|

New wireless IPO planned

|

|

April 4, 2000: 12:37 p.m. ET

Joint venture of Bell Atlantic and Vodafone also plans $3B investment

|

NEW YORK (CNNfn) - Bell Atlantic Corp. and Vodafone AirTouch Tuesday announced a proposed initial public offering for their wireless communication joint venture, along with plans to invest $3 billion in their combined network by 2000.

The joint venture, Verizon Wireless, the new company formed by combining the cellular, paging and PCS business of the two companies, began operation Tuesday. The merger of those operations was worth an estimated $70 billion.

The companies did not give details about the size of the planned IPO, saying only that they expected to take the offering to market by the end of the year. However, analysts said the offering could at least be competitive with the float planned by AT&T Wireless, the nation's No. 2 wireless service, which is valued at approximately $13.25 billion.

When Bell Atlantic's planned merger with GTE Corp. is completed later this year, Verizon Wireless expects to reach 90 percent of the U.S. population and 96 of the 100 largest wireless markets in the country. By comparison, AT&T Wireless will cover about 70 percent of the United States by the end of the year.

"Certainly this is a decided advantage for AT&T (T: Research, Estimates) to have this wireless strategy already in place, so Bell Atlantic is not going to just sit by and let AT&T beat them," said David Menlow, president of IPOFinancial.com.

Single rate plan mimics OneRate

In conjunction with Tuesday's announcements, Verizon officials also unveiled a nationwide single-rate pricing plan, designed to compete directly with AT&T Wireless' OneRate plan.

The plan features price ranges from $35 a month for 150 minutes nationwide to $150 for 1,500 minutes. That compares to AT&T Wireless's charges of $59.99 for 300 minutes and $149.99 for 1,400 minutes.

SingleRate customers will also be eligible to purchase one of two Web-ready digital phones, as well as a coast-to-coast two-way short messaging service the company plans to unveil later this year.

Company officials said the planned $3 billion investment will be used to grow the company's digital footprint, roll-out the two-way messaging service and providing wireless network support for General Motors Corp.'s (GM: Research, Estimates) OnStar personal calling feature. Company officials said the planned $3 billion investment will be used to grow the company's digital footprint, roll-out the two-way messaging service and providing wireless network support for General Motors Corp.'s (GM: Research, Estimates) OnStar personal calling feature.

"The formation of our wireless joint venture gives us unparallel wireless strengths," said Dennis Strigl, the former president of Bell Atlantic Mobile, who was named president and CEO of Verizon. "We'll be the premier wireless company in the nation, bar none."

Wireless communication has been a hot sector in the stock market this year and wireless equipment IPOs have been particularly strong.

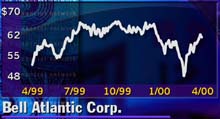

Bell Atlantic (BEL: Research, Estimates) surged on the IPO announcement, jumping 1-15/16 to 65 by midday, while GTE (GTE: Research, Estimates) rose 2 to 75-7/16. Shares of Vodafone fell 13 pence to 321.50 pence in trading in London Tuesday, and lost 3-3/8 to 52-1/8 in mid-day trading on the New York Stock Exchange.

|

|

|

|

|

|

|