|

'Old economy' lifts Europe

|

|

April 4, 2000: 12:42 p.m. ET

Another day, another battering for tech stocks; banks lead recovery

|

LONDON (CNNfn) - Europe's largest stock markets closed higher Tuesday as investors sought refuge from declines in the technology sector by buying neglected "old economy" stocks such as retailers, banks and drug makers. Frankfurt and Paris rose more than 1 percent, with only London failing to buck the trend.

In Frankfurt, the Xetra Dax index climbed 1.2 percent to 6,427.00, while the CAC 40 in Paris gained 1.7 percent to 6,236.87. Zurich's SMI rose 0.85 percent to 7,588.00. In London, the benchmark FTSE 100 rose 0.5 percent to 6,427.00, pulled for most of the day in opposite directions by falling tech shares and gains for financial stocks.

The pan European FTSE 300, a broader index of the region's largest stocks, rose 0.65 percent to 1,619.84, with its beverage, tobacco, bank and retail segments rising more than 3 percent. The media sub-index fell more than 5 percent, while telecom stocks slipped more than 3 percent. The pan European FTSE 300, a broader index of the region's largest stocks, rose 0.65 percent to 1,619.84, with its beverage, tobacco, bank and retail segments rising more than 3 percent. The media sub-index fell more than 5 percent, while telecom stocks slipped more than 3 percent.

Tech stocks tumbled for the second straight day Tuesday, pulling the Nasdaq composite below 4,000 and into the minus column for the year. The tech-heavy index tumbled more than 5 percent to about 3,985 -- below its close of 4,069 at the end of 1999. The Dow Jones industrial average rallied early, then gave up its gains at midday to show a 70 point loss.

European techs, telecoms slide

Europe had only one direction to follow Tuesday, and the Nasdaq provided the inspiration. Reuters (RTR) fell 5.8 percent after shares of Tibco (TIBX: Research, Estimates), the  financial news and information provider's Internet software subsidiary, fell 5 percent in the U.S. Monday. Sema Group (SEM) a computer consulting firm, fell 9.8 percent. financial news and information provider's Internet software subsidiary, fell 5 percent in the U.S. Monday. Sema Group (SEM) a computer consulting firm, fell 9.8 percent.

The biggest decliner in London was hand-held computer maker Psion (PON), which slumped 18.3 percent, while Irish-based Internet security company Baltimore Technology (BLT) followed in close pursuit, dropping 16 percent. Computer chip designer ARM Holdings (ARM) plummeted 14 percent and technology investor 3i Group (III) slumped 12 percent.

Telecom companies didn't fare any better. Scotland's Thus (THUS) fell 14 percent, while Cable & Wireless [LSE:CW- ] dropped 6.6 percent and the U.K.'s largest telecom company, British Telecommunications (BT-), fell 3.4 percent. Index heavyweight Vodafone AirTouch (VOD) dropped 3.7 percent.

British Sky Broadcasting (BSY), Europe's second-largest satellite broadcaster, fell 8.7 percent, while commercial TV rival Carlton Communications (CCM) dropped 6 percent.

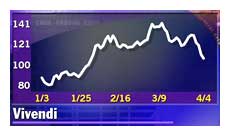

In Paris, media-defense conglomerate Lagardere (PMMR) lost 9.5 percent, data network operator Equant (PEQU) dropped 8.3 percent, and media-water company Vivendi (PEX) fell 4.8 percent. In Paris, media-defense conglomerate Lagardere (PMMR) lost 9.5 percent, data network operator Equant (PEQU) dropped 8.3 percent, and media-water company Vivendi (PEX) fell 4.8 percent.

In Germany, electronic components maker Epcos (FEPC) lost 5.3 percent and electronic components giant Siemens (FSIE) fell 2.5 percent after engineering workers across East Germany staged lightning strikes ahead of a bid by union leaders to negotiate a pay deal based on conditions agreed to for western counterparts.

Leading financial service stocks in London, Frankfurt and Paris rose. Among the banks, Lloyds TSB Group (LLOY) rose 8 percent, Barclays (BARC) gained 2.9 percent, Abbey National (ANL) leapt 3.2 percent, Royal Bank of Scotland (RBOS) rose 5.4 percent and Halifax (HFX) shot up 6.3 percent.

Insurance company Royal & Sun Alliance (RSA) jumped 2.8 percent after announcing a new online payment system that the company expects will lead to cost savings of about $32 million per year. French insurer Axa (PCS) climbed 7.5 percent.

In Frankfurt, HypoVereinsbank (FHVM) rose 5.8 percent, insurer Allianz (FALV) rose 5.3 percent, Deutsche Bank (FDBK) rose 3.6 percent and its merger partner Dresdner Bank (FDRB) tacked on 4.4 percent.

In Paris, Société Générale (PGLE) rose 4.1 percent, while Banque Nationale de Paris (PBNP) gained 6.2 percent.

British drug retailer Boots (BOOT) was the leading gainer in London, surging 13.7 percent after investment bank J.P. Morgan rated the stock a long-term buy. Others following the drugstore chain higher included diversified retailer Kingfisher (KGF), which rose 9 percent, and the U.K.'s second-largest supermarket chain, J. Sainsbury (SBRY), up 8.2 percent. British drug retailer Boots (BOOT) was the leading gainer in London, surging 13.7 percent after investment bank J.P. Morgan rated the stock a long-term buy. Others following the drugstore chain higher included diversified retailer Kingfisher (KGF), which rose 9 percent, and the U.K.'s second-largest supermarket chain, J. Sainsbury (SBRY), up 8.2 percent.

British American Tobacco (BATS) rose 3.7 percent amid optimism that the state of Florida will introduce legislation that could derail a class-action lawsuit against cigarette makers.

Other "old economy" stocks had their day in the sun. British brewer Bass (BASS) rose 6.9 percent, soft drinks maker Cadbury Schweppes (CBRY) gained 5.6 percent, and Anglo-Dutch consumer goods maker Unilever (ULVR) climbed 7.7 percent.

Outside London's benchmark index, Thomson Travel (TRV) jumped 28 percent after German airline Lufthansa (FLHA) and retailer Karstadt Quelle (KAR) teamed up to launch a £1.3 billion ($2.05 billion) takeover bid for Britain's largest travel business. Karstadt rose 1.4 percent, while Lufthansa shares were little changed.

In currency markets, the euro weakened against the dollar to $0.9540 from $0.9585 late Monday.

-- from staff and wire reports

|

|

|

|

|

|

|