|

Stock picks by the pros

|

|

May 15, 2000: 5:19 p.m. ET

Cisco, Quest, Nabisco, Symantec, Yankee Candle, and Kellogg win mention

|

NEW YORK (CNNfn) - Monday trading was light ahead of Tuesday's Federal Reserve meeting and the central bank's expected interest rate hike.

Analysts and portfolio managers took a close look at what another rate hike could mean for the long-term investor, with some suggesting the time is ripe, in light of the market's volatility, to build a more diverse portfolio.

Here are some comments on the stocks that recent guests on CNNfn are buying, and why.

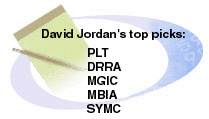

"Interest rates have been on the rise for a year and a half now," said David Jordan, portfolio manager, First Omaha Growth Fund. "We're closer to the peak than we were earlier in the year. So I think that those ('old economy') stocks could do well. Some of the manufacturing stocks could do well, because the economy has been so good, but the industry has been out-of-favor and the stocks sell at very reasonable valuations. "Interest rates have been on the rise for a year and a half now," said David Jordan, portfolio manager, First Omaha Growth Fund. "We're closer to the peak than we were earlier in the year. So I think that those ('old economy') stocks could do well. Some of the manufacturing stocks could do well, because the economy has been so good, but the industry has been out-of-favor and the stocks sell at very reasonable valuations.

Within the sector he likes Plantronics (PLT: Research, Estimates) and Dura Automotive (DRRA: Research, Estimates).

"DRRA make headsets for telephones," he said. "They've been doing it for a long time, but they're also making headsets for other purposes now: wireless headsets, headsets for wireless phones, headsets for games. As an example, Microsoft (MSFT: Research, Estimates) has selected their headset for their new game." DRRA also make auto parts for the "big three" auto makers. "It's a company that's been growing rapidly through acquisition, but also by having higher content in new cars. The stock sells at a very low price, five times earnings, even though earnings have been advancing in the 25-to-30 percent range," Jordan said.

Other picks in the financial and software sectors include: MGIC (MTG: Research, Estimates), MBIA (MBI: Research, Estimates), and Symantec (SYMC: Research, Estimates).

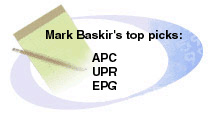

"There are four main areas in energy and I'm bullish on all of them because oil and gas fundamentals are so strong," said Mark Baskir, portfolio manager, Strong Investments. "The oil service exploration companies, the big oils and natural gas pipelines." "There are four main areas in energy and I'm bullish on all of them because oil and gas fundamentals are so strong," said Mark Baskir, portfolio manager, Strong Investments. "The oil service exploration companies, the big oils and natural gas pipelines."

"One of my favorite stocks is Anadarko Petroleum (APC: Research, Estimates)," he said. They explore for and produce oil and gas. They're merging with a company called Union Pacific Resources (UPR: Research, Estimates). Anadarko has been an excellent growth company, but never had enough money to develop all of the projects they've had. Union Pacific Resources is rich in cash and short of profits. Also, El Paso Energy (EPG: Research, Estimates)."

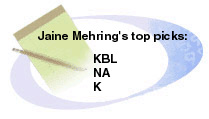

"Food stocks are viewed as 'classically defensive,' meaning that the earnings hold up well across a dip in the economy, across a recession," said Jaine Mehring, food analyst, Salomon Smith Barney. "Food stocks are viewed as 'classically defensive,' meaning that the earnings hold up well across a dip in the economy, across a recession," said Jaine Mehring, food analyst, Salomon Smith Barney.

Her picks include Keebler (KBL: Research, Estimates), Nabisco (NA: Research, Estimates), and Kellogg (K: Research, Estimates).

"Keebler, like Nabisco, is totally focused on that U.S. snacking business," Mehring said. "It's number two in cookies and crackers, behind Nabisco. It's been a real turnaround story. The margins are not quite where Nabisco's are yet, but they're going to get there over time. Really superior execution in the retail environment. KBL's our top pick for 2000. NA was my 'top pick' for 1999. The stock really didn't work in the end of last year. It's now starting to."

"I've just upgraded this stock (Keebler) a couple of months ago," Mehring said. "It's completely out of favor. I think I'm the only person recommending it right now. The problem there for people is that the U.S. ready-to-eat cereal category, which I'm probably a little more bullish on than some, gets about 110 percent of people's attention. It's really only 37 percent of the top-line. Keebler has a great international distribution: Latin America, Asia Pacific and a global brand equity."

There are a lot of big blue chip stocks that are selling at very reasonable valuations," said Timothy Ghriskey, senior equity portfolio manager, Dreyfus Corp. "IBM (IBM: Research, Estimates) is an inexpensive technology stock, something people should look at. Nabisco (NGH: Research, Estimates), which is being basically bid around by various companies and will be sold, most likely, at a much higher price, we think is a great investment." There are a lot of big blue chip stocks that are selling at very reasonable valuations," said Timothy Ghriskey, senior equity portfolio manager, Dreyfus Corp. "IBM (IBM: Research, Estimates) is an inexpensive technology stock, something people should look at. Nabisco (NGH: Research, Estimates), which is being basically bid around by various companies and will be sold, most likely, at a much higher price, we think is a great investment."

In terms of Nabisco Group Holdings' two options: "We actually like both available stocks," he said. "We think the pure food group, Nabisco (NA: Research, Estimates), is actually the less risky way to play it because they have said they will be sold. Nabisco Holdings is a little bit of a dicier way to play it, but probably a bigger upside if everything falls into place as we think it will."

