|

Lycos deal seen imminent

|

|

May 15, 2000: 6:43 p.m. ET

Lycos, Spain's Terra could reach $10 billion deal Tuesday, reports say

|

NEW YORK (CNNfn) - Spain's Terra Networks SA could reach an agreement as early as Tuesday afternoon to acquire the U.S.-based Web portal Lycos Inc. for stock valued at more than $10 billion, sources familiar with the situation told Reuters.

Terra Networks (TRRA: Research, Estimates) is an Internet access provider that is majority-owned by Telefonica SA, the parent company of the largest telecommunications group in Spain and Latin America. Terra has offered to swap more than 1.5 shares of its stock for each share of Lycos (LCOS: Research, Estimates), sources told Reuters.

|

|

VIDEO

|

|

CNN's Finnoula Sweeney reports on the possible merger between Terra and Lycos.

CNN's Finnoula Sweeney reports on the possible merger between Terra and Lycos.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

"They are making progress. They are in serious discussions that could still fall apart, but they are more likely than not to get there," one source, who declined to be named, told Reuters.

An announcement could be made after the close of the U.S. stock markets on Tuesday, sources said.

Several details are still being sorted out, including the potential role of Germany's Bertlesmann AG, Europe's largest media company. Bertlesmann, which now has a joint venture with Lycos, is interested in taking an equity stake in a combined Lycos-Terra, but the financial structure of such a move is complicated, sources told Reuters.

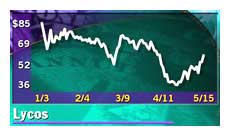

Lycos shares soared 7-1/2 to 61-5/8 on Monday in response to published reports of the acquisition talks. Lycos reached a 52-week high of 93-5/8 last December. At Monday's closing price, Lycos has a market capitalization of about $6.8 billion, less than one-tenth the market value of the larger Internet portal Yahoo! Inc.

Terra's American depository receipts declined 2-1/2 to 56-7/8 on Monday, giving the Spanish company a market capitalization of about $15.7 billion, the second-largest among European Internet companies.

Terra confirmed Friday that the two sides were in talks, after reports of the talks surfaced in the Spanish newspaper Expansión. Lycos spokesman Brian Payea on Monday declined to comment on the possibility of a merger.

Analysts said the primary benefit for Terra, which gets most of its revenue from providing Internet service, would be to add content. The Lycos network of Web sites provides aggregated third party content, Web search and directory services, personal Web site publishing, and online shopping. The company derives most of its revenue from advertising on its sites.

While Terra's market capitalization is more than double that of Lycos, Terra has incurred steep losses, and its revenue is much smaller. Terra's aggressive spending to expand its audience caused it to record a pro forma net loss of 173.7 million euros (about $159.6 million at current exchange rates) last year, compared with a 117.1 million-euro ($108.2 million) deficit in 1998.

Terra's revenue climbed 50 percent to 78.5 million euros ($72.2 million) last year. The company derives about 60 percent of its revenue from Internet access fees it charges its two million subscribers in Spain, Brazil, Mexico, Chile, Peru, Guatemala, and the United States, with the rest of its revenue coming from advertising on its portals, e-commerce and corporate Internet services. However, Terra's revenue stream is threatened by a major shift towards free Internet access in Europe and Latin America.

Lycos, by contrast, reported a profit of $3 million, or 3 cents per share, on revenue of $68.6 million in the quarter ended January 31, 2000. Securities analysts expect the company's revenue to total more than $260 million this fiscal year, with net income rising to an estimated $15 million.

"It makes great strategic sense for one of the largest Spanish speaking Web portals to merge with one of largest English speaking sites to create a global giant that could better compete with the likes of America Online and Yahoo!," said Frederick Moran, an analyst at Jeffries & Co. "Terra could triple its revenue while only doubling its market cap and globalizing itself."

"A bid in the low 90s would be the minimum for Lycos because Lycos brings so much more to the table than Terra does," Moran said. "A bid in the low 90s would be the minimum for Lycos because Lycos brings so much more to the table than Terra does," Moran said.

Last year, Lycos management agreed to merge with Barry Diller's USA Networks in a complicated deal that shareholders eventually rebuffed - not least because key shareholder CMGI (CMGI: Research, Estimates) publicly denounced the offer and withdrew from the Lycos board of directors. CMGI owned about 17 percent of Lycos as of October 1999.

When that deal was aborted, Lycos returned to the top of the list of independent Internet properties poised for a takeover. Many competing Internet portals or access providers are either owned by large companies or have market values that are too high to make an acquisition economical.

"The Internet leaders are retaining premium valuations and are often too big to get taken over," Jeffries' Moran said. "Many smaller Internet players could remain pressured, but well-established second tier players such as Lycos, EarthLink and PSI Net are undervalued, representing attractive takeover plays."

-- Reuters contributed to this report

|

|

|

|

|

|

Terra Networks

Lycos

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|