|

Seagram deal all but official

|

|

June 19, 2000: 8:30 p.m. ET

Vivendi, Canal Plus, Seagram boards approve three-way, $52B merger

|

NEW YORK (CNNfn) - French conglomerate Vivendi is poised to unveil an approximately $52 billion acquisition of Seagram Co. and Canal Plus Tuesday, creating an international media and entertainment powerhouse with assets stretching from movies to theme parks to publishing.

Seagram's (VO: Research, Estimates) board late Monday accepted a bid of $33.7 billion or $77.35 per share from Vivendi, a source told Reuters. Vivendi will also assume $6 billion in outstanding Seagram's debt, a separate source told CNNfn.com.

Both the Vivendi and Canal Plus boards had unanimously approved the three-way merger in separate board meetings Monday, Vivendi Chairman and CEO Jean-Marie Messier told Reuters.

"The Vivendi board was enthusiastic," Messier told Reuters at a presentation of the Vizzavi Internet portal. Asked if that meant the boards of Vivendi and Canal Plus had approved the merger, he said: "Enthusiastic means we approved it unanimously, likewise for Canal Plus."

A no-premium buyout by Vivendi of the 51 percent of Canal Plus it does not own would require payment of another 13 billion euros ($12.4 billion), based on its total value at the close Friday. The pay-TV company is virtually debt-free. A no-premium buyout by Vivendi of the 51 percent of Canal Plus it does not own would require payment of another 13 billion euros ($12.4 billion), based on its total value at the close Friday. The pay-TV company is virtually debt-free.

|

|

VIDEO

|

|

CNN's Paula Hancocks takes a look at the deal.

CNN's Paula Hancocks takes a look at the deal.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

An official merger announcement has been scheduled Tuesday for 11:30 a.m. local time in Paris.

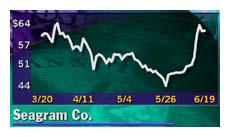

Seagram shares slumped in early trading Monday, before rebounding to close up 2-9/16 at 64.

Facing up to AOL Time Warner

If the proposed merger becomes official, it would end more than two months of negotiations between Paris-based Vivendi and Seagram, the Canadian entertainment, media and spirits company that reportedly has been courting a suitor for quite some time.

Despite boasting the world's largest music company in Universal Music Group and one of the largest film and television production companies in Universal Studios, Seagram Chairman Edgar Bronfman Jr. has made no secret of his desire to find a larger partner that would help his company compete with the proposed America Online/Time Warner Inc. combination. CNNfn.com is a subsidiary of Time Warner (TWX: Research, Estimates).

Bronfman told BusinessWeek magazine's online edition last week that he would serve as the combined company's No. 2 executive behind Vivendi's Messier, and his family would be the combined company's largest shareholders, with an 8 percent stake.

Messier has publicly stated his desire to sell Seagram's vast liquor and spirits business, which includes Captain Morgan rum, Crown Royal whiskey and a variety of wines and other liquors.

Bronfman's grandfather, Sam, founded Seagram in 1916 as a liquor business, which it largely remained before Edgar Bronfman Jr. plunged into the entertainment business by purchasing Universal Studios for $5.7 billion in 1993. Bronfman's grandfather, Sam, founded Seagram in 1916 as a liquor business, which it largely remained before Edgar Bronfman Jr. plunged into the entertainment business by purchasing Universal Studios for $5.7 billion in 1993.

Bronfman later added record and television assets to Seagram's product line, but Universal Studios' financial troubles and the prospect of facing off against AOL Time Warner pushed the company into merger negotiations.

The deal also would signify the end of a significant transition for Vivendi.

Founded as a water supply and waste services business, which has served as its main revenue source for years, Vivendi recently said it intends to separate the environmental operation from the media and telecom units and list it as a separate entity later this year.

A person familiar with the transaction said the merger would take into account different national cultures, but that it is likely one person will be tapped to head Vivendi's film operations on both sides of the Atlantic. Vivendi is said to be accelerating plans for a U.S. stock market listing, which could be a key to completion of the purchase of Seagram shares.

Messier covets Seagram's music assets -- which Bronfman boosted in 1998 with its $10 billion buyout of Dutch group Polygram NV -- because he wants to offer music to customers who subscribe to Vivendi's new Vizzavi mobile-phone service that it runs jointly with Britain's Vodafone. The partners are expected to roll out the service in France Monday, with other European countries slated to follow soon.

Regulatory scrutiny could impact deal

Shares of both Seagram and Vivendi slumped recently as investors worried regulators, who already have their hands full with AOL Time Warner, might move to block the deal, or force the companies to divest some media assets.

"I'm not convinced yet that this deal will pass the regulatory mustard," one arbitrager, who asked not to be named, said Monday.

U.S. lawmakers have already begun their investigation into the AOL-Time Warner deal and the European Commission on Monday launched a four-month probe of the agreement. Both investigations will likely set a benchmark for marriages between media, entertainment and online concerns.

A pact between Vivendi and Seagram would probably face a similar review.

Although neither of the principles is headquartered in the U.S., Seagram's media and spirits products are deeply intertwined with American culture and its economy. Still, experts saw little, if any, serious antitrust challenges from U.S. lawmakers.

"I don't see where there is a problem in the U.S.," said Robert Litan of the Brookings Institution in Washington, D.C.

"Perhaps the EC is going to investigate it," said Litan, a former senior Justice Department antitrust official. "Maybe they fear that a combination of content companies with distribution companies is a problem, but I am wrestling with seeing what the antitrust problem is in the U.S."

"The restriction with a lot of the other companies (like AOL-Time Warner) might have involved cross ownership restrictions between a lot of the other types of media, but I don't think that's an issue here," said James Goss, media analyst for Barrington Research Associates.

|

|

|

|

|

|

Vivendi

Seagram Co.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|