"If the Fed makes a statement that says we have to administer the bad medicine here, 50 basis points, which is what everyone's expecting, and they make somewhat of a conciliatory statement saying that perhaps the interest rate increases have begun to slow things down, I think that could be bullish," said Donald Selkin, chief investment strategist at Joseph Gunnar and Co. "If the Fed makes a statement that says we have to administer the bad medicine here, 50 basis points, which is what everyone's expecting, and they make somewhat of a conciliatory statement saying that perhaps the interest rate increases have begun to slow things down, I think that could be bullish," said Donald Selkin, chief investment strategist at Joseph Gunnar and Co.

"I think the best we could hope for now is the market kind of fits in and starts to try to build a good base here, go up a little, pull back," Selkin said. "And then hopefully as we get closer to the end of the second quarter, the earnings prospects, if they are better, should provide us a base to perhaps do a little better later in the year."

Selkin said it's an opportune time for investors to be putting money into the market.

"I think it is a good time because one can take stocks that have pull backed significantly. I think Cisco Systems (CSCO: Research, Estimates) is the best example of that, down 23-to-25 points from its high, and it still represents I believe, good value here. So, one should be selective, try to take stocks that have good earnings prospects going forward. And on weakness, because of the uncertainty over the Fed, try to put your toe in the water with them so to speak. "

"I would recommend for instance Quest Diagnostics (DGX: Research, Estimates), it is a company that has more than doubled in price this year. It seems to be immune to the market turmoil. Rare Hospitality (RARE: Research, Estimates) is another stock that has seemed oblivious to the market turmoil. The reason that their restaurant sales per unit have gone up is because there has been a lack of new restaurant openings over the past couple of years, believe it or not. Also, Silicon Storage (SSTI: Research, Estimates), they're involved in the flash memory devices, these compact flash cards that you use in a digital camera. This is a stock that has a tremendous earnings growth going forward."

"The opinion also on Wall Street is that more rate hikes are likely to follow this. And if that occurs, there's still uncertainty in the overall market and consequently it will be tough to get a big rally off the low," said Peter Green, market analyst, Gerard Klauer Mattison & Co. "The market has certainly become tired. The psychology is that of a bear market. We get strong openings only to close either at the low of the day or near the low of the day. Witness what we saw on Friday. So on balance, yes, that psychology has changed." "The opinion also on Wall Street is that more rate hikes are likely to follow this. And if that occurs, there's still uncertainty in the overall market and consequently it will be tough to get a big rally off the low," said Peter Green, market analyst, Gerard Klauer Mattison & Co. "The market has certainly become tired. The psychology is that of a bear market. We get strong openings only to close either at the low of the day or near the low of the day. Witness what we saw on Friday. So on balance, yes, that psychology has changed."

"I think the major regional banks look attractive at this particular time. Some of the money center banks also look okay. The utilities still look constructive. Some of the semiconductor stocks, long term, look very bullish. UST (UST: Research, Estimates) is a manufacturer of smokeless tobacco. The stock has been building base for seven weeks or so. My opinion is that technically it looks attractive. I think we'll get some upward movement here in the next several weeks," Green said.

"Crown Cork & Seal Co. (CCK: Research, Estimates), a manufacturer of fasteners, particularly in the soda can industry, has a nice technical base that we like to see in stocks. And we think again the stock can get to about $22, perhaps $23 a share," said Green. "Sallie Mae (SLM: Research, Estimates) put in a selling climax last week. It made a new 52-week high and closed higher in the preceding week. That's a sign of accumulation. It looks quite attractive to me. Money flow is also very good. Chase Manhattan (CMB: Research, Estimates) has been lagging the larger money center banks. Probably because there is feeling that they are going to acquire someone. It looks quite bullish from an intermediate-term perspective."

"The volatility is the friend of the long-term investor in that the moves we've seen in the market have created tremendous buying opportunities for companies that have outstanding fundamentals," said Michael Moe, growth stock strategist, Merrill Lynch. "Inflation is nowhere to be found and the earnings growth in technology is really the driver of the new economy. It really creates a very healthy environment and very fertile ground to find companies growing very quickly." "The volatility is the friend of the long-term investor in that the moves we've seen in the market have created tremendous buying opportunities for companies that have outstanding fundamentals," said Michael Moe, growth stock strategist, Merrill Lynch. "Inflation is nowhere to be found and the earnings growth in technology is really the driver of the new economy. It really creates a very healthy environment and very fertile ground to find companies growing very quickly."

"Most of these companies are growing independent of the overall growth of the economy. So the economy slowing down actually would make the relative growth look that much more attractive," Moe said.

"TMP Wordwide (TMPW: Research, Estimates) is the owner of Monster Board. Monster Board is the latest Internet job board with over two million job seekers. Human capital is absolutely crucial for corporations to grow. Seventy percent of the Fortune 1000 says that finding and attracting workers is one of the key issues for growth. TMP and Monster Board is the leader there. Saba Software (SABA: Research, Estimates) really benefits from is the huge growth in e-learning. e-learning is expected to go from 1.1 billion in revenue this year to 11.4 billion in 2003. What Saba does is it creates the infrastructure for global corporations to run e-learning across. The company is a leader with key clients such as Cisco, Lucent, GE, etc."

"Yankee Candle (YCC: Research, Estimates) reminds us of Starbucks Coffee six, seven years ago in that they are creating a brand in an unbranded industry. They benefit from very favorable demographics. They have 30 percent operating margin. The company is growing very quickly, have a fanatical following with their customers and outstanding management team. Finally, Scientific Learning (SCIL: Research, Estimates). They have a proprietary patented product with kids that have difficulty reading, dyslexia, ADD. It's a remarkable product, huge potential," Moe said.

-- compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

|