|

Dell's 1Q surprises Street

|

|

May 11, 2000: 9:55 p.m. ET

Increase in sales of higher-margin products, lower component costs cited

|

NEW YORK (CNNfn) - Dell Computer on Thursday turned in a fiscal first-quarter profit that was slightly ahead of Wall Street's expectations, which executives attributed largely to an improved product mix and lower than expected component costs.

The Round Rock, Tex.-based company, the world's second largest personal computer maker, said its net income was $525 million, or 19 cents per share, during the period ended April 28.

|

| VIDEO |

Dell Computer reported a 31-percent increase in revenues and higher first-quarter earnings that topped Wall Street estimates. CNNfn's Bruce Francis has more on the story.

Dell Computer reported a 31-percent increase in revenues and higher first-quarter earnings that topped Wall Street estimates. CNNfn's Bruce Francis has more on the story.

|

| Real |

28K |

80K |

| Windows Media |

28K |

80K |

|

That's up 21 percent from $434 million, or 16 cents per share, during the same period last year, and better than the 16 cent-per-share profit analysts polled by earnings tracker First Call had expected.

Revenue rose to $7.3 billion, up 31 percent from $5.5 billion during last year's fiscal first-quarter.

The most recent quarter's results included 2 cents per share from gains on outside investments, which most analysts had figured in to their forecasts. In a conference call Thursday evening, Dell executives told analysts to expect to see an increasing amount of the company's earnings coming from gains on investments in the current quarter.

Even so, industry observers were impressed by Dell's performance.

"It was about as good a quarter as you're going to get," said Robertson Stephens analyst Dan Niles. "They cleanly beat the numbers by about three cents."

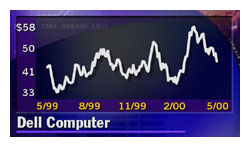

Dell (DELL: Research, Estimates) shares edged down 1/4 to 44-11/16 in Nasdaq trade ahead of the earnings announcement. Shares moved higher after the release of results, gaining 3 to 47-11/16 by 8:30 p.m. in after-hours trade.

Click here to see which stocks are moving in after-hours activity

Dell executives pointed out that sales of their higher-margin products continued to increase during the quarter. Revenue from servers, storage products, workstations and notebook PCs rose to 48 percent of total system sales, up from 39 percent. Dell executives pointed out that sales of their higher-margin products continued to increase during the quarter. Revenue from servers, storage products, workstations and notebook PCs rose to 48 percent of total system sales, up from 39 percent.

Sales of storage products rose more than 100 percent. The company accounted for 40 percent of global industry growth in servers, and said it gained more than three points of worldwide market share and five full share points in the U.S.

Sales of workstations were up more than 80 percent, contributing to a 52-percent increase in overall sales of enterprise-class computer systems, the company said.

In notebook PCs, total revenue from the company's Inspiron and Latitude portable computers soared 67 percent, and shipment growth was twice the industry average, the company said.

"The fundamental competitive advantages of our customer-focused direct business model are widening," said Michael S. Dell, the company's chairman and chief executive "That's particularly true in the server and storage products at the heart of the Internet infrastructure." "The fundamental competitive advantages of our customer-focused direct business model are widening," said Michael S. Dell, the company's chairman and chief executive "That's particularly true in the server and storage products at the heart of the Internet infrastructure."

The company also said it has expanded revenue and profitability beyond its base computer systems. Worldwide services sales topped $500 million for the first time during the quarter, an increase of more than 50 percent.

The most recent quarter's growth rate for Dell is in line with the lower rate executives said Wall Street should expect when they reported fiscal fourth-quarter results in February. They said the company's revenue should grow at roughly 30 percent for the remainder of this fiscal year, down from its historical growth rate of about 50 percent.

Dell, the leading PC maker in the United States and slightly larger than No. 2 Compaq (CPQ: Research, Estimates), said its sales were particularly strong in the U.S., rising 35 percent from last year. Sales also were strong in Asia, coming in 47 percent higher.

The company's European business, however, continued to be sluggish, growing at only 17 percent. But Dell Vice Chairman Kevin Rollins said that the company's sales to Europe, which has been a trouble spot for most PC makers in recent quarters, will gain parity with its broader business by the end of the year.

"We see it performing by the end of the year at where it can, and should -- at or above the corporate average," he said. "We believe it could be a net adder."

Product mix begins to pay off

Dell executives recently laid out a plan under which they said they will focus more on higher margin products such as servers, portable computers and storage systems in an effort to boost profitability.

Desktops now represent 52 percent of the company's total computer system sales, down from 61 percent a year ago, according to James Schneider, who took over as Dell's chief financial officer in March.

"We saw considerable progress in driving our product mix to the high end," Schneider said. "We saw considerable progress in driving our product mix to the high end," Schneider said.

Dell's Gross margin as a percentage of revenue during the quarter was 21.5 percent, which was up from 19.5 percent during the previous quarter but down slightly from 21.5 percent in the year-ago period.

Barry Jaruzelski, an analyst with Booz Allen & Hamilton in New York, said diversification was a key to Dell's strong showing.

"The Dell machine rolls on," Jaruzelski said. "The business is not just common desktop PCs anymore, which is the brutal part of the market. The mix is good."

Moving ahead, Schneider said demand for Dell's products continues to track at the level the company had expected, and that it expects to meet the growth targets it set in February. For the current quarter, he said sales should grow about 8 percent sequentially.

"Our revenue goals and expectations over the balance of the year remain unchanged," he said.

During the fourth quarter, Dell was stung by a shortage of certain microprocessors from chip giant Intel, its chief supplier of those components. That resulted in lower than-expected-shipments and reduced profit margins.

Because Dell is a direct seller operating on a build-to-order model, it is more vulnerable to spot component shortages than companies that build computers ahead of time and distribute them through resellers.

Schneider told analysts that the company anticipates an adequate supply of components during the current quarter. "We should be able to manage our requirements adequately, based on everything we know at this point," he said.

|

|

|

|

|

|

|