|

Telecoms sink Europe

|

|

May 9, 2000: 1:09 p.m. ET

Late tumble accelerates as Nasdaq loses ground, Deutsche Telekom sinks 6.7%

|

LONDON (CNNfn) - Europe's stock markets tumbled Tuesday, dragged down as investors dumped shares in once-hot telecommunications and monitored new weakness for technology-related issues on the U.S. Nasdaq composite.

Leading the way lower was the media and telecom-heavy CAC 40 index in Paris, which shed 2.2 percent, or 144.81 points, to close at 6,369.61.

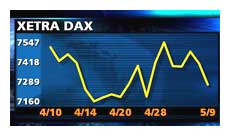

In Frankfurt, the electronically traded Xetra Dax dropped 127.55 points, or 1.7 percent, to 7,280.54 as Deutsche Telekom (FDTE) fell 6.7 percent and compounding its loss of 4.2 percent Monday.

London's benchmark FTSE 100 index shed 92.5 points, or 1.5 percent, to 6,123.8, despite gains for food and beverage companies. Key media issues were undercut there as well.

One bright spot was in Zurich, where the SMI index, with its relatively low exposure to the high-tech sector but larger weightings in financial-services and drug stocks, rose 74.1 points, or 1 percent, to close at 7,595.4.

The FTSE Eurotop 300, a broader index of Europe's largest stocks, shed 1.5 percent to 1,613.24. The telecom sub-index was by far its leading loser among sectors, slumping 5.2 percent.

Weakness in the Nasdaq struck Europe's markets, with the Nasdaq down 2.2 percent as the bourses closed. The blue-chip Dow Jones industrial average was little changed.

In the currency market Tuesday, the euro traded up slightly at $0.9063, compared with $0.8970 in late New York trade Monday. Underpinning the bounce was a report that showed Germany's jobless rate fell in April to its lowest since 1996.

Telecoms get their bells rung

On exchanges across Europe telecom shares came under pressure for a second straight day.

"Telecoms may have a bit lower to go," said Sharon Coombs, a European economist with HSBC in London, adding that concerns about the high cost of new mobile phone licenses and international deal-making have taken their toll. "Any negative news is likely to come out over the next few months."

Aside from European industry titan Deutsche Telekom, in Paris France Telecom (PFTE) shed 7 percent, the biggest loser on the CAC 40 index, with rival Bouygues (PEN) not far behind, losing 6.7 percent.

In London, British Telecommunications (BTA) fell 4.9 percent and regional telecom operator Kingston Communications (KCOM) shed 6.3 percent.

In Amsterdam, Royal KPN sank 6.9 percent even after Japan's NTT DoCoMo agreed to buy a 15 percent stake in the Dutch telecom company's mobile-phone unit for about $4.5 billion. Telecom Italia fell 4 percent.

But Spain's Telefónica, which had been in merger talks with KPN until last Friday, trickled down just 0.4 percent.

Elsewhere, U.K. mobile-phone operator Vodafone AirTouch (VOD) shed 5.9 percent. Telecom equipment maker Marconi (MNI) fell 4.7 percent in London and French rival Alcatel (PCGE) shed 4.5 percent. Dresdner Kleinwort Benson downgraded Alcatel to "hold" from "buy."

WPP droops in London

Leading London's losers was advertising firm WPP Group (WPP), off 10.9 percent on news that the company is close to agreeing the acquisition of U.S. rival Young & Rubicam for some $5.5 billion in stock.

Elsewhere in media, financial data and news company Reuters (RTR) fell 6.9 percent and pay-TV broadcaster BSkyB (BSY) fell 7.2 percent. But two publishers were among top gainers: Pearson (PSON) rose 3.5 percent and Reed (REED) added 3.8 percent.

Cable company Telewest Communications (TWT) shed 8 percent.

Among declining U.K. tech shares, Web security firm Baltimore Technologies (BLM) fell 4.8 percent even after reporting that first-quarter revenue doubled to $15 million while its pretax loss widened less than expected to $11.56 million from $11.09 million in 1999.

Strong in the hospitality sector were Granada Group (GAA), adding 5.6 percent, and France's Accor (PAC), rising 2.9 percent. Granada's Forte Hotel Group, Accor and U.K.-based Hilton International (HG-) unveiled an Internet joint venture to provide online booking for hotel rooms.

Britain's food and beverage sector fared well. Bass (BASS) rose 4.9 percent and Diageo (DGE) added 6.9 percent, making it the leading gainer in the FTSE index.

French, German techs also hit

Technology, media and telecommuncations companies made up the first half-dozen biggest percentage losers on the CAC-40 in Paris. The pay-TV company Canal Plus (PAN) shed 3.6 percent, Dutch network operator Equant (PEQU) fell 2.1 percent and chip maker STMicroelectronics (PSTM) fell 4.8 percent.

Also lower were two top retailers: Carrefour (PCA) fell 3.2 percent while Casino (PCO) shed 2.8 percent.

On the upside in Paris was defense company Aérospatiale-Matra (PARO), which rebounded from recent losses to gain 4.6 percent. Food company Danone (PBN) added 3 percent.

In Frankfurt, insurer Allianz fell 2.5 percent. Electronic components maker Epcos (FEPC) shed 3.6 percent and parent company, electronics and engineering firm Siemens (FSIE), shed 3.8 percent.

Leading the Dax higher was Volkswagen (FVOW), climbing 4.1 percent after reporting a 36 percent jump in first-quarter profit.

Shares of rival automaker BMW (FBMW) added 3.6 percent on their return after a trading halt, when the Munich-based company agreed to hand control of its money-losing Rover unit to Britain's Phoenix consortium, along with £500 million ($766 million) to help Phoenix restructure the carmaker.

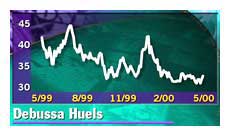

Leading German chemicals companies rallied. Degussa Huels (FDHA) was among the top Dax gainers, up 3.8 percent, after announcing a 38 percent jump in first-quarter operating profit amid strong global growth. Degussa said it expects full-year profit to rise from 1999. Leading German chemicals companies rallied. Degussa Huels (FDHA) was among the top Dax gainers, up 3.8 percent, after announcing a 38 percent jump in first-quarter operating profit amid strong global growth. Degussa said it expects full-year profit to rise from 1999.

Elsewhere in the sector, BASF (FBAS) rose 1.7 percent and rival Bayer (FBAY) rose 1.5 percent.

-- from staff and wire reports

|

|

|

|

|

|

|