|

Key telecoms lift Europe

|

|

May 11, 2000: 1:16 p.m. ET

Wall Street revives bourses and top telecoms bounce; ECB holds rates steady

|

LONDON (CNNfn) - Europe's major markets closed higher Thursday, prodded by U.S. retail sales data that sparked a rally on Wall Street and bargain hunting for recently weakened telecommunication sector companies.

London's FTSE 100 index led the way, up 145.3 points, or 2.4 percent, to 6,245.9, led by news and data provider Reuters (RTR), which rose 8.4 percent. But top British technology players continued to lag.

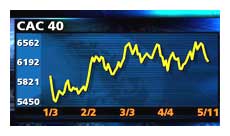

Key indexes in France and Germany also climbed in a see-saw session. TheXetra Dax in Frankfurt gained 2 percent, up 138.62 points to 7,259.48, while the blue-chip CAC 40 in Paris rose 116.79 points, or 1.9 percent, to 6,388.49. Zurich's SMI climbed 1.6 percent to 7,706.9.

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, gained 1.7 percent to 1,610.34. Tobacco and gas stocks were top gainers, while its recently battered telecommunications sector sub-index rose 3.4 percent. Forestry products companies led the losers.

Largely reviving the mood on the bourses was a gain for U.S. shares. The Nasdaq composite index was up 3 percent as European trading ended, in the wake of report that showed U.S. retail sales fell in April for the first time in almost two years. That caused a flurry of speculation U.S. interest rates may not have to rise as much as recently thought to cool the economy. The Dow Jones Industrial Average rose 160 points, or 1.5 percent.

The Nasdaq has suffered three straight losing sessions amid rate fears.

"The American numbers showed the people who had been getting nervous about interest rates may now think we may be overdone," George Hodgson, an equity market expert at ABN Amro in London, told CNNfn.com.

ECB stands pat on rates

In the currency market, the euro fell to $0.9021 from $0.9090 late Wednesday in New York. The euro was unmoved after the European Central Bank, as expected, left interest rates unchanged at 3.75 percent. An interest rate hike would tend to support the euro.

Earlier Thursday, a report showed Germany's annual consumer price inflation fell to 1.5 percent in April from 1.9 percent in March, helped by a drop in oil prices. Fighting inflation is among the top duties of ECB officials, and higher interest rates are a tool they may use to combat price rises.

Telecoms lead the way

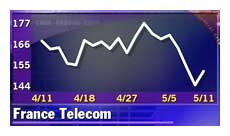

Leading European telecom sector firms that were pounded in recent days rallied. Dax heavyweight Deutsche Telekom (FDTE) rose 7.2 percent - leading the index's gainers - while key rival France Telecom (PFTE) jumped 4.8 percent, the second-best performance Thursday on the CAC-40.

Britain's mobile phone heavyweight Vodafone AirTouch (VOD), which accounts for about 13 percent of the FTSE, rose 6.2 percent.

However, key smaller-fry telecom companies in London fell: business telecom operator Colt Telecom (CTM) fell 10.4 percent, leading the FTSE losers, after announcing a wider pre-tax and operating loss in the first quarter compared to a year ago.

Also losing ground: Scottish telephone firm Thus (THUS) fell 3.5 percent and telecom Kingston Communications (KCOM) shed 2.8 percent.

Key FTSE technology stocks fell. Software firm Misys (MSY) dropped 6 percent, information technology services firm Logica (LOG) shed 4.6 percent, and computer consultant CMG (CMG) shed 6.5 percent.

Paris a mixed tech, media bag

In Paris, it was a mixed bag for tech and media issues. Data network operator Equant (PEQU) dropped 2.1 percent and TF1 (TFI), France's No. 1 broadcaster, lost 2.4 percent, the top percentage loser on the CAC 40.

On the upside, Microchip maker STMicroelectronics (FSTM) climbed 4.1 percent and information technology consultant Cap Gemini (PCAP) rose 6.6 percent, leading the list of CAC 40 gainers.

French auto makers sputtered. Renault (PRNO) fell 2 percent and Peugeot (PUG) fell 1.5 percent.

Key German techs revive

In Frankfurt, electronic components maker Epcos (FEPC) jumped 2.7 percent, engineering and industrial gas company Linde (FLIN) rose 2.8 percent, and business software firm SAP [FSE:FSAP3] gained 2.3 percent.

Automaker BMW (FBMW) rose 2.5 percent after earlier falling as much as 3 percent, Rival DaimlerChrysler [FSE:FDCX1] fell 2.4 percent despite denying speculation it is poised to issue profit warning. Truck maker MAN (FMAN) added 2.4 percent.

Sportswear maker Adidas Salomon (FADS) was among the Dax's biggest losers, sliding 4 percent.

-- from staff and wire reports

|

|

|

|

|

|

|