|

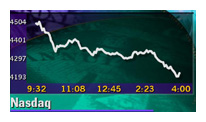

Nasdaq sinks 350 points

|

|

April 3, 2000: 5:58 p.m. ET

Hit by Microsoft, tech gauge tumbles nearly 350 points; Dow rises

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Nasdaq composite index plunged nearly 8 percent Monday, suffering its biggest point loss on record, hurt by Microsoft, which tumbled after talks to settle its landmark antitrust case with the government collapsed.

Microsoft fell nearly 15 percent, erasing billions of dollars in market value, as investors bet a federal judge's ruling against the company could cripple the world's biggest software maker.

The plunge sparked a broad technology sell-off that pushed the Nasdaq, down for the fifth time in six sessions, deep into the hole Wall Street considers a correction.

The Nasdaq lost 349.15 points, or 7.6 percent, to close at 4,223.68. The decline puts the index more than 16 percent below its high set March 10 at 5,048, well past the 10 percent decline most analysts deem a correction.

"A lot of people assume that what's bad for Microsoft is bad for technology, and that's what's hurting the Nasdaq," said Art Hogan, chief market strategist at Jefferies & Co.

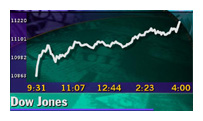

But the Dow Jones industrial average rose, posting its sixth biggest jump on record. Gains in financial stocks more than offset losses in Microsoft, a Dow component. Retailers and drug makers also drew buyers, as money moved into out-of-favor value stocks with stable earnings.

"I think the Nasdaq was facing a lot of profit taking already," said Terrence Gabriel, stock market strategist at IDEAglobal. "Certainly on the Nasdaq today, the Microsoft issue is hitting stocks in general." "I think the Nasdaq was facing a lot of profit taking already," said Terrence Gabriel, stock market strategist at IDEAglobal. "Certainly on the Nasdaq today, the Microsoft issue is hitting stocks in general."

The point loss easily topped the previous daily record, a 229 drop set Feb. 4., while the percentage tumble was the biggest this year.

But the Dow jumped 300.01, or 2.6 percent, to 11,221.93. And the broader S&P climbed 7.39 to 1,505.97.

"We are seeing a rotation back into some of the real companies, if you will," Robert Armknecht, portfolio manager at FleetBoston Financial, told CNNfn's market coverage.

Advancing issues on the New York Stock Exchange, home to many beaten-up value stocks, outpaced declining issues 1,571 to 1,489, as trading volume topped 1 billion shares.

But Nasdaq losers beat winners, 3172 to 1,129. More than 1.7 billion shares changed hands.

The day's action puts the Nasdaq's and Dow's performance closer to parity than they've been in months. The Nasdaq is now up about 3.6 percent this year while the Dow is down roughly 2.4 percent in 2000.

In other markets, the dollar rose against the yen but fell versus the euro. Treasury securities rose.

Microsoft tumbles

Analysts say the collapse in settlement talks with the Justice Department Saturday could mean more legal troubles ahead for Microsoft, whose stock surged last month on hopes that a deal was near.

The extent of those troubles was revealed after the close of trading Monday, when U.S. District Court Judge Thomas Penfield Jackson ruled that Microsoft violated the Sherman Antitrust Act. The decision may lead to harsh penalties against the company, including a possible breakup.

And with the ruling, the software maker could be subject to other lawsuits, a development that could mean lengthy proceedings in the case that painted Microsoft as a monopolistic bully.

Microsoft (MSFT: Research, Estimates) plummeted 15-3/8, or 14.5 percent, to 90-7/8. More than 129 million shares changed hands, making Microsoft Nasdaq's most traded stock. The plunge shaved off about $80 billion of the company's market value.

In the near term, William Epifanio, software analyst at J.P. Morgan, told CNN's In the Money, he expects Microsoft's stock to trade in a narrow range until the federal judge's ruling is appealed. (241K WAV) (241K AIFF).

Still, many on Wall Street retained their favorable impression of the company, one of the nation's largest and most profitable.

