|

Vivendi toasts Seagram

|

|

June 20, 2000: 6:46 p.m. ET

Three-way $51B deal creates global media-communications colossus

By Staff Writers Jamey Keaten and Franklin Paul

|

NEW YORK (CNNfn) - Vivendi and Seagram, which built their fortunes peddling water and whiskey, respectively, emerged Tuesday as a global media colossus through a $34 billion marriage proposal, the latest in a string of mega-mergers that spotlight the value of linking media content and distribution companies.

Under a three-way deal that forms the world's No. 2 media company, French conglomerate Vivendi agreed to pay roughly $51.5 billion for Canadian entertainment and beverage company Seagram Co. (VO: Research, Estimates) and the 51 percent of Vivendi's pay-TV affiliate Canal Plus that it doesn't yet own.

|

|

VIDEO

|

|

CNNfn's Tom Bogdanowicz profiles Vivendi's CEO, Jean-Marie Messier.

CNNfn's Tom Bogdanowicz profiles Vivendi's CEO, Jean-Marie Messier.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Paris-based Vivendi will shell out $34 billion in stock and assume $6.6 billion in debt for Montreal-based Seagram, based on share prices when the deal was announced early on Tuesday. Vivendi also said it would buy the Canal Plus stake for about $10.9 billion.

But by the end of the day, the Seagram portion of the deal shed over $4 billion in value to ring up at just over $29 billion, after investors frowned on the deal. Analysts said some were concerned about the company's ability to reach its goals of being "the first global communications group."

The new company, named Vivendi Universal, will have combined annual revenue of around $55 billion and earnings before interest, taxes, depreciation and amortization -- or cash flow, a key barometer of a media concern's fiscal health -- of about $7 billion, the companies said. The new company, named Vivendi Universal, will have combined annual revenue of around $55 billion and earnings before interest, taxes, depreciation and amortization -- or cash flow, a key barometer of a media concern's fiscal health -- of about $7 billion, the companies said.

That would make it the world's No. 2 media and entertainment company after AOL Time Warner, the company being created by the merger of America Online and Time Warner, the parent of CNNfn.com.

It's all part of Vivendi Chairman Jean-Marie Messier's plan to deliver content, especially music from Seagram's world-leading Universal Music Group, across Vivendi's web of telecommunication systems, including Cegetel, one of France's biggest mobile-phone operators.

The new company, dubbed Vivendi Universal, will own businesses ranging from the Universal film studio and music labels to European pay-TV channels, electronic media, wireless telecommunications and theme parks.

Along the way, the agreement will end the Bronfman family's 84-year charge over Seagram and its well-known liquor brands such as Chivas Regal, Absolut Vodka and Captain Morgan Original Spiced Rum.

For Seagram chief executive Edgar Bronfman Jr., the loss of control of the company was in the best interest of the company's investors.

"Control is only valuable if it can create value," he said at a press briefing. "As we looked at the opportunities for Seagram and remaining independent, we felt that while we would continue to grow, it would not be the best way to optimize the assets that we have." (361K WAV) (361K AIFF)

Bronfman said that while the family intends to be "long-term holders" of their new Vivendi stock, its feelings toward selling the company were bittersweet. (595K WAV) (595K AIFF)

Philips Electronics NV, the second-largest shareholder in Seagram behind the Bronfman family, said Tuesday it supports the deal and will tender its 11 percent stake to Vivendi.

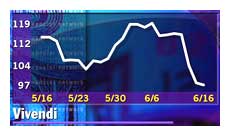

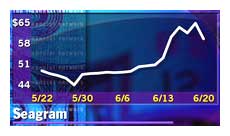

Stocks battered after the announcement

Investors were not enthused about the deal. Vivendi (PEX) shares sank some 8 percent to  88.10, indicating possible concern that the company, born 150 years ago as a water-services utility, might be paying too much for the acquisition. The stock has dropped 24 percent since June 14, when it said it was engaged in talks. 88.10, indicating possible concern that the company, born 150 years ago as a water-services utility, might be paying too much for the acquisition. The stock has dropped 24 percent since June 14, when it said it was engaged in talks.

Linda Bannister, an analyst for Banc of America Capital Management, said she thinks the price is right, when one adds up the value of Seagram's media properties.

"I believe it is a reasonable price," she said from the company's St. Louis office. "Seagram has a vast array of strong assets, especially in the music area. And any company that wanted to have access to that content was going to have to pay for it."

Canal Plus (PAN) sank more than 10 percent to Canal Plus (PAN) sank more than 10 percent to  178.60 Tuesday; its stock was halted limit-down earlier in the day, after Vivendi's offer came in below the broadcaster's closing price Monday. Shares of Seagram, which have risen sharply in recent days amid reports of the pending deal, closed at 58-5/16 on Tuesday down 5-15/16. 178.60 Tuesday; its stock was halted limit-down earlier in the day, after Vivendi's offer came in below the broadcaster's closing price Monday. Shares of Seagram, which have risen sharply in recent days amid reports of the pending deal, closed at 58-5/16 on Tuesday down 5-15/16.

Bronfman blamed the sliding price on traders taking a profit on the stock, a portent of the kind of price instability that may persist until the deal is completed later this year. Salomon Smith Barney analyst Jill Krutick downgraded her opinion of Seagram the stock for that very reason.

