|

Stock picks by the pros

|

|

June 12, 2000: 6:01 p.m. ET

Chevron, Exxon, Aetna, Nokia, Ericsson, CenturyTel, among others, make the list

|

NEW YORK (CNNfn) - Oil stocks, telecoms, health care and Internet stocks were among the standouts with market analysts and portfolio managers Monday.

While the stock markets plummeted, recent guests on CNNfn commented on the stocks they are buying, and why.

"I think, you know, you're going to have these crosscurrents in place here for the next few months where investors will be reacting to slower spending, but also the likelihood that interest rate hikes are going to be behind us," said David Presson, associate director of equity research for Banc of America Capital Management. "But because we think the economy is slowing, we think a better place to put your money going forward are in some of the sectors where growth rates will hold up somewhat better." "I think, you know, you're going to have these crosscurrents in place here for the next few months where investors will be reacting to slower spending, but also the likelihood that interest rate hikes are going to be behind us," said David Presson, associate director of equity research for Banc of America Capital Management. "But because we think the economy is slowing, we think a better place to put your money going forward are in some of the sectors where growth rates will hold up somewhat better."

He said he likes energy, technology, healthcare and retail.

"If you want the most leveraged to higher energy prices, then you want to buy the drillers like Schlumberger (SLB: Research, Estimates) and Ensco (ESV: Research, Estimates). They have the most upside potential if we have a period of higher sustained energy prices. If you want to be less risky and still have a play in the sector, we suggest some of the large integrated oil companies, like ExxonMobil (XOM: Research, Estimates), Conoco (COCB: Research, Estimates) or Texaco (TX: Research, Estimates).

In tech: "We think you know you need to buy those companies who are providing the backbone or the infrastructure of the Internet, including Cisco Systems (CSCO: Research, Estimates), Oracle (ORCL: Research, Estimates) and EMC (EMC: Research, Estimates). We also like companies that are working to build out the pipes that help the information flow. It would be companies like CIENA (CIEN: Research, Estimates) and Nortel (NT: Research, Estimates)."

On the pharmaceutical side, he said he likes Guidant (GDT: Research, Estimates) and the pending merger between Warner-Lambert (WLA: Research, Estimates) and Pfizer (PFE: Research, Estimates).

In retail, he said he likes, "Home improvement, like Home Depot (HD: Research, Estimates) and Loews (LTR: Research, Estimates), consumer electronic chains like Best Buy (BBY: Research, Estimates), Circuit City (CC: Research, Estimates) and RadioShack (RSH: Research, Estimates) and discount stores who we think should weather this economic slowdown fairly well, like Wal-Mart (WMT: Research, Estimates), Target (TGT: Research, Estimates) and Dollar General (DG: Research, Estimates)."

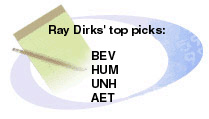

Ray Dirks, senior analyst for Dirks & Co. thinks a summer rally is inevitable. "I just think it's a normal thing, number one, but even more important, it's election year. And during most of the presidential years, we've had very strong markets from June 1 on through the end of the year." Ray Dirks, senior analyst for Dirks & Co. thinks a summer rally is inevitable. "I just think it's a normal thing, number one, but even more important, it's election year. And during most of the presidential years, we've had very strong markets from June 1 on through the end of the year."

In addition, "I just think we have had a strong rally here from the lows of about a month ago and those lows were pretty devastating. We had a pretty severe correction here of almost 2,000 points on the Nasdaq. So it popped up 600 points, which is more than just a rally - that's a very good rally. So here we are about 3,800 up from 3,150 or so. And I think it's natural to have back and fill at this point. So that sets stage for the rally when the summer starts."

He also said he likes nursing home company Beverly Enterprises (BEV: Research, Estimates). "It was the original great nursing home company. And the chart there shows a very severe decline over the last year from about $8 down to about $3. And I think at this level or below 3, Beverly is just a terrific buy."