"We'll hold on to what we have and probably be adding to our positions over time," David Presson, associate director of equity research at Banc of America Capital Management, told CNNfn's market coverage. "This is a stock that you want to own longer term."

The Nasdaq, like Microsoft, has shown an ability to rebound from weakness, as investors inevitably return to the technology stocks expected to lead the economy's growth.

"I think tomorrow we're going to get a bounce," Brian Finnerty, head of Nasdaq listed trading, predicted on CNN's Street Sweep.

Still, the losses caused pain at the Redmond, Wash.-based software firm, where Chairman Bill Gates, the largest shareholder, lost about $11 billion in paper wealth.

But the software maker's competitors got a boost Monday.

VA Linux (LNUX: Research, Estimates, a provider of Linux, an operating system that competes with Microsoft's Windows NT, jumped 1-15/16 to 62-5/16. Red Hat (RHAT: Research, Estimates), also a maker of Linux, traded higher all day, before succumbing to selling and closing down 1/4 to 42-1/8.

Other technology bellwethers weakened. Intel (INTC: Research, Estimates) fell 1-5/16 to 130-5/8 and Cisco Systems (CSCO: Research, Estimates) shed 4-3/8 to 72-15/16.

1Q earnings ahead

It wasn't supposed to be this way at the start of the second quarter.

Forecasts for a strong first-quarter results reporting season, which starts this week, were seen drawing investors into stocks.

Technology companies in the S&P 500 are expected to increase profits by a cumulative 26.2 percent in the first quarter, outpacing the 18.4 percent gain for the overall index, according to First Call/Thomson Financial.

Shares in the No. 1 online brokerage firm jumped 3/8 to 57-3/8 after the company said that it expects to report first-quarter earnings of between 31 and 33 cents a diluted share, above the 26 cents a share consensus of analysts surveyed by First Call.

Charles Schwab (SCH: Research, Estimates) offered a hint of what may come. Shares in the No. 1 online brokerage firm jumped 3-1/16 to 60-1/16 after the company said that it expects to report first-quarter earnings of between 31 and 33 cents a diluted share, above the 26 cents a share consensus of analysts surveyed by First Call.

Other financial services firms also rose, lifting the Dow. American Express (AXP: Research, Estimates) soared 6-9/16 to 155-1/2 J.P. Morgan (JPM: Research, Estimates) rose 10 to 141-3/4 and Citigroup (C: Research, Estimates) gained 2-1/16 to 61-15/16.

With trading volume setting record after record this year, "there shouldn't be any question that the broker-dealers are going to have a great quarter," Art Hogan, chief market strategist at Jefferies & Co., said.

Also supporting the Dow, Merck (MRK: Research, Estimates) gained 4-3/8 to 66-1/2 and Wal-Mart (WMT: Research, Estimates) surged 5-1/4 to 61-3/4.

Without Microsoft the gains to the index of blue chip stocks would have been more dramatic; Microsoft's loss accounted for more than 76 Dow points.

In the day's biggest deal, Anadarko Petroleum Corp. (APC: Research, Estimates) fell 4-3/16 to 34-1/2 after agreeing to acquire Union Pacific Resources Group Inc. for $4.4 billion in stock. Union Pacific (UPR: Research, Estimates) rose 3/16 to 14-11/16.

Mattel Inc. (MAT: Research, Estimates) rose 7/16 to 10-15/16. The Wall Street Journal reported Monday that the toy maker is trying to sell Learning Co. and may get just a third of what it paid a year ago for the troubled software business.

In economic indicators, manufacturing activity rose at a slightly slower pace in March while costs for manufacturers are rising.

The National Association of Purchasing Management said its index of manufacturing activity slipped to 55.8 in March from 56.9 in February, below the 56.5 reading expected by analysts. A reading above 50 points indicates growth in manufacturing; one below that indicates contraction.

The "prices paid" component -- a measure of costs -- jumped to 79.8 in March from 74.1 in February. The latest figure is the highest in five years.

Separately, the U.S. government said construction spending rose 1.5 percent in February, stronger than expected.

Click here for a look at CNNfn's hot stocks

|

|

|

|

|

|

|