial times have hit the entire industry and is not limited to Xerox.

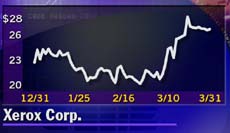

Shares of Xerox (XRX: Research, Estimates) slipped 9/16 to close at 26 on the New York Stock Exchange Friday.

--From staff and wire reports

|

|

|

|

|

|

Xerox

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|