|

Bonds ease on rate fears

|

|

May 2, 2000: 3:50 p.m. ET

More strong economic news fuels rate jitters; euro resumes decline vs. dollar

By Staff Writer Jill Bebar

|

NEW YORK (CNNfn) - Treasury securities ended mostly lower Tuesday as investors expressed concern the Federal Reserve will hike rates aggressively in the near term to cool the buoyant economy.

Longer maturities such as 30-year bonds were under pressure throughout the session, partly due to disappointment that the government did not announce its next buyback operation. Some speculated that the government would provide details about the next leg of its ongoing buyback program to retire some older, longer-term debt.

With more analysts now expecting a one-half percentage point rate hike, shorter maturities ended little changed, but also experienced pressure. These issues are more sensitive to changes in monetary policy.

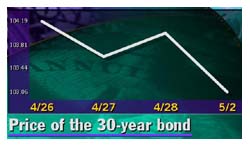

Shortly after 3 p.m. ET, the 30-year Treasury bond fell 16/32 of a point in price to 103-3/32. The yield, which moves in the opposite direction to price, rose to 6.02 percent - above the psychologically significant level of 6 percent - from 5.98 percent Monday. Shortly after 3 p.m. ET, the 30-year Treasury bond fell 16/32 of a point in price to 103-3/32. The yield, which moves in the opposite direction to price, rose to 6.02 percent - above the psychologically significant level of 6 percent - from 5.98 percent Monday.

The 10-year note dropped 8/32 to 101-11/32, its yield rising to 6.31 percent from 6.27 percent Monday.

The Treasury market has had to digest news that points to little signs of an  economic slowdown. Along with a booming economy, recent data suggests increased evidence that inflation is picking up. The latest economic reports were no exception. economic slowdown. Along with a booming economy, recent data suggests increased evidence that inflation is picking up. The latest economic reports were no exception.

New home sales jumped 4.5 percent to a rate of 966,000 units in March, according to the Commerce Department. The figure was the second strongest on record and far above the 900,000-unit pace forecasted by analysts.

"It was a very strong report," said Mike Ryan, senior fixed income strategist at PaineWebber. "It shows the rate hikes engineered by the Fed so far have had little or no impact so far in slowing the economy."

The central bank has hiked rates five times since June, each time by a quarter point. Analysts widely expect the Fed to hike rates again at its next monetary policy meeting on May 16.

Despite rate jitters, one analyst was confident about the Fed's ability to control inflation. Amaury deBarrasConti, senior trader of fixed income securities at U.S. Global Investors, told CNN's Before Hours he was bullish about both bonds and stocks in the months ahead. (291K WAV) (291K AIFF)

The market still faces numerous hurdles this week, including a speech from Fed Chairman Alan Greenspan, who is scheduled to address a banking group in Chicago Thursday.

Investors consider the Friday's April employment report the key event of the week, noting the market was vulnerable if the data were above consensus, revealing continued tightness in the labor market. Analysts surveyed by Briefing.com forecast non-farm payrolls to have increased by 325,000 workers compared with 416,000 in March.

Wednesday's Treasury quarterly refunding announcement and Thursday's productivity data for the first quarter should also garner investors' attention.

In other economic news, leading indicators, a gauge of the economy's direction six to nine months ahead of time, rose 0.1 percent to 106.1 in March, the Conference Board said Tuesday.

(Click here for a look at Briefing.com's economic calendar.)

Looking ahead, PaineWebber's Ryan expects longer maturities to fare well due to the buyback program. However, shorter maturities will remain vulnerable due to expectations of more rate hikes.

Euro falls to near-record lows

The euro resumed its decline against the dollar Tuesday, relinquishing gains from the previous session. The beleaguered single currency fell to an intraday low of 90.33 cents, just above its lifetime low of 90.30 cents set last Friday.

Analysts said the euro's slump was not news driven, but a continuation of the weakness seen last week. Market sentiment remained negative in its short-term outlook for the currency despite the release of bullish Euro-zone economic data.

With a slew of key U.S. economic reports slated for release later in the week, Bob Lynch, currency strategist at Paribas, noted it was difficult for traders to find reasons to sell the dollar. Shortly after 3 p.m. ET, the euro traded at 90.78 cents, down from 91.57 cents Monday, a 0.9 percent gain in the dollar's value.

Meanwhile, the dollar fell slightly against the yen. Analysts expect trading conditions to be subdued for the remainder of the week due to the Japanese market being closed in observance of the Golden Week holiday.

Alex Beuzelin, senior market analyst at Ruesch International, attributed the yen's recovery to growing disappointment with recent Japanese economic indicators, particularly those related to consumer demand.

The dollar changed hands at 108.52 yen compared with 108.71yen Monday.

|

|

|

|

|

|

|