His second pick is managed care stock Humana (HUM: Research, Estimates). Like BEV, "both are health care service stocks more from the attitude of the U.S. government about three years ago, [which] was let's clamp down on Medicare spending and that sort of thing. Then all of sudden we found ourselves with a balanced budget and a surplus and it was not so important any more. So now the trend is to improve the treatment of Medicare people."

His final picks: United HealthCare (UNH: Research, Estimates) and Aetna (AET: Research, Estimates). "Those are big stocks. And they led the parade up on the health care stocks. And I think they have done well. United Health is a leader and Aetna is a company that may be split in two and the health care may be sold off to Wellpoint or someone else. But I think this is why I think right now those stocks have done very well."

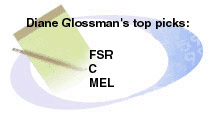

"You have to consider concerns about the economy and interest rates," said Diane Glossman, banking analyst, Warburg Dillon Read. "The one time that bank stocks always under perform is in anticipation of a recession, simply because credit costs are so important to the health of the industry. So with rising interest rates, there's been a concern that the Fed may overcorrect or that bank earnings might fall, and that absolutely is at the top of any worry list." "You have to consider concerns about the economy and interest rates," said Diane Glossman, banking analyst, Warburg Dillon Read. "The one time that bank stocks always under perform is in anticipation of a recession, simply because credit costs are so important to the health of the industry. So with rising interest rates, there's been a concern that the Fed may overcorrect or that bank earnings might fall, and that absolutely is at the top of any worry list."

She said she likes Firstar (FSR: Research, Estimates). "It's a company that we believe has been hampered by concerns about a merger that it did a while ago: it merged with Mercantile of St. Louis and there's been concern that the numbers were not going to come through as expected. We believe that management is on top of it, and will indeed be able to turn this into a very accretive transaction."

Her second pick is Citigroup (C: Research, Estimates). "Citi has been my top pick among the large cap names for quite some time. I think that its diversity in terms of both product and geography is something that is very tough to match, both in the U.S. and globally, and the deals they've been able to put together complement the internally generated growth that we've seen there as well."

Her final pick is Mellon Bank (MEL: Research, Estimates). "It's a company that generates two-thirds of its income from fees, either from asset management or asset servicing, and we believe that they deserve some multiple revaluation on the basis of the earnings mix."

"The Fed will be meeting later this month, and whether they raise rates 1/4 percent or not, I think it's not going to be the main focus of investor's attention. People are going to be watching the earnings pretty closely. We've seen a couple of pronouncements of disappointment -- EDS (EDS: Research, Estimates) and Procter & Gamble (PG: Research, Estimates). There will probably be more in the retail sector. Financial sector is still struggling a little bit, although I think it's beginning to show some signs of recovery. But clearly corporate earnings are going to be on people's minds in the weeks ahead, said John Carey, portfolio manager, Pioneer Investments. "The Fed will be meeting later this month, and whether they raise rates 1/4 percent or not, I think it's not going to be the main focus of investor's attention. People are going to be watching the earnings pretty closely. We've seen a couple of pronouncements of disappointment -- EDS (EDS: Research, Estimates) and Procter & Gamble (PG: Research, Estimates). There will probably be more in the retail sector. Financial sector is still struggling a little bit, although I think it's beginning to show some signs of recovery. But clearly corporate earnings are going to be on people's minds in the weeks ahead, said John Carey, portfolio manager, Pioneer Investments.

"I do like the oil sector," Carey continued. "I don't think the price, particularly of some of the major oil producing companies, have yet reflected the higher oil prices we've seen over the last 12 months. I think oil is up about 80 percent over the last 12 months to this current $30 or so level. The oil drillers, some of the oil service companies have done pretty well, but there could be some further room for them as well. I think Chevron (CHV: Research, Estimates) is among the major oil companies, also Exxon (XOM: Research, Estimates), Texaco (TX: Research, Estimates). In the oil service area, Transocean (RIG: Research, Estimates), which is a large operator of semi-submersible offshore rigs would be a favorite name."

