|

Delta, Southwest top marks

|

|

April 18, 2000: 11:35 a.m. ET

Revenue gains help carriers fly over steep fuel hikes during period

|

NEW YORK (CNNfn) - Delta Air Lines Inc. and Southwest Airlines Co. overcame increased fuel prices to top earnings forecasts, raising some hopes for performance of the sector in the quarter.

The two carriers are the first to report for what analysts expect to be a difficult period for the industry due to higher fuel costs.

Delta Air Lines, the nation's third-largest carrier, posted an unexpected increase in earnings per share in its fiscal third quarter Tuesday, although its profit from operations slipped. Meanwhile, discount carrier Southwest Airlines saw fuel costs more than double in its first quarter, but was able to maintain profits from operations by filling more of its available seats.

Atlanta-based Delta had income excluding non-recurring items of $179 million, or $1.33 a diluted share. Analysts surveyed by earnings tracker First Call forecast the carrier would earn $1.10 a share in the period. A year earlier, Delta earned $201 million, or $1.31 a share, excluding non-recurring items. The earnings per share rose despite the drop in overall profit due to a share repurchase program.

Jet fuel costs were sharply higher in the quarter, and Delta's fuel bill rose 37 percent to $434 million. But that likely was less of an increase than many carriers will report later this week and next because Delta has made greater use than many competitors of long-term fuel contracts to limit price increases. Jet fuel costs were sharply higher in the quarter, and Delta's fuel bill rose 37 percent to $434 million. But that likely was less of an increase than many carriers will report later this week and next because Delta has made greater use than many competitors of long-term fuel contracts to limit price increases.

The airline also was helped by a drop in commissions to $169 million from $191 million, as major carriers cut the amount they pay travel agents and shift more of their ticket sales to the Internet.

Delta had a $73 million pretax gain from the sale of 1.2 million shares of Priceline.com Inc. (PCLN: Research, Estimates). The airline still holds about 6 million shares of the stock and warrants to purchase another 5.5 million shares. It posted a gain in the year-earlier period from the sale of its holding in Equant, an industry-wide data network.

Including those gains and other special items, income totaled $220 million in the latest quarter, or $1.67 a diluted share, up from $214 million, or $1.42 a share, a year earlier.

Revenue rose to $4.0 billion from $3.5 billion. Delta followed other carriers in instituting fuel surcharges on most domestic tickets during the quarter.

For the first nine months of its fiscal year, Delta's income excluding special items came to $643 million, or $4.53 a diluted share, compared with $721 million, or $4.69 a share, a year earlier. Net income came to $918 million, or $6.59 a share, up from $729 million, or $5.06 a share, a year earlier. Revenue rose to $11.6 billion from $10.8 billion.

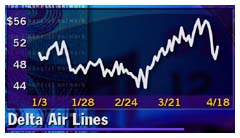

Shares of Delta were up 1-5/8 to 50-5/8 at midday Tuesday.

Fuller planes helps Southwest overcome fuel hike

Southwest earned $95.6 million, or 18 cents a diluted share, excluding a $14 million after-tax charge for a change in accounting practices. Analysts surveyed by First Call had forecast 16 cents a share. A year earlier, the carrier earned $95.8 million, or 18 cents a diluted share.

Including the accounting charge, income totaled $73.5 million, or 14 cents a diluted share, in the latest period.

Southwest (LUV: Research, Estimates) revenue climbed 15 percent to $1.24 billion from $1.08 billion a year earlier, even though the carrier did not institute as large a fuel surcharge as the other major carriers. Part of its gain came from increased load factor, which filled 66.8 percent of seats with paying passengers, up from 64.9 percent a year earlier.

Operating expenses per available seat mile, a measure of a carrier's efficiency, rose 5 percent in the quarter, although it would have decreased 5 percent excluding the increased cost of fuel.

Fuel expenses rose to $197.1 million from $85.7 million a year earlier, as the average cost per gallon climbed to 82 cents from 39 cents a year earlier. The airline will use long-term fuel contracts for the majority of its fuel needs for the remainder of the year.

Shares of Southwest gained 1/2 to 19-5/8 a midday Tuesday.

|

|

|

|

|

|

Delta Air Lines

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|