|

Treasurys edge higher

|

|

April 14, 2000: 3:32 p.m. ET

Bonds rebound from earlier losses amid equity market plunge; dollar retreats

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury bonds ended slightly higher Friday, recovering from earlier losses as some investors moved money into fixed-income securities amid another sharp sell-off in U.S. equities.

In late trade, the three major stock indexes plummeted. The crosscurrents between weak stocks and strong data were able to balance each other out.

The latest economic data, which showed a surging economy, weighed on the Treasury market earlier in the day.

"The market is torn between the implications of the stock market fall and the economic news," said Tony Crescenzi, chief market strategist at Miller Tabak & Co. "The performance of stocks next week will determine who wins this tug of war."

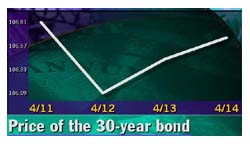

Shortly after 3 p.m. ET, the 30-year Treasury bond rose 2/32 of a point in price to 106-16/32. Its yield, which moves in the opposite direction to price, fell to 5.79 percent from 5.81 percent Thursday. Ten-year Treasury notes rose 10/32 to 104-16/32, their yield retreating to 5.88 percent from 5.94 percent Thursday.

Friday's market activity concluded another volatile week in which Treasury bonds strengthened early in the week, pulling yields to their lowest levels since early May. But prices then tumbled as investors snapped up non-government securities such as agency and corporate bonds.

And the slew of solid economic reports seen both Thursday and Friday  reinforced investors' fears of aggressive rate hikes in the near term. The consumer price index (CPI), which measures inflation at the retail level, rose 0.7 percent in March, and the core rate, which excludes volatile food and energy prices, rose 0.4 percent, the Labor Department said Friday. reinforced investors' fears of aggressive rate hikes in the near term. The consumer price index (CPI), which measures inflation at the retail level, rose 0.7 percent in March, and the core rate, which excludes volatile food and energy prices, rose 0.4 percent, the Labor Department said Friday.

The inflation report comes in the wake of Thursday's robust retail sales, which jumped 1.4 percent, excluding autos.

Despite an ailing stock market, analysts say the outlook for interest rates remains the same. The market still expects the Fed to hike rates by a quarter point when it meets May 16, and many expect an additional hike in June.

The central bank has increased short-term interest rates five times since June in order to slow the economy and keep inflation tame. But consumer demand continues to surge and the gradual tightening cycle has had no apparent effect.

With recent heavy selling in stocks, there was speculation the Fed would hold off hiking rates. Fed chief Alan Greenspan often refers to the so- called "wealth effect," in which rising share prices make consumers feel wealthier, prompting a surge in spending. But numerous speeches by Fed officials signaled the Fed would not consider the equity plunge in determining monetary policy.

Jim Bianco, president of Illinois-based Bianco Research, told CNNfn's market coverage the Treasury market may be reacting too strongly to movements in stocks. (280K WAV) (280K AIFF)

Remarks by Greenspan at midday had little market impact as he did not address monetary policy directly. Speaking to an economic conference in Washington, Greenspan warned of potential risks new financial instruments bring.

Other economic news released Friday pointed to a strong economy: February business inventories rose 0.5 percent and March industrial production rose 0.3 percent, both largely in line with expectations.

(Click here for a look at Briefing.com's economic calendar.)

Dollar drops

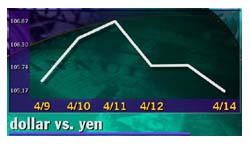

The dollar fell against the major currencies Friday, pressured by the sharp drop among stocks and the robust CPI report.

However, analysts said traders were cautious ahead of the weekend's Group of Seven (G-7) meeting in Washington, which limited volatility.

Shortly after 3 p.m. ET, the dollar traded at 104.84 yen, down from 105.80 yen Thursday, a 0.9 percent decline in the dollar's value. Meanwhile, the euro changed hands at 95.92 cents, up from 95.23 cents Thursday, a 0.7 percent loss in the dollar's value.

|

|

|

|

|

|

|