"The demand for all of the networking gear and Internet infrastructure equipment is running way ahead of expectations. These companies cannot produce enough product to meet the demand, and that's their biggest challenge right now. Demand for the Internet data traffic is still growing around 300 percent per year. The Internet is still doubling in size every 98 days. All of these things that had shaken investor confidence over the last several months is a non-event. The fundamental business line is 100 percent intact," said Andrew Barrett, technology analyst, Salomon Smith Barney. "The demand for all of the networking gear and Internet infrastructure equipment is running way ahead of expectations. These companies cannot produce enough product to meet the demand, and that's their biggest challenge right now. Demand for the Internet data traffic is still growing around 300 percent per year. The Internet is still doubling in size every 98 days. All of these things that had shaken investor confidence over the last several months is a non-event. The fundamental business line is 100 percent intact," said Andrew Barrett, technology analyst, Salomon Smith Barney.

"The chips that are going into these kind of equipment are absolutely phenomenal. These guys are seeing their lead times extend. They're seeing pricing starting to firm," Barrett said. "And again, just like everybody else, their biggest issues is capacity. They're having to build out every single month and it's going to be a pretty amazing run."

"I think investors should be focused on several key areas, because at the end of the day you really want to be focused on earnings momentum," said Barrett. "One key area is going to be wireless. You look at companies like Qualcomm (QCOM: Research, Estimates). You look at companies like Nokia (NOK: Research, Estimates), Ericsson (ERICY: Research, Estimates) looks very, very solid in here. The chips look very good. Intel (INTC: Research, Estimates), Texas Instruments (TXN: Research, Estimates), PMC-Sierra (PMCS: Research, Estimates), and AMCC (AMCC: Research, Estimates) look very good to us.

You want to look at the Web infrastructure, companies like RealNetworks (RNWK: Research, Estimates) are going to be a big play upon the broadband going forward. And then, in the datacom space look at companies like Nortel (NT: Research, Estimates) and Cisco (CSCO: Research, Estimates). They look very solid to us. Also, investors should look at the AOLs (AOL: Research, Estimates), the Yahoos (YHOO: Research, Estimates), and the DoubleClicks (DCLK: Research, Estimates). Stay at the higher of the range. That's where you're going win."

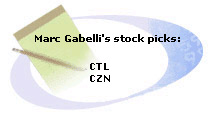

"I think the Fed still has no other choice but still to raise rates. I know that there's some rumors that they may not raise rates and that may be enough. There are several elements that go into this. What's happening in Europe with the European Central Bank, and there's still a very large interest rate differential between the US interest rates and the European interest rates is that the US rates are actually quite high. So the European rates have to come a bit higher. Everything is now coordinated in a much more global fashion, but I do think that the Fed will continue to raise rates here," said Marc Gabelli, managing director of Gabelli Funds. "I think the Fed still has no other choice but still to raise rates. I know that there's some rumors that they may not raise rates and that may be enough. There are several elements that go into this. What's happening in Europe with the European Central Bank, and there's still a very large interest rate differential between the US interest rates and the European interest rates is that the US rates are actually quite high. So the European rates have to come a bit higher. Everything is now coordinated in a much more global fashion, but I do think that the Fed will continue to raise rates here," said Marc Gabelli, managing director of Gabelli Funds.

"I think investors have to find good, solid businesses that they know well. Cisco Systems (CSCO: Research, Estimates) is a very good business. Some of the more, 'old economy communications properties,' as we call them, like Bell Atlantic (BEL: Research, Estimates) or BellSouth (BLS: Research, Estimates) in the southeastern U.S., or SBC (SBC: Research, Estimates) out west. These are stable cash generating businesses that we like, and in a period of volatility, it is a sense of safety," Gabelli said.

"I think when you look at telecom, from a services perspective, the industry is very cheap in the United States," he said. "You look at small companies. There is a company called CenturyTel (CTL: Research, Estimates). It's a great takeover candidate. Citizens Utilities (CZN: Research, Estimates) [is] also a terrific takeover candidate in about a three-year time frame. At the same time, both of these companies continue to grow their businesses."

--compiled by Parija Bhatnagar and Alexandra Twin

* Disclaimer

|

|

|

|

|

|

Track your stocks

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|