|

Kraft IPO could raise $10B

|

|

June 26, 2000: 5:35 p.m. ET

Philip Morris expects to sell a minority stake in food business next year

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Philip Morris Cos. Inc. expects to raise between $5 billion and $10 billion when it sells a minority stake in its Kraft and Nabisco brand holdings early next year, but the tobacco conglomerate has no plans to spin off its lucrative food business entirely.

Philip Morris Chairman Geoffrey Bible said Monday his company initially intends to sell between a 15-to-20 percent stake in its food holdings, which following Sunday's $18.9 billion acquisition of Nabisco Holdings Corp. will soon encompass everything from Philadelphia cream cheese to Ritz crackers to Oreo cookies. Nabisco's products will be merged into Kraft's operation following the deal's completion, expected by October.

|

|

VIDEO

|

|

CNNfn's Allan Dodds Frank takes a look at the Philip Morris-Nabisco deal.

CNNfn's Allan Dodds Frank takes a look at the Philip Morris-Nabisco deal.

|

|

Real

|

28K

|

80K

|

|

Windows Media

|

28K

|

80K

|

|

Should it raise between $5 billion and $10 billion Bible expects, the planned IPO would rank among the 10 largest public offerings in history. It will also permit the company to maintain its regular dividend payment schedule and share repurchase programs, as well as reduce some of the $4 billion in debt being assumed through the Nabisco merger, Bible said.

However, Bible said the company currently had no plans to take the entire operation public, particularly now that the Kraft/Nabisco combination will rank as the world's most profitable operation with an annual profit exceeding $5.5 billion.

"The IPO is not a forerunner to a spin-off (of) the food business," Bible said, speaking to reporters and analysts at a press conference Monday morning to discuss the Nabisco acquisition. "We are very proud of what the food business has become. We think we've built a superb business in Kraft and we didn't buy it to spin it off."

Still, the idea clearly intrigued investors. Philip Morris (MO: Research, Estimates) shares closed up 3-11/16, or more than 15 percent Monday, to 27-1/8, the company's highest closing price in a month.

Analysts said floating the food operation appealed to investors because it would allow them to buy into the high-growth portion of Philip Morris' business while avoiding the so-called tobacco litigation taint that has suppressed the company's stock during the last year.

But IPO experts noted that despite the sheer size of the offering, first-time food industry stocks typically fail to excite investors, leaving Kraft's future prospects unclear.

"This will not be a deal that vis-a-vis recent history that has any profit of being a standout," said David Menlow, president of IPOFinancial.com. "The issuer and underwriter will try to squeeze maximum short-term value out of the deal and Seasonal factors will weigh very heavily on it. It will be a real effort to get it out the door."

Still, the bulked up Kraft operation will have several factors working in its favor, analysts said.

The deals ensure that Philip Morris (MO: Research, Estimates), which beat out a combined bid from Britain's Cadbury Schweppes and France's Groupe Danone for Nabisco Holdings, will remain entrenched as the world's No. 2 food concern ranked by total revenue and adds the world's premier cookie and cracker company to its ranks. Philip Morris will now boast seven "mega-brands" with annual sales exceed $1 billion.

In addition, Philip Morris intends to wring more than $400 million in annual cost savings from the transaction by 2002, a higher total than analysts initially anticipated. Bible would not comment on possible layoffs, but said some of the cost savings would be achieved through brand line synergies -- such as promoting Ritz crackers and Kraft cheese simultaneously. In addition, Philip Morris intends to wring more than $400 million in annual cost savings from the transaction by 2002, a higher total than analysts initially anticipated. Bible would not comment on possible layoffs, but said some of the cost savings would be achieved through brand line synergies -- such as promoting Ritz crackers and Kraft cheese simultaneously.

"It's a very solid deal," said John O'Neil, a food analyst with PaineWebber. "It's a solid deal because the cost savings are greater than what people anticipated and Philip Morris intends to IPO the combined Kraft-Nabisco next year."

"Remember, Philip Morris is the biggest tobacco company in the world, it is primarily known as a tobacco company, it produces about a trillion cigarettes a year, and here it is actually now beating the biggest food company in the world (Nestle) in terms of food profits," agreed Martin Feldman, a tobacco analyst with Salomon Smith Barney. "So it's a gigantic deal for Philip Morris."

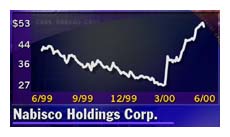

Much like Philip Morris, the fear that numerous national tobacco-related lawsuits would eat into company profitability significantly depressed the value of Nabisco Holdings' stock during the past year.

That taint ultimately forced Nabisco Holdings and its parent company, Nabisco Group Holdings (NGH: Research, Estimates), onto the selling block in April and resulted in Sunday's sale.

While Philip Morris picked up Nabisco Holdings (NA: Research, Estimates) for $55 per share plus about $4 billion in assumed debt, tobacco company R.J. Reynolds Tobacco Co. (RJR: Research, Estimates) acquired the cash-flush parent company for $30 per share, or $9.8 billion.

Financier Carl Icahn, who pushed the companies' fortunes onto the open market in April after becoming frustrated with the company's sagging stock prices, heavily influenced the sales.

Icahn initially offered to buy a 30 percent stake in Nabisco Group Holdings for $13 per share, or $1.3 billion, in late March. Just days later, he followed that offer with a proposal to buy the entire company -- whose sole holding consists of an 81 percent stake in Nabisco Holdings -- for $16 per share, or $5.2 billion. Icahn initially offered to buy a 30 percent stake in Nabisco Group Holdings for $13 per share, or $1.3 billion, in late March. Just days later, he followed that offer with a proposal to buy the entire company -- whose sole holding consists of an 81 percent stake in Nabisco Holdings -- for $16 per share, or $5.2 billion.

Icahn could not immediately be reached for comment, but the wealthy investor, long a thorn in Nabisco's side, profited handsomely from the agreements despite having lost out on his final bid to purchase the holding company at $28 per share. By some estimates, Icahn, who purchased most of his Nabisco stock when it traded at between $9 and $12 per share, made an estimated $600 million on the deals.

Although more than a dozen companies initially signed confidentiality agreements to negotiate with Nabisco, only four bidders remained when the company concluded its second-round of negotiations last Wednesday.

While R.J. Reynolds and Icahn competed for control of the parent company, Philip Morris' bid for Nabisco Holdings beat the Cadbury Schweppes/Groupe Danone offer because of its ability to achieve greater cost savings than Cadbury and Groupe Danone.

Sources familiar with the negotiations said Icahn, considered by some an opportunistic bidder hoping to simply drive the bidding price higher, was actively involved in the auction process and made himself known if the process wasn't proceeding as smoothly as he liked.

"Every time we thought he wasn't serious, he did enough to rattle everyone's cages," one source said.

For its part, Cadbury said Monday Nabisco was acquired "at a price that would not have met Cadbury Schweppes' criteria for creating value for its shareholders."

The company, it said, "will continue to pursue any options that enable the development of its businesses in core markets and related sectors."

Nabisco executives continued their practice of not commenting on the deal Monday. A company spokesman said Nabisco's top officials intended to spend the next couple of days with the firm's more than 50,000 employees, who now face an uncertain future.

Bible said Philip Morris would likely would maintain the Nabisco brand name on all the company's products. He also said the company would be reviewing certain brands that now did not fit in with the company's core food business and consider them for a possible sale.

|

|

|

|

|

|

|