NEW YORK (CNNfn) - Stocks fell sharply across Asia, as investors failed to resist Wall Street's pessimism ahead of the Federal Reserve meeting.

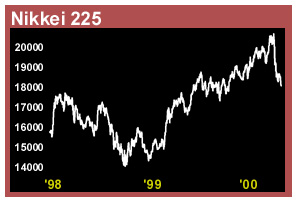

Japan's Nikkei 225 average dropped more than three percent by midday Thursday, rattled by another steep fall on Nasdaq.

Australian shares followed other regional stocks into negative territory. The S&P-ASX 200 index opened about 1.5 percent lower.

Taiwan stocks also opened in the red, influenced by chip giant Intel's announcement of a major recall. Liu Jaw-Chyun of National Capital Management said, "Intel's move to replace computer circuit boards will be likely to slow Taiwan computer maker's sales and profits in the second quarter."

Two minutes into the trading, the benchmark Weighted index was down 179.05 points, or 2.09 percent, at 8,380.82. Two minutes into the trading, the benchmark Weighted index was down 179.05 points, or 2.09 percent, at 8,380.82.

Singapore's key Straits Times index traded to an early low of 2,011.58 points, down more than two percent, weighed down mostly by a weak technology sector. The 55-component benchmark index was down 44.28 points, or 2.15 percent, at 2,012.94.

The Hong Kong and South Korean markets are closed for national holidays.

Tokyo stocks sharply lower at mid-session

Tokyo stocks took a tumble on Thursday morning as steep falls in U.S. shares prompted investors to play safe and sell ahead of a rate-setting U.S. Federal Reserve meeting next week, traders said.

Large-cap high-tech shares, often popular among foreign investors, were under heavy pressure amid concerns that foreigners could accelerate selling, they said.

Foreigners turned net sellers of Japanese stocks in April for the first time since September 1998.

"It's more investor worries over possible selling by foreigners rather than actual selling by foreign investors that has scared domestic traders into selling," said Shinji Fujinaga, deputy general manager of the equities section at Kankaku Securities. "It's more investor worries over possible selling by foreigners rather than actual selling by foreign investors that has scared domestic traders into selling," said Shinji Fujinaga, deputy general manager of the equities section at Kankaku Securities.

By midday, the benchmark Nikkei 225 average was down 633.84 points or 3.58 percent at 17,067.63. It briefly marked a low of 17,054.43 -- a level not seen since September 28, 1999.

The widely watched, capital-weighted TOPIX index of all first-section shares lost 51.39 points or 3.10 percent to 1,608.47.

Volume on the Tokyo Stock Exchange's first section was active, with 286.27 million shares traded, up from 241.17 million in the morning session on Wednesday.

Some traders said foreign selling is believed to be in part responsible for the increased volume in the morning.

"Foreign selling seems to be behind sharp losses in some stocks like Matsushita. It's no secret they want to lock in profits in Japanese shares after being severely hurt in steep falls in U.S. shares," said Masayoshi Okamoto, a trader at Jujiya Securities.

Matsushita Electric Industrial Co., the world's largest maker of consumer electronics, dropped 9.26 percent to 2,695 yen.

The sharp loss came after it said on Wednesday it would post a group operating profit of 190 billion yen for the current business year to next March, up from an actual profit of 159.05 billion yen for the past year but below analysts' expectations.

Other major high-tech stocks were all lower, with industry leader Sony Corp. down 2.88 percent at 11,470 yen, and Toshiba Corp. declining 4.07 percent to 1,036 yen.

In the currency market, the dollar gained value against the Japanese yen at the start of the Tokyo business day Thursday.

The 9 a.m. local time quote on the Tokyo Foreign Exchange has the U.S. dollar at 109.42 yen, up 0.06 yen from the end of the previous business day in Tokyo.

News Corp. fell 4% in Australia

Australian equity market opened sharply lower on Thursday as a wave of anxiety on Wall Street about interest rates and technology stock valuations swamped the domestic market.

The S&P-ASX 200 index dropped 44.9 points or about 1.5 percent to 2,999.4. The old All Ordinaries Index fell 43 points to 2,999.4.

Media heavyweight News Corp. fell over four percent to A$20.00 (US$11.60) but Morgan Stockbroking's Tony Russell said that had more to do with Wall Street's performance than News' third quarter results.

U.S. stocks slid for the third day running on Wednesday as the re-evaluation of technology stocks continued and interest rate angst hit banks and brokers ahead of next week's U.S. Federal Reserve policy meeting. U.S. stocks slid for the third day running on Wednesday as the re-evaluation of technology stocks continued and interest rate angst hit banks and brokers ahead of next week's U.S. Federal Reserve policy meeting.

After Wall Street had closed and News Corp.'s share price had already fallen three percent, News reported a third quarter net profit before special charges of A$300 million, compared with A$263 million a year ago, in line with estimates.

The company said also it was fairly optimistic about results in the current fourth quarter.

"I think this morning's share price fall is all to do with Wall Street because the profit result was fairly well telegraphed and in line with expectations," said Morgan's Russell.

Among other so-called convergence stocks, Australia's second largest telecommunications stock Cable & Wireless Optus dived 33 cents or almost seven percent to A$4.42, Kerry Packer's Publishing & Broadcasting lost 20 cents to A$11.30, and software group Solution 6 plunged over 12 percent to A$3.00.

Solution announced on Thursday its merger with U.S-based Elite Information Group had been terminated because of regulatory opposition.

Turnover on the wider market was A$119 million.

Declining stocks outpaced advances by a ratio of five to one, while about 27 percent of stocks traded remained steady.

- compiled by staff writer Joseph Lee

|