|

Retailer profits disappoint

|

|

May 11, 2000: 12:36 p.m. ET

Kmart profit drops, Gap misses earlier forecast; Lands' End below estimates

|

NEW YORK (CNNfn) - Weak April sales led Kmart Corp. and Gap Inc. to report fiscal first-quarter earnings Thursday in line with the warnings they issued to investors last week, but below earlier forecasts.

And catalog retailer Lands' End surprised Wall Street by falling far short of its first-quarter expectations.

The reports came as the U.S. Commerce Department reported a 0.2 percent drop in overall retail sales in April, the first decline in two years. Dana Telsey, a retailing analyst with Bear Stearns, said the drop in overall sales could prompt the Federal Reserve Board to impose a lower interest rate hike than previously anticipated when its policy makers meet next week.

Kmart profit shrivels

Kmart, the nation's third-largest retailer, saw its profit cut by more than half -- although it said it believes it can be back on track by the end of the year.

The Troy, Mich.-based retailer earned $22 million, or 5 cents a diluted share, for the quarter ended April 26, down from $56 million, or 11 cents a share, a year earlier. Before the May 4 warning from the discount store chain, analysts surveyed by First Call had expected the company to earn 10 cents a share.

For the first time, Kmart's results included the impact of its majority ownership of BlueLight.com, its online retail arm, which had an after-tax operating loss of $11 million, or about 2 cents a share.

Revenue edged up 1.4 percent to $8.2 billion. Sales at stores open at least a year, a closely watched measure known as same-store sales, were flat in the quarter.

The company said it saw strength in some products during the quarter, notably seasonal merchandise, outdoor living, home electronics, home decor, jewelry, prescription drugs, cosmetics and fragrances. The company said it saw strength in some products during the quarter, notably seasonal merchandise, outdoor living, home electronics, home decor, jewelry, prescription drugs, cosmetics and fragrances.

"We are taking steps to regain our sales momentum and remain confident that we can meet or exceed the company's financial plans for the year," Chairman and CEO Floyd Hall said.

Analysts have lowered their Kmart estimates for the first three quarters of the fiscal year, although they have raised the estimates for the fourth quarter, which includes the holiday season. The forecasts of analysts surveyed by earnings tracker First Call now stand at 27 cents a share for the second quarter, down a penny from the previous estimate, 9 cents a share in the third quarter and 81 cents a share in the fourth quarter.

Shares of Kmart (KM: Research, Estimates) slipped 1/8 to 7-1/2 in Thursday midday trading.

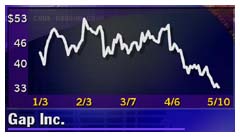

Weak Easter hurts Gap

Gap Inc., the nation's largest apparel retailer, posted record profit in the quarter, but just fell short of earlier forecasts due to a weak Easter season.

The San Francisco-based company posted net income of $235.5 million in the quarter, or 27 cents a diluted share. First Call had forecast the company would earn 28 cents a share before the company's May 4 warning that earnings would fall 1 to 2 cents below consensus estimates for the period. The San Francisco-based company posted net income of $235.5 million in the quarter, or 27 cents a diluted share. First Call had forecast the company would earn 28 cents a share before the company's May 4 warning that earnings would fall 1 to 2 cents below consensus estimates for the period.

The company earned $202.4 million, or 22 cents a diluted share, in the year earlier period.

Revenue rose nearly 20 percent to $2.7 billion from $2.3 billion a year earlier. Same-store sales fell 2 percent.

Shares of Gap (GPS: Research, Estimates) rose 1-1/4 to 34-3/8 at midday Thursday.

Lands' End 1Q disappoints

Catalog retailer Lands' End reported fiscal first-quarter earnings that fell far short of Wall Street's expectations Thursday, mainly because of weaker sales in its kids' division and in Japan, as well as some late catalog mailings.

For the quarter ended April 28, the Dodgeville, Wis.-based company reported net income of $292,000, or 1 cent a share, compared with net income of $8.5 million, or 21 cents a share in the year-earlier quarter.

The year-earlier quarter results included a one-time charge of 3 cents a share.

Lands' End results came nowhere near the analysts' consensus estimate of 16 cents a share, according to earnings tracker First Call/Thomson Financial.

The retailer also reported first-quarter revenue of $266 million, an 8.1 percent decrease from the $290 million it posted in the same period a year earlier.

Officials attributed the revenue shortfall to the discontinuation of its Willis & Geiger business, which contributed about $11 million in liquidation sales in the year-ago quarter. The company also blamed lower sales on the planned late mailings of the May primary catalog and a women's tailored catalog, which officials expect shifted about $11 million in sales into the second quarter.

Looking forward, Lands' End said it plans a 6 percent increase in page circulation in its catalogs, mostly during the fourth quarter, which includes the year-end holiday season. Looking forward, Lands' End said it plans a 6 percent increase in page circulation in its catalogs, mostly during the fourth quarter, which includes the year-end holiday season.

Shares of Lands End (LE: Research, Estimates) gained 1/2 to 34-3/4 at midday Thursday.

|

|

|

|

|

|

|