|

Bank merger law; fruitless?

|

|

May 19, 2000: 2:36 p.m. ET

After repeal of Glass-Steagall Act many are waiting - and waiting - for mergers

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - It had such a bold, sweeping ring to it -- President Clinton overturning Depression-era banking laws.

With a stroke of a pen, banks, brokers and insurance firms can now enter each others' businesses; promising a wave of mergers across the land and a revolution in the way consumers buy financial services.

But it hasn't happened.

In the six months since the partial repeal of the Glass-Steagall Act of 1933, only a handful of small-scale merger activity has occurred -- none of it involving insurance firms.

Analysts now credit the Internet with the changes in how people buy mutual funds, mortgages and car insurance, and not the new law, the Gramm-Leach-Bliley Act, which was signed last November to amend Glass-Steagall.

"It hasn't been the big bang event that some people thought it would be," said Kevin Timmons, senior banking analyst at First Albany.

No one calls the new law a failure. And many say it's too soon to measure any impact. Still, the banking landscape of today looks pretty much like it did before Gramm-Leach-Bliley's passage.

Glass-Steagall was enacted after the Great Depression to insulate banks from collapse, similar to other financial reforms pushed through during the 1930s. But over the years, Wall Street came to view the restrictions on combining banks with other businesses as burdensome and unnecessary.

And now that it has been partially overturned, analysts are awaiting results.

"No one has got this thing completely figured out yet," said Todd Davenport, editor of the bank and thrift group at SNL Securities.

There are several reasons for the head scratching.

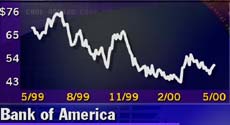

Financial stocks performed poorly in the past year, giving banks less muscle to make acquisitions that are allowed under the new law. J.P. Morgan (JPM: Research, Estimates), Bank of America (BAC: Research, Estimates), and Wells Fargo (WFC: Research, Estimates) all lost value in the last 52 weeks.

"For banks, in particular, their currencies are so depressed now that they can't make the acquisitions they had contemplated," Davenport said.

Insurers such as Allstate (ALL: Research, Estimates); Unumprovident (UNM: Research, Estimates); and Chubb Corp. (CB: Research, Estimates) posted mixed performances. Only brokers saw solid gains. Shares of Lehman Brothers (LEH: Research, Estimates) and Merrill Lynch (MER: Research, Estimates) surged in the last year. But Charles Schwab (SCH: Research, Estimates), the nation's biggest discount broker, fell 18 percent in the last 52 weeks. Insurers such as Allstate (ALL: Research, Estimates); Unumprovident (UNM: Research, Estimates); and Chubb Corp. (CB: Research, Estimates) posted mixed performances. Only brokers saw solid gains. Shares of Lehman Brothers (LEH: Research, Estimates) and Merrill Lynch (MER: Research, Estimates) surged in the last year. But Charles Schwab (SCH: Research, Estimates), the nation's biggest discount broker, fell 18 percent in the last 52 weeks.

1998: Year of the bank merger

At the same time, some of the top mergers in the financial services industry were announced before the new legislation, as executives anticipated its passing. Meanwhile, the Federal Reserve had already loosened restrictions in the Bank Holding Company Act of 1956, permitting an array of marriages.

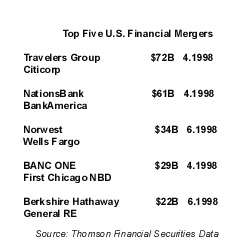

In 1998, Wells Fargo bought Norwest for $34 billion. That deal came two months after BankAmerica Corp. merged with NationsBank Corp. in a $60 billion hookup.

In the same month, Travelers Group Inc. and Citicorp merged in a deal worth $70 billion to form Citigroup Inc. (C: Research, Estimates), the world's No. 1 financial services company. In the same month, Travelers Group Inc. and Citicorp merged in a deal worth $70 billion to form Citigroup Inc. (C: Research, Estimates), the world's No. 1 financial services company.

All those deals were approved.

At the same time, many brokers were bought before financial stocks began falling in late 1998. Citigroup got Salomon Smith Barney, Deutsche Bank snapped up B.T. Alex Brown and BankBoston secured Robertson Stephens.

Schwab, U.S. Trust a standout

Still, one hybrid merger did materialize since November: Charles Schwab in January agreed to acquire U.S. Trust, combining the king of bargain brokers with one of the nation's leading wealth management firms.

But conspicuously absent are the insurers. On reflection, some analysts say banks may be reluctant to enter the slow-growth business of underwriting. And then there's the complex regulation; individual states govern the insurance business.

"I don't know that [banks and insurers] really have many synergies," said Tom McCandless, banking analyst at CIBC World Markets. Still, McCandless predicts more financial consolidation ahead.

Meanwhile, many banks through partnerships have opted to simply sell insurance but not underwrite it.

A spokeswoman for Sen. Phil Gramm, R-Texas, one of the bill's sponsors, said six months is too small a window to evaluate the new law. Gramm's office said a lot of the regulatory changes haven't taken effect.

The law's advocates, meanwhile, point to the other features, which include a series of privacy provisions to protect customers' confidentiality and a strengthening of fair lending laws to those with low incomes.

Services explode

The physical landscape of banking may look the same since Gramm-Leach-Bliley. But the business is unmistakably altered. Many credit the Internet.

Most banks offer online accounts and sell mutual funds. Americans increasingly are applying for mortgages online. Brokers such as Salomon Smith Barney offer the kind of financial advice that once came only from accountants. Mutual fund companies such as Vanguard are quick to dispense tax-saving tips.

"Banks are now recognized as providers of financial services," said Andrew Collins, of ING Barings.

They've also treated the Internet like a land grab. CheckFree Holdings Corp. in April acquired Bank of America's electronic billing and payment assets in exchange for CheckFree (CKFR: Research, Estimates) shares. The deal gave the bank a stake in CheckFree, an electronic financial services and software provider. Fannie Mae has online partnerships with e-Loan (EELN: Research, Estimates) and mortgage.com (MDCM: Research, Estimates). They've also treated the Internet like a land grab. CheckFree Holdings Corp. in April acquired Bank of America's electronic billing and payment assets in exchange for CheckFree (CKFR: Research, Estimates) shares. The deal gave the bank a stake in CheckFree, an electronic financial services and software provider. Fannie Mae has online partnerships with e-Loan (EELN: Research, Estimates) and mortgage.com (MDCM: Research, Estimates).

Microsoft has a mortgage and home-buying Web site that claims faster approval and cost savings for consumers shopping for a home online.

HSBC Holdings and Merrill Lynch in April each committed $500 million to fund a new online banking unit. E*Trade Group Inc. in March agreed to acquire the largest independent network of automated teller machines in the United States.

"More and more people are going after the consumer," said Chip Dickson, banking analyst at Salomon Smith Barney.

More of them, yes. But analysts are also waiting, in a sense, for fewer of them.

"There's no doubt in my mind that all the big financial companies are looking at each other [as merger partners]," First Albany's Timmons said. "You've got to give it a couple of years."

After all, the Glass-Steagall Act of 1933 wasn't changed overnight.

|

|

|

|

|

|

|