|

Nuance breaks IPO jinx

|

|

April 13, 2000: 4:43 p.m. ET

Browser developer nearly doubles in debut, breaks week-long IPO slump

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Two Internet-related initial public offerings, including a long-awaited Chinese Internet portal, forged their way into the battered Nasdaq market Thursday and emerged unscathed, bucking the recent trend of disappointing IPO offerings.

Nuance Communications and Sina.com both recorded respectable first-day gains as investors renewed their on-again, off-again love affair technology issues -- at least for one day.

Their performance came even as three more companies called off their market debuts, citing the recent market volatility -- bringing the total number of IPO cancellations this week to five, while three others have lowered their expected pricing range.

It also comes amid a widespread IPO slump. Three of the seven companies that priced their initial offerings prior to Thursday finished their first day of trading in negative territory.

"It's a self-cleansing market right now," said David Menlow, president of IPOFinancial.com "It's going to continue. The stocks that are out there need valuation haircuts."

A 'Nuance' no more

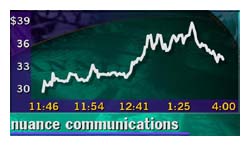

Nuance (NUAN: Research, Estimates), which develops and supports browser software that responds to vocal commands, priced 4.5 million shares at $17 per share, above its expected range, late Wednesday. Thursday, it built on that momentum, climbing as high as 38-3/4 before closing the day at 33-15/16, up nearly 100 percent.

Analysts said investors flocked to Nuance because the company operates with few true competitors, and has the backing of such heavyweights as Cisco Systems (CSCO: Research, Estimates), which holds an approximate a 9 percent stake in the company. Analysts said investors flocked to Nuance because the company operates with few true competitors, and has the backing of such heavyweights as Cisco Systems (CSCO: Research, Estimates), which holds an approximate a 9 percent stake in the company.

"We like the technology from day one, particularly with [underwriter] Goldman Sachs being at the helm here," Menlow said. "These days, there's got to be a eyebrow factor, something that makes investors raise their eyebrows and become interested."

Sina.com (SINA: Research, Estimates) is the latest in a growling line of Chinese Internet portals that are tapping Wall Street for additional capital. The company didn't see the first-day pop that others, such as China.com (CHINA: Research, Estimates), did, but analysts said the results were still admirable given recent market conditions.

Sina.com closed the day at 20-11/16, up 22 percent from its pricing level of $17 per share.

Sounding a retreat

The market's recent volatility continued to wreak havoc on other company's IPO plans, however.

Three other companies expected to debut on Wall Street this week have called off their offerings for the foreseeable future, while two postponed their scheduled IPOs for at least another week.

Drug developer Adolor Corp., Internet direct marketing provider FloNetwork Inc. and biotech drug researcher Rigel Pharmaceuticals all called off their planned offerings, citing market volatility.

The IPO market has been particularly unfriendly to the biotech industry recently, making the decision a bit easier on companies like Adolor and Rigel, which both had already postponed their offerings an additional week in hopes that conditions might improve.

Two others are holding out for brighter days ahead. Optical inspection system manufacturer Camtek, "CAMT," which already had postponed its offering until this week, decided to wait yet another week, according to its lead underwriter, CIBC World Markets.

Also postponing until next week was Qualstar Corp., "QBAK," a maker of automated tape library systems, which hoped to float 3.3 million shares at $10-to-$12 per share this week.

Isky Inc. and PEC Solutions Inc. both still intend to price this week, but will do so at lower terms.

Customer management service firm Isky, "ISKY," dropped its expected price range to $9-to-$10 per share from $11-to-$13, and will now offer 4 million shares to the public instead of 5 million. The decrease could cost the company approximately $22 million in start-up capital.

PEC Solutions, "PECS," which provides Internet solutions for government agencies, likewise lowered its expected range to $10-to-$12 per share, down from $12-to-$14. The company kept the size of its expected offering at 7 million shares.

|

|

|

|

|

|

CNNfn's IPO calendar

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|