"While this transaction has all the markings of a home run, there are uncertainties that are likely to contribute to volatility in Seagram's shares until the deal closes," she said. "As such we suggest taking profits on strength."

Bronfman told a press conference that Seagram had anticipated a drop in the stock, and that his company would not walk away even if the price slump continues. Should the deal fall through, however, Seagram stands to earn an $800 million "break up" fee.

Vivendi banking on Vizzavi for its Internet link

The company is banking on developing Vizzavi, a venture with Britain's Vodafone AirTouch to offer Internet access and online content to mobile-phone users, as one of the outlets for music on the Web.

Giving an example of the synergies that should emerge from the combination, Messier said he envisages putting Vizzavi promotions on Universal Music's compact discs. Universal's recording roster includes artists such as chart-topping Shania Twain and rock group U2. Giving an example of the synergies that should emerge from the combination, Messier said he envisages putting Vizzavi promotions on Universal Music's compact discs. Universal's recording roster includes artists such as chart-topping Shania Twain and rock group U2.

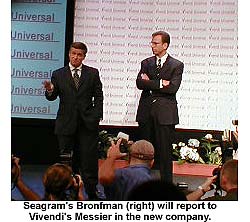

"We believe this will be the best combination ... to deliver all the array of content and access that customers will want, will require and will pay for in the 21st century," said Bronfman, who will become Messier's second-in-command at the new company.

Bringing in Canal Plus, Europe's biggest pay-TV company, will expand Vizzavi's potential customer base, Messier said. (544K WAV) (544K AIFF)

Vivendi decline to hit Seagram shareholders

Vivendi said it began negotiations intending to pay $75 per Seagram share, but raised that to $77.35, for a total of $34 billion in stock. Under a flexible share-exchange formula, that's how much Seagram shareholders will get as long as the value of Vivendi's stock is in the range $96.69 to $124.30 a share, as it was a week ago, before confirmation of the talks.

But with Vivendi shares trading below that level Tuesday, the offer is now worth around $30 billion, or $68 per Seagram share, with the Canadian company's shareholders getting a maximum of 0.8 Vivendi share for each one of their own.

Vivendi also plans to swallow $6.6 billion in Seagram debt, which officials of the companies say will be repaid by the sale of liquor assets. Messier said he expects the liquor business to fetch about $8 billion, and insisted the new company will be debt-free and have positive cash flow by the end of 2000. Vivendi also plans to swallow $6.6 billion in Seagram debt, which officials of the companies say will be repaid by the sale of liquor assets. Messier said he expects the liquor business to fetch about $8 billion, and insisted the new company will be debt-free and have positive cash flow by the end of 2000.

Analysts have speculated that companies such as Britain's Allied Domecq PLC might be interested in buying Seagram's liquor assets.

Vivendi also is offering two of its shares for every share of Canal Plus that it does not already own, a bid valued at about  11.5 billion ($10.9 billion) for the 51 percent stake. The company is virtually debt-free, sources said. Canal Plus operates a joint venture with CNN International in Spain. 11.5 billion ($10.9 billion) for the 51 percent stake. The company is virtually debt-free, sources said. Canal Plus operates a joint venture with CNN International in Spain.

Vivendi will absorb Canal Plus's film studio, Internet business and the pay-TV units outside France, but will divest its French pay-TV business, which will be taken public to comply with French laws governing the ownership of broadcasting assets. Vivendi will absorb Canal Plus's film studio, Internet business and the pay-TV units outside France, but will divest its French pay-TV business, which will be taken public to comply with French laws governing the ownership of broadcasting assets.

The transaction will give Seagram five seats on the Vivendi Universal board, while Vivendi will hold 14 seats. Vivendi Chairman Jean-Marie Messier would not commit to giving Barry Diller, chairman of USA Networks Inc., one of the new company's two board seats set aside for non-Bronfman family members from the Seagram camp. Seagram owns a 45 percent stake in USA Networks.

Few antitrust concerns seen

Bronfman said he does not expect the deal to run afoul of antitrust officials in Europe, Canada or the United States. Its would-be rival, AOL Time Warner, learned Monday that its own proposed merger faces an extended antitrust review by European Union officials. It would be normal for such a precedent to play a big part in the review process, legal experts pointed out.

"The thing the dealmakers tend to look at is: 'what did the guy ahead of me in line have to pay to get through?'" William Kovacic, a law professor and antitrust expert at George Washington University in Washington, D.C., said. "The thing the dealmakers tend to look at is: 'what did the guy ahead of me in line have to pay to get through?'" William Kovacic, a law professor and antitrust expert at George Washington University in Washington, D.C., said.

While Vivendi has said the deal will provide support for French cinema, cultural protection will be one of the issues on the agenda for antitrust officials at the European Commission, the EU's executive arm.

"The EC is more aggressive than either Canada or the United States, in the

sense that they are more likely to be concerned with problems U.S. enforcers might find peripheral," said Eleanor Fox, a professor at New York University School of Law and an antitrust expert. "They will be looking to see what's best for consumers, and might also consider cultural concerns."

The European Commission has said it plans to review the deal.

|

|

|

|

|

|

Vivendi

Seagram

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|