|

Paid by an angel

|

|

May 20, 2000: 8:30 a.m. ET

Small companies get billions in capital every year from private investors

|

NEW YORK (CNNfn) - If your company is too young, too risky, or too offbeat to qualify for traditional bank financing, you might want to look for an angel. An angel is a private investor, often a successful entrepreneur, who invests in small businesses close to home.

Angels prefer to invest in companies they are familiar with. They usually seek out small and growing companies in their own industry. Although the figures vary widely, angels are believed to provide billions of dollars in capital to entrepreneurs every year. Angels prefer to invest in companies they are familiar with. They usually seek out small and growing companies in their own industry. Although the figures vary widely, angels are believed to provide billions of dollars in capital to entrepreneurs every year.

How do you find an angel for your business, besides praying for help? Here are some tips:

1. Prepare a well-researched, detailed business plan that emphasizes why you need additional financing and exactly what you plan to do with the new money.

2. Write an executive summary for the plan that spells out in one page why someone should invest money in your business. Explain, too, how you plan to repay the money and when.

3. Join a professional association or trade group for your industry. Begin attending meetings on a regular basis. This is the best way to get acquainted with successful business owners in your field.

4. Discreetly inquire about the people who appear to be the most successful members of the group. You might ask the executive who runs the professional group whether or not those people invest in small businesses.

5. Once you find a prospect, send a letter requesting a short meeting to discuss your proposal. A letter is better than a phone call. If the answer is "no," it's less awkward to find out via the mail, rather than on the telephone.

6. If you are fortunate enough to schedule a meeting, bring along copies of your business plan and executive summary.

7. Practice your presentation before the meeting. You want to be as confident and relaxed as possible.

What to do when you find an angel

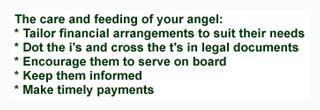

Angels may prefer to make straight loans at rates comparable to banks or at a slightly higher rate. Others may want to be repaid in stock if your company eventually goes public. Be sure to tailor the financial arrangements to fit your angel's needs.

If possible, encourage your angel to become a member of your informal advisory board. Many angels like to keep a close eye on their money; plus, they can offer you invaluable advice. If your angel is well connected in the local business community, he or she may help you find additional investors, introduce you to a banker or an attorney, or bring in new customers. An angel may also help you gain membership in a club or professional society that will benefit your business. If possible, encourage your angel to become a member of your informal advisory board. Many angels like to keep a close eye on their money; plus, they can offer you invaluable advice. If your angel is well connected in the local business community, he or she may help you find additional investors, introduce you to a banker or an attorney, or bring in new customers. An angel may also help you gain membership in a club or professional society that will benefit your business.

Remember, every relationship is different. The key to success is doing everything you can to increase your angel's comfort level so the person's investment and relationship with you and your business will be longstanding and profitable.

If your angel happens to be a friend or relative, be sure you treat him or her the same way you would treat a stranger.

Draft the appropriate legal documents and make your payments in full and on time.

Be sure to give your angel frequent status reports. If business falls off or problems arise, keep your angel informed. You don't want your angel to hear any bad news via the grapevine.

To learn more about angel investors, read Finding Your Wings, by Gerald Benjamin and Joel Margulis (John Wiley and Sons; $34.95).

(Excerpted from 201 Great Ideas for Your Small Business, Copyright 1998 by Jane Applegate. Published by arrangement with Bloomberg Press. Excerpts appear on Saturdays on CNNfn.com.)

|

|

|

|

|

|

ApplegateWay

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|