|

ECB leaves rates at 3.75%

|

|

May 11, 2000: 10:53 a.m. ET

Central bank opts for no change; signals price inflation will be tackled

|

LONDON (CNNfn) - The European Central Bank left its key interest rate unchanged at its latest biweekly meeting on Thursday, and vowed to tackle inflationary pressures brought on by a weak euro.

The ECB left its short-term interest rate at 3.75 percent, after raising the benchmark by a quarter percentage point on Apr. 27

ECB President Wim Duisenberg reiterated that the weakening euro did not reflect economic fundamentals although it added to the region's inflationary pressures, but said the central bank was determined to keep prices stable.

"The depreciation of the exchange rate of the euro will increase the risks to price stability," Duisenberg said at a news conference. "In the medium term these risks have to be taken seriously, and we are taking them seriously in light of the current exchange rate."

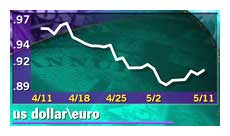

Economists had mostly anticipated the decision to hold rates, although the euro had fallen 2 percent against the dollar in the days after the last interest-rate hike, before recovering in recent sessions from its record low below $0.89 set last week. The euro has lost ground against all other major currencies.

After the ECB's decision the euro traded at $0.9080, little changed from its value immediately prior to the announcement.

The currency has dropped in value by around a fifth against the dollar since it was created in January 1999, and politicians have demanded action to halt the fall. The currency has dropped in value by around a fifth against the dollar since it was created in January 1999, and politicians have demanded action to halt the fall.

ECB officials, in tandem with euro-zone governments, last week tried and failed to talk up the single currency. Economists expected further attempts to be made to convince traders of the fundamental strength of the 11-nation euro-zone economy.

Duisenberg declined to be drawn into a discussion about possible ECB intervention to shore up the currency, and denied the central bank had carried out "covert intervention" in the markets last week.

"Only two weeks after the last move it would have portrayed considerable nervousness if they had moved rates again," said Thomas Mayer, a senior economist at Goldman Sachs in Frankfurt.

"I don't think the ECB should go out of its way to boost the currency either verbally or through action," Mayer added. "Their mandate is very clear, and that is to maintain price stability. To the extent that price stability is in danger they have already acted. There is no point in deviating from that strategy."

The single currency has regained some ground in recent days on expectations that the bank might intervene directly in the currency markets.

While the ECB has maintained that the euro's exchange rate is not its concern, intervention to bolster the currency could be justified on the grounds that a falling currency tends to fuel inflation.

--from staff and wire reports

|

|

|

|

|

|

European Central Bank

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|