|

Icahn in Nabisco bid talks

|

|

April 10, 2000: 5:13 p.m. ET

Billionaire investor urges cookie and cracker company to find merger partner

|

NEW YORK (CNNfn) - Billionaire financier Carl Icahn signed a confidentiality agreement with Nabisco Group Holdings Monday, clearing the way for him to seek "strategic partners" to join his takeover bid for the nation's leading seller of cookies and crackers.

The signed agreement follows Nabisco's invitation last week to have Icahn join the company's internal review of possible strategies to lift its sagging stock price. Icahn, the company's largest individual shareholder, had previously offered to buy Nabisco outright in a friendly deal for $16 per share, or $5.2 billion, with the aim of finding a permanent buyer later.

The billionaire investor said he had hired the Industrial Bank of Japan to begin the due diligence process on Nabisco, but is now also free to seek out third party buyers for the company's sole holding -- a roughly 80 percent stake in Nabisco Holdings Corp. (NA: Research, Estimates), maker of Oreo cookies, Ritz crackers and Snackwells products.

Analysts said the agreement all but guarantees the company will seek out a merger partner in the next few months.

"I see Icahn's proposal as an attempt to rattle the cage and force the company to find a buyer," said Martin Feldman, a food analyst with Salomon Smith Barney. "He has effectively served as a conduit for a third-party buyer."

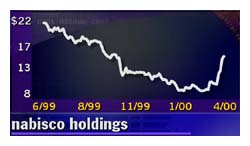

Shares of Nabisco (NGH: Research, Estimates) closed down 1/2 to 14-5/8 Monday.

Proxy battle avoided

The agreement prevents Icahn from initiating a proxy battle for control of the company's board, as he had previously threatened, for at least three months. He is also restricted from increasing his roughly 9 percent stake in the Parsippany, N.J.-based company.

In an interview with CNNfn.com last week, Icahn said if he remained unconvinced that Nabisco's board was actively pursuing a merger, he would almost certainly have launched a proxy battle to replace the company's 12-member board with his own nine-member slate at the company's annual meeting next month.

But Nabisco's board responded to his last buyout proposal with an offer to open the company books and work with the billionaire investor on finding a potential suitor, leading to Monday's agreement.

"We are pleased that Mr. Icahn has joined the process," said Henry Sandbach, a Nabisco spokesman. When asked if his company was now up for sale, Sandbach said "we've indicated that we are looking at the broadest range of alternatives, including selling the company."

Nabisco hired Wall Street investment banks Morgan Stanley Dean Witter and Warburg Dillon Read earlier this month to review its strategic alternatives after Icahn stepped up his public demands to sell the company. Nabisco hired Wall Street investment banks Morgan Stanley Dean Witter and Warburg Dillon Read earlier this month to review its strategic alternatives after Icahn stepped up his public demands to sell the company.

One of the food industry's strongest brand names, Nabisco Holding's shares have languished in recent months, hit hard by a deep sector slump and investor concerns about lingering legal liabilities related to tobacco lawsuits from its former association with RJR Nabisco.

Accordingly, analysts have mentioned Phillip Morris Co. (MO: Research, Estimates) as the most likely buyer for Nabisco, given its desire to beef up its food operations and the fact that it is already exposed to the tobacco litigation.

|

|

|

|

|

|

Nabisco

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|