|

Europe ends in tech fervor

|

|

May 2, 2000: 12:49 p.m. ET

Technology, media and telecom stocks stoke fire among European markets

|

LONDON (CNNfn) - Europe's major stock markets closed higher Tuesday with telecommunications, media and technology shares taking their cue from Monday's rally in U.S. technology stocks.

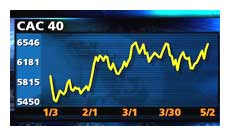

The CAC 40 in Paris was the region's best performer, rising 2.2 percent to 6,563.64, while Frankfurt's Xetra Dax climbed 1.9 percent to 7,555.88 and the SMI in Zurich gained 1.3 percent. The FTSE 100 in London inched higher, rising 46 points, or 0.7 percent, to 6,373.4.6.

In Madrid, the Ibex 35 rose 3.5 percent, spurred by a 2.3 percent advance by Telefónica after the Spanish telecom operator said Monday it was in alliance talks with Netherlands' Royal KPN, which could lead to a merger of the two companies. The Dutch firm rose 2.8 percent, following its gain of 8 percent Monday, when all European markets except Amsterdam were closed for a public holiday. In Madrid, the Ibex 35 rose 3.5 percent, spurred by a 2.3 percent advance by Telefónica after the Spanish telecom operator said Monday it was in alliance talks with Netherlands' Royal KPN, which could lead to a merger of the two companies. The Dutch firm rose 2.8 percent, following its gain of 8 percent Monday, when all European markets except Amsterdam were closed for a public holiday.

The FTSE Eurotop 300, a broader measure of the region's largest stocks, climbed 1.7 percent to 1,667.99, with the index's tech and media sectors each rising more than 5 percent.

European technology stocks got a lift from strong performances in U.S. markets Monday, spearheaded by a 2.5 percent gain on the Nasdaq composite.

But Tuesday morning, the Dow Jones industrial average fell prompted by a selloff of AT&T after the phone and cable service provider warned analysts it would have slower-than-expected sales growth and lower-than-expected profit for the rest of the year. The Dow slipped 52.74 points to 10,759.04, and the Nasdaq composite index shed 16.00 points to 3,942.08.

Euro weakens

In the currency markets, the euro weakened against the dollar, falling to $0.9068 from $0.9157 late trading in New York.

Equity strategists at Morgan Stanley told CNNfn that the euro's weakness had prompted them to raise their estimates for European company earnings by 20 percent. A weaker euro means exports of goods and services from the euro-currency zone become more competitive, while revenue that companies in the euro-zone generate from overseas is worth more in terms of their base currency.

In London, handheld-computer maker Psion (PON) led the index higher with a 15.9 percent surge, chip designer ARM Holdings (ARM) rose 9.9, while  Web security firm Baltimore Technologies (BLM) added 11.4 percent. Web security firm Baltimore Technologies (BLM) added 11.4 percent.

The U.K.'s biggest biotechnology company Celltech (CCH) rose 8.9 percent.

Internet service provider Freeserve (FRE) rose almost 10.7 percent following a media report suggesting that Deutsche Telekom (FDTE) might bid for the U.K.'s largest ISP. Deutsche Telekom shares rose 4.4 percent.

Among the FTSE 100's smaller telecom operators, Energis (EGS) gained 6.5 percent, while Colt Telecom [LSE:CTM ] climbed 7.5 percent.

Mobile phone giant Vodafone fell 2 percent after the Times of London said the company would have to pay around £20 billion ($31.2 billion) to buy next-generation mobile phone licenses across Europe, raising doubts about whether Europe's financial markets could cope with the telecom group's financing demands.

Media groups also benefited from renewed enthusiasm for "new economy" stocks, with financial-data-and-news company Reuters Group (RTR) rising 3.9 percent and satellite broadcaster British Sky Broadcasting (BSY) up 11 percent.

Outside the tech and media sectors, insurer Sun Life & Provincial (SLP) jumped 7.2 percent after its controlling shareholder, the French insurer Axa (PCS) moved to buy the 44.7 percent of the firm it does not already own.

On the FTSE 350, Associated British Ports (ABP) surged 19.5 percent after the U.K.'s biggest port operator said it received a takeover offer, but declined to name the party involved. News reports Monday said the bidder was Japan's Nomura Securities, which valued the port company at more than £1 billion ($1.6 billion). ABP said the bid undervalued the company.

In Paris

France Telecom (PFTE) gained 4.2 percent, while data network operator Equant (PEQ) added 4.9 percent and Bouygues (PEN), a telecom and construction company, rose 7 percent.

Europe biggest pay-TV company Canal Plus (PAN) led the index higher, rising 11.6 percent, with its controlling shareholder, water services and telecom company Vivendi (PEX), adding 6.6 percent. Media-to-missiles company Lagardère (PMMB) advanced 6.2 percent.

In Frankfurt

Automaker BMW (FBMW) was the leading gainer with a 4.7 percent gain after Britain's Phoenix consortium - which is negotiating to acquire loss-making carmaker Rover from the German company -- said on Tuesday that the initial talks had gone well. Alchemy Partners, the U.K. venture capital firm that said Friday it had dropped out of the bidding for BMW's Rover arm, said it was willing to restart talks. A BMW spokesman, though, said the company did not plan to revive negotiations with Alchemy.

Electronics and engineering firm Siemens (FSIE) rose 2.2 percent after it agreed Monday to acquire Shared Medical Systems, a maker of health care software, for about $2.1 billion in cash to increase its presence in the U.S. market. Software publisher SAP [FSE:FSAP3] gained 3 percent.

HypoVereinsbank (FHVM) rose 4.4 percent, leading gains among Frankfurt bank shares, after it posted buoyant first-quarter earnings.

--From staff and wire reports

|

|

|

|

|

|

|