|

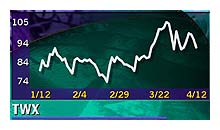

Time Warner 1Q tops Street

|

|

April 12, 2000: 5:33 p.m. ET

Media conglomerate cites strength in its cable and publishing subsidiaries

|

NEW YORK (CNNfn) - Time Warner Inc., the world's biggest media and entertainment company, posted on Wednesday first-quarter earnings that outpaced analysts' expectations, led by strength in its publishing and cable TV operations.

New York-based Time Warner, the parent company of CNNfn, said it earned 5 cents per share during the three-month period excluding one-time items -- an improvement over its breakeven results in the year-earlier quarter. Analysts polled by research firm First Call Corp. predicted the company to earn 2 cents per share. New York-based Time Warner, the parent company of CNNfn, said it earned 5 cents per share during the three-month period excluding one-time items -- an improvement over its breakeven results in the year-earlier quarter. Analysts polled by research firm First Call Corp. predicted the company to earn 2 cents per share.

"I'm very pleased with how we are starting off the year 2000," said Gerald Levin, Time Warner chairman and chief executive, in a conference call with analysts.

"We continue on our consistent path of delivering solid ongoing operating results, while at the same time we are executing on our plan of digitally transforming the company as it relates to the AOL transaction," he said, referring to Time Warner's January agreement to merge with America Online (AOL: Research, Estimates).

Despite the optimistic report, shares of Time Warner (TWX: Research, Estimates) closed down 5-3/4 to 90, after slipping 2-5/8 on Tuesday. Despite the optimistic report, shares of Time Warner (TWX: Research, Estimates) closed down 5-3/4 to 90, after slipping 2-5/8 on Tuesday.

Time Warner shares have closely tracked AOL shares, which also slumped Wednesday, down 3 5/8 to 61-7/8.

On a net basis, Time Warner posted a loss of $101 million, or 8 cents per share, compared with year-ago earnings of $120 million, or 10 cents per share.

The company's cash flow -- measured as earnings before the amortization of intangible assets -- increased 13 percent to $1.17 billion, when one-time items were excluded. Wall Street analysts track cash flow to measure the health of media companies.

Revenue for the quarter jumped 7.5 percent to $6.55 billion as the company recorded double-digit sales growth from its cable networks operation and improved results from its filmed entertainment unit, excluding one-time gains.

Cable, publishing lead growth

Cash flow at Time Warner's cable networks, which include TBS Superstation and HBO, was a record $364 million, up 18 percent from $309 million a year earlier. The Turner Cable Networks' 20 percent cash flow growth was led by strong gains in both subscription and advertising revenue, but partially offset by lower results at World Championship Wrestling.

At the end of the quarter, Time Warner Cable had some 613,000 digital video subscribers, a 40 percent growth spurt compared to year-end 1999. Time Warner Cable also added about 117,000 high-speed Internet customers during the quarter, up about 35 percent compared to year-end 1999, resulting in 447,000 total customers at the end of the quarter.

First-quarter cash flow for the Time Inc. publishing arm reached $117 million, up 14 percent from $103 million for the year-ago quarter. First-quarter cash flow for the Time Inc. publishing arm reached $117 million, up 14 percent from $103 million for the year-ago quarter.

Contributing to the results were double-digit advertising revenue gains, led by Fortune, In Style and Entertainment Weekly magazines.

Time Inc.'s results included a gain of about $30 million related to the partial sale of its stake in Martha Stewart Living Omnimedia (MSO: Research, Estimates).

The company's WB broadcast television network reduced its loss to $31 million in the quarter, from a loss of $41 million a year ago, supported by higher broadcast revenues.

Soft market bruises music segment

The company's music unit, Warner Music Group, posted first-quarter cash flow of $80 million, compared with $89 million in the first quarter of 1999. The results reflect a decline in domestic recorded music partially offset by DVD manufacturing profits, the company said.

The company stressed that it still expects positive results this year from its music business, and is banking on new CDs later this year from names such as Madonna, Brandy and Matchbox 20.

Time Warner president Richard Parsons noted that Warner Music is moving forward with plans to sell and deliver music over the Internet, likely starting in the third quarter.

Rivals Sony Music Entertainment (SNE: Research, Estimates) and Bertelsmann AG's BMG unit in recent weeks have also set plans to let customers by this summer download a limited number of songs.

But Parsons said that Time Warner's pending merger with AOL and EMI Group PLC's (EMI: Research, Estimates) music unit will automatically make the company dominant in the nascent electronic-music-distribution segment.

"Combining the Warner-EMI roster and relationships with AOL's subscriber base and ease-of-use know-how, we will be able to lead the industry in the way this business develops," Parsons said.

Speaking of its other segments, Time Warner said its WB television network reduced its losses by 24 percent in the quarter, to a loss of $31 million, boosted by strong broadcast revenues.

Close of AOL deal seen later in 2000

Levin told analysts that the both AOL and Time Warner are actively doing the footwork to integrate the two market-leading companies, and that he sees the deal passing federal regulator review by the latter half of this year.

"We are on track from every aspect," Levin said. "We don't see anything that should slow down our game plan to close (the merger) sometime in the fall."

"(Executives) are focused on developing the new company's strategic and operating game plan," Levin stressed. "We are using these months well before the close of the transaction, to put the right plans in place."

Levin told CNNfn's Moneyline that both AOL and Time Warner believe strongly in the validity of the new company. (218 WAV, 218 AIFF)

The company also expects the Warner-EMI deal to close by the end of the year.

Columbia House woes continue

The company reported a $220 million charge to write down an investment in Columbia House, its struggling music direct-marketing joint venture with Sony Corp. Time Warner is continuing to evaluate its alternatives for Columbia House, which could include online initiatives or joint ventures.

Last month, online music retailer CDNow Inc. (CDNW: Research, Estimates) terminated its proposed merger with Columbia House. Time Warner said it has concluded that the decline in Columbia House's business is going to continue through the near term.

(Click here for more earnings news)

|

|

|

|

|

|

Time Warner Inc.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|