|

Atecs chase revs up

|

|

April 5, 2000: 5:55 a.m. ET

Siemens, Bosch target Mannesmann auto-parts unit with $8.7B counter-bid

|

LONDON (CNNfn) - German industrial and electronics firms Siemens and Bosch on Wednesday launched a joint  9.1 billion ($8.74 billion) bid for Atecs, Mannesmann's auto-components and engineering business, topping an earlier offer from fellow German industrial firm ThyssenKrupp. 9.1 billion ($8.74 billion) bid for Atecs, Mannesmann's auto-components and engineering business, topping an earlier offer from fellow German industrial firm ThyssenKrupp.

The bid promises to fuel one of the largest contested takeover fights in German corporate history. The country's business climate was thrown into upheaval earlier this year by Vodafone's successful takeover of Mannesmann, the world's biggest ever corporate takeover.

ThyssenKrupp's  8.5 billion offer, launched on Mar. 31, threatened an existing agreement by Mannesmann to merge VDO, Atecs's auto-electronics arm, into a new 50:50 joint venture with Siemens. 8.5 billion offer, launched on Mar. 31, threatened an existing agreement by Mannesmann to merge VDO, Atecs's auto-electronics arm, into a new 50:50 joint venture with Siemens.

The latest bid came amid reports in German and U.K. newspapers that Klaus Esser, who is staying as chief executive at Mannesmann to oversee its takeover by Vodafone, was organizing a German consortium to support his plan to float Atecs rather than sell it to a rival company.

New bidders would drop flotation

Bosch and Siemens already have large auto and industrial components operations that would be complementary to the Atecs business. They said they had no plans to float the Mannesmann unit, which analysts had valued at between  8 billion and 8 billion and  11 billion. 11 billion.

The two companies said they would operate Atecs as a joint venture. Siemens would go ahead with its plan to merge Atecs's VDO division with its own comparable business, while privately owned Bosch would form a new unit with Atecs' Rexroth hydraulics unit. The companies said they were confident of securing regulatory approval for the takeover.

The five businesses that make up Atecs generated about 60 percent of Mannesmann's total sales last year. They include Rexroth, plastics and pipes maker Demag Kraus-Maffei, and the Sachs auto-parts unit. The five businesses that make up Atecs generated about 60 percent of Mannesmann's total sales last year. They include Rexroth, plastics and pipes maker Demag Kraus-Maffei, and the Sachs auto-parts unit.

Within Atecs, VDO accounted for 28 percent of sales in 1999. ThyssenKrupp said Monday that it was only interested in a purchase only if it could get the whole of Atecs, which had sales of  12.3 billion last year. 12.3 billion last year.

Mannesmann holds the key

Mannesmann has legal responsibility for deciding the future of Atecs. Esser is believed to favor an initial public offering over a sale to a rival company, because a buyer might make deep cuts in the unit's workforce of 90,000. Mannesmann's board was due to meet later Wednesday to review the unit's future.

Vodafone, which won control of Mannesmann in February after a bitter four-month battle, is believed to favor a trade sale of Atecs. Vodafone said last week it would consider the ThyssenKrupp offer after it has completed its acquisition of Mannesmann, which European antitrust officials are reviewing. Vodafone, which won control of Mannesmann in February after a bitter four-month battle, is believed to favor a trade sale of Atecs. Vodafone said last week it would consider the ThyssenKrupp offer after it has completed its acquisition of Mannesmann, which European antitrust officials are reviewing.

European regulators are expected to deliver a verdict on Vodafone-Mannesmann in mid-April. Vodafone said it would consider the offer for Atecs if it was still on the table after clearance is received, and would take account of other factors than just price.

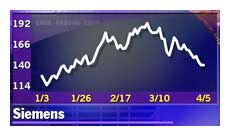

ThyssenKrupp (FTKA) shares slipped 2 percent to  26.35 after the Siemens-Bosch bid emerged. Siemens (FSIE) shares were 1.5 percent higher at 26.35 after the Siemens-Bosch bid emerged. Siemens (FSIE) shares were 1.5 percent higher at  137.55. 137.55.

-- from staff and wire reports

|

|

|

|

|

|

|