|

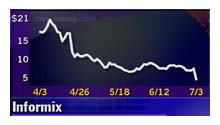

Informix sees 2Q shortfall

|

|

July 3, 2000: 1:29 p.m. ET

Software supplier warns of 10-cent-per share earnings miss, flat revenue

|

NEW YORK (CNNfn) - Informix Corp. warned Monday that its second-quarter earnings will ring in well below Wall Street forecasts, making it the latest technology company to warn about earnings for the latest quarter.

With very little other news to focus on in Monday's abbreviated trading session, investors punished Informix (IFMX: Research, Estimates) shares, driving them down 2-3/4, or 37 percent, to 4-11/16 on volume more than three times the stock's average.

The Internet and electronic commerce software maker said it expects to earn between 1 cent and 3 cents per share during the quarter, well below the 12 cents per share analysts surveyed by First Call had expected. Second-quarter sales will be between $240 million and $250 million, which is about flat with revenue during the same period last year, the company said.

The company said revenue was essentially flat in all geographic areas, including Europe, which has been further impacted by the strength of the dollar. A strong dollar can hurt American companies by making exports more expensive in world markets.

Like its larger rival Oracle Corp. (ORCL: Research, Estimates), Informix has been moving away from its historical role as a provider of database software to become a supplier of software products that enable companies to conduct electronic commerce. Like its larger rival Oracle Corp. (ORCL: Research, Estimates), Informix has been moving away from its historical role as a provider of database software to become a supplier of software products that enable companies to conduct electronic commerce.

Executives at Informix in Menlo Park, Calif., said that transformation has been slow.

"Although we have been experiencing good acceptance of our new economy technologies, Informix is in the midst of a fundamental transition into this new market," Jean-Yves Dexmier, the company's president and chief executive, said in a statement.

"We are confident we understand the market and have the products to penetrate it but, clearly, we need to further accelerate our transformation process," Dexmier added.

Informix is the latest tech company to warn that it won't live up to Wall Street's increasingly stringent profit projections.

Last week, Unisys Corp. (UIS: Research, Estimates), which provides computer services and technology, warned that its second-quarter profit would be roughly half what Wall Street had expected. Earlier last month, Unisys competitor Electronic Data Systems Corp. (EDS: Research, Estimates) warned of "soft revenue" for its second quarter.

Also last week, wireless communication device maker Research in Motion (RIMM: Research, Estimates) reported last week that its second-quarter loss will be wider than anticipated; SCM Microsystems (SCMM: Research, Estimates) also issued a warning last week.

In addition to the quarterly earnings miss, Informix said its recently completed acquisition of Ardent Software Inc. will not add to earnings this year, as previously had been expected.

"This remains a strategically sound acquisition for Informix, but leveraging its benefits will take more time than we had first planned," Dexmier said.

In April, Informix reported a 10 percent year-over-year increase in revenue and an operating profit that tripled to $27 million, or 10 cents per share, beating analysts expectations by two cents.

The company is expected to post its second-quarter results after the close of trading on July 19.

|

|

|

|

|

|

Informix

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|