LONDON (CNNfn) - Europe's major stock markets all posted sharp falls Thursday amid fears of higher global interest rates. But a late rally limited the losses on the blue-chip indexes in Frankfurt and Paris to around 2.2 percent, while London ended off 1.2 percent.

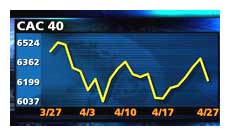

The CAC 40 in Paris, with its heavier weighting of media and telecom shares, fell 143 points to close at 6,247.86. The market had traded marginally lower through most of the session and fell as low as 6,184 after the U.S. data were released before recovering ground near the end of the day. Pay-TV operator Canal Plus shed 7 percent, breaking a five-session advance. The CAC 40 in Paris, with its heavier weighting of media and telecom shares, fell 143 points to close at 6,247.86. The market had traded marginally lower through most of the session and fell as low as 6,184 after the U.S. data were released before recovering ground near the end of the day. Pay-TV operator Canal Plus shed 7 percent, breaking a five-session advance.

The Xetra Dax in Frankfurt closed down 166 points, or.2.26 percent, at 7,221.74, again off its afternoon low of 7,156. Deutsche Telekom, the largest constituent, also suffered the worst decline as it closed down more than 6 percent.

London's FTSE 100 lost 77.2 points to close a volatile session at 6,179.30 after peaking in morning trade at 6,306. Techs and financial stocks suffered the brunt of the sell-off, with Internet service provider Freeserve losing 8 percent and mortgage bank Abbey National off 5 percent.

The FTSE Eurotop 300, a broader index of the largest European stocks, ended down 0.6 percent at 1,609.24.

European markets hit their lows ahead of the U.S. market open and regained ground amid volatile trade in New York. The Dow Jones industrial average was down 1 percent at the close of European trade while the Nasdaq composite was flat.

The market spill came after the U.S. government reported that employment costs rose 1.4 percent in the first quarter, the fastest rate in more than 10 years and one-half percentage point more than economists anticipated. That came as another report showed a disturbingly strong inflation trend. The 2.7 percent rise in the implicit price deflator element to U.S. gross domestic product was 0.3 percentage point ahead of forecast. GDP rose 5.4 percent in the quarter.

European markets had earlier displayed little adverse reaction to the decision by the European Central Bank (ECB) to hike short-term interest rates by one quarter of a percentage point to 3.75 percent. However, the rate rise also failed to spark the euro, which ended European trading around $0.91 having earlier fallen to a new low of $0.9089 after the ECB decision.

The late recovery in equities took the edge of the bond markets, with the benchmark 10-year German Bund contract falling back, pushing the yield up to 5.30 percent from 5.27 percent Wednesday.

London weakened by techs, financials

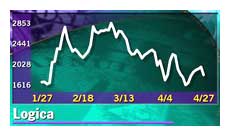

In London, technology and financial shares bore the brunt of the selling pressure despite the modest rise on the Nasdaq. Internet service provider Freeserve (FSE) led the declines with a loss of 9 percent. Logica (LOG), the computer-services firm, fell 6 percent, while chip designer ARM Holdings (ARM) dropped 8.4 percent.

Financial shares suffered on the gloomy interest-rate outlook, sending Lloyds TSB (LLOY), Britain's largest consumer bank, down 5.1 percent. Bank of Scotland (BSCOT), the biggest loser Wednesday after disappointing earnings, fell another 5.6 percent. Financial shares suffered on the gloomy interest-rate outlook, sending Lloyds TSB (LLOY), Britain's largest consumer bank, down 5.1 percent. Bank of Scotland (BSCOT), the biggest loser Wednesday after disappointing earnings, fell another 5.6 percent.

The telecom firms that had buoyed the market in morning trade also lost ground. Thus (THUS) fell 6.25 percent and Cable & Wireless (CW) closed down 4.2 percent. However, Vodafone AirTouch (VOD), the largest component on the FTSE 100, closed narrowly ahead having earlier fallen 2 percent.

With gainers outnumbered by declines three to one, British-based international bank Standard Chartered (STAN) was one of the few bright spots as it rose 3.6 percent after agreeing to buy the Grindlays unit of Australia and New Zealand Banking Group for $1.3 billion cash, raising its exposure to emerging markets. With gainers outnumbered by declines three to one, British-based international bank Standard Chartered (STAN) was one of the few bright spots as it rose 3.6 percent after agreeing to buy the Grindlays unit of Australia and New Zealand Banking Group for $1.3 billion cash, raising its exposure to emerging markets.

Psion (PON), a maker of handheld computers, led the market with a 7.8 percent rise, lifted by positive reaction to a tie-up with Sony.

Telecoms weigh on Frankfurt, Paris

Frankfurt was hurt by a 5.7 percent fall in Deutsche Telekom (FDTE), its largest component,. Software publisher SAP [FSAP3] lost 2.7 percent and Siemens (FSIE), the electronics and engineering firm, was down 2.8 percent having earlier been 1 percent ahead after reporting second-quarter earnings doubled.

Retailer Metro (FMEO) continued its recent decline with a 3.1 percent fall. DaimlerChrysler (FDCX) was off 2.7 percent and Lufthansa (FLHA) shed almost 3.5 percent. Retailer Metro (FMEO) continued its recent decline with a 3.1 percent fall. DaimlerChrysler (FDCX) was off 2.7 percent and Lufthansa (FLHA) shed almost 3.5 percent.

In Paris. France Telecom (PFTE) weighed on the CAC 40 with a 4.2 percent drop. Pay-TV operator Canal Plus (PAN) lost 7.3 percent and data network provider Equant (PEQU) fell 3.4 percent.

Among smaller markets, the AEX in Amsterdam lost 2.5 percent, the Mib-30 in Milan ended 0.76 percent lower, and the Ibex 35 in Madrid fell 1.7 percent.

Helsinki and Stockholm were the best performers. Helsinki gained after Nokia, the world's largest mobile-phone maker, posted a 55 percent rise in first-quarter earnings to beat expectations. However, the broader market falls took the shine off the earnings as its shares ended up 7 percent. Rival Ericsson gained 5.2 percent in Stockholm.

-- from staff and wire